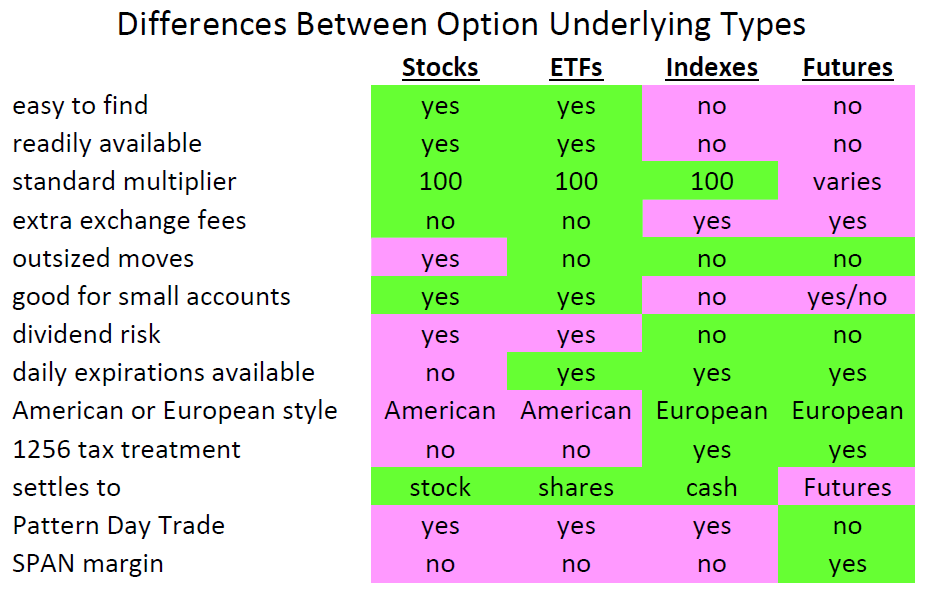

When most people discuss trading options, they are talking about stock options. But stocks are one just type of underlying security for trading options. Owners of options have the right to either buy or sell the underlying security at some point in the future. So, stock options give option buyers the right to buy or sell stock. However, other types of underlying security provide additional choices that are very useful for different kinds of traders. The other types of underlying securities, or underlyings, are Exchange Traded Funds (ETFs), Indexes, and Futures. Let’s go through each type and discuss the pros and cons of each.

Stock options

Options on stock are the most widely known version option trading. Almost every broker offers options on stock and the options are easy to find on broker platforms. Just go to options and type in the ticker symbol for the stock and you can find all the options. Since many stocks are low priced, stock options can be affordable, even for fairly small accounts. Stock options almost always are based on the option to buy or sell 100 shares of stock, so numbering is standard.

Some watchouts with stock options are that options can be exercised at any time before expiration, as well as at expiration. Sometimes, this catches sellers of stock options off guard. One particular situation that can be problematic is the risk that a call seller can have shares called away right before a dividend payment is issued. This dividend risk is most likely when options are near expiration. The idea that an option can be exercised before expiration means that the stock option is what is called an American style option. All stock options are American style.

These days many option traders like to day trade options that are expiring at the end of the day. Currently, stock options only expire at the end of the week or once a month on the third Friday of the month. This is mainly because there are only a limited number of traders for options on many stocks. Only the top 100 biggest stocks or so have the really large option trading volume to support liquid options on a weekly basis, and many smaller stocks have limited liquidity even on monthly expirations.

People who day trade also can be subject to restrictions on Pattern Day Trading. This rule prevents accounts with less than $25,000 from opening and closing a position the same day more than 3 times in 5 trading days. Stocks and stock options trades can trigger trading restrictions based on this regulation.

Probably the biggest watchout with stock options is the likelihood of outsized moves in the price of the stock. Stocks are ownership positions in public companies, and those companies have news that can significantly impact the price of the stock. For example, if quarterly earnings are less than expected, the stock price can drop 10-20% or more instantaneously. Corporate takeovers or extremely good or bad news can also cause stock prices to move in large, unexpected amounts.

For many traders, stocks provide a great vehicle for trading options. For some, options make stock ownership less volatile. Others try to find ways to take advantage of unexpected moves by speculating with options. But for some, outsized moves make stock options a poor choice and they look for other kinds of underlying securities.

Exchange Traded Funds

Options on Exchange Traded Funds share a lot of similarities with stock options. Most people are familiar with Exchange Traded Funds, or ETFs for short. An ETF is a fund made up of a basket of stocks usually based on an index, but sometimes just managed by an investment firm that picks stocks and other securities for the fund. ETFs offer shares that trade just like stock, and options are traded on ETFs very similar to how options trade on stocks. ETF options also are based on a standard 100 shares of the ETF. Options that are exercised settle to 100 shares of the ETF.

Not all ETFs are based on stock. Some are based on other financial instruments like bonds, or commodities like gold or oil. But, in the end, the ETF provides an easy way to own an interest in the thing that the ETF owns. The options on those ETFs provide a fairly simple way to speculate or hedge those same products.

Any broker that offers stock options will also offer options on ETFs. Trading options on large ETFs like SPY and QQQ dwarf the options on even the largest stocks. ETF options are easy to look up on broker platforms. Most ETFs are priced low enough that their options are a good choice for even small accounts.

One difference with ETF options from stock options is that some of the largest ETFs now offer option expirations every day, which some traders like to use. Smaller ETFs have weekly options expirations, while some less frequently traded ETFs may only offer monthly options expirations. However, with the availability of daily options expirations, the potential for triggering Pattern Day Trading restrictions is more likely.

Many of the watchouts of stock options are the same for ETF options. ETF options are American style and can be exercised at any time, so dividend risk can be an issue.

However, since ETFs are made up a group of stocks or other securities, they generally don’t have as big of a risk of an outsized moves as individual stocks. Some ETFs are based on individual economic sectors or industries, which may have stock moves that jump in unison, but even in those situations, the moves of the individual companies are averaged together making the worst moves less severe.

Index Options

While most traders are familiar with stocks and ETFs, index options are less used by newer traders. Of course, people can trade options on ETFs that are based on indexes, but why not trade options that are directly tied to the actual index? There are a number of trade-offs, but trading options on the actual indexes is generally a better choice than options on an index-based ETF.

Index options are based on an underlying that can’t be bought or sold directly. Traders can’t buy or sell the S&P 500 index directly. They can buy an ETF that tracks the S&P 500 index, or buy or sell futures on the index, but not the actual index. As a result, options settle at expiration to the cash value of the option, because there are no security shares to be assigned. Also, index options are European style options, in that there is no early exercise of options- they simply settle at expiration for cash. Because the index doesn’t pay a dividend, there is no consideration of the impact of dividends. So, all the weird surprise events that might cause early exercise of stock options or ETF options simply don’t exist in index options.

Since there aren’t index shares, index options are based on the cash value of 100 times the index, instead of 100 shares. Essentially, it works out the same for all practical purposes, but technically, we are getting options on a multiple of the index. However, like options on stocks and ETFs, 100 is the standard multiple for index options.

Interestingly, two of the most commonly quoted indexes have limited or no index options available. The Dow Jones Industrial Average and the Nasdaq Composite Index are quoted in the news media everywhere, but don’t have index options available. The major stock indexes with options are the S&P 500 index with the ticker symbol SPX, the Nasdaq 100 index with the ticker symbol NDX, and the Russell 2000 index with the ticker symbol RUT. Another less known index option is the Mini S&P 500 index with the ticker symbol XSP, which is simply 1/10 the value of the regular S&P 500 index. As a result, XSP is priced very similarly to the SPY exchange traded fund, but with the characteristics of index options instead of ETF options. One somewhat unique index with options is the volatility index known as VIX.

One reason that many option traders aren’t familiar with index options is that many brokerages don’t offer them. Index options have extra exchange fees on top of any commission charged by the broker, and some brokers that offer free commissions on options can’t offer index options for free.

Some brokers that do offer index options, list their ticker symbols differently, to differentiate them from stock and ETF options. One broker I use adds a dollar sign in front of the symbol, so the S&P 500 index is $SPX in their trading platform. Another that I know of has a period in front, so .SPX is the symbol. So, between the options not being available, or just hard to find, or having extra fees, index options don’t get a lot of broad publicity.

While most brokers will charge a bit more per contract to trade index options, it generally is more than made up for by the fact that the underlying indexes are much higher in price than an ETF based on the same index. For example, a trader would have to trade 10 contracts in SPY to have the same position as trading one contract in SPX. So expense-wise, the index option would actually cost less to trade. The flip side is smaller accounts can’t afford to trade options on underlyings that expensive. So, SPX, NDX, and RUT may be just too big for many traders. XSP is a available as an affordable alternative to SPX.

While there are thousands of ETFs based on all kinds of indexes, there are only a handful of index option underlyings. But the major indexes have the advantage of being very diversified compared to the many specialty indexes. Index options also trade with very high volumes, which provides liquidity to get good pricing to get in and out of positions. That isn’t always the case with minor index ETFs.

Index options are tax-advantaged. In taxable accounts, index options are given Section 1256 tax treatment. The advantage is that all capital gain profits are treated as being 60% long-term and only 40% short-term, no matter how long the option is held. Since most index options are held anywhere near normal long-term duration, this is a significant help to capital gains taxes.

Finally, index options have lots of expiration dates. SPX options have expirations every day, and the other indexes generally do as well. For traders that want to buy and sell options very close to expiration, index options provide a good choice, but small accounts still must adhere to Pattern Day Trading restrictions.

Futures

Options on Future contracts are a trade that is probably the least familiar type of option trade to most people. Partly this is because it is complicated, and partly because it isn’t easy to get started for a number of reasons. But there are some significant advantages to futures options for those who take the time to understand them.

To understand futures options, one has to first understand futures contracts. Futures contracts are an agreement to either buy or sell some underlying product or security at some specific date in the future. There are futures on stock indexes, energy, metals, agriculture products, currencies, and bonds/interest rates. Futures contracts have been used in commodities to provide price certainty in the future for buyers and sellers. A farmer can sell futures contracts on the crops or livestock he raises, and food companies can buy futures on those same products. A farmer then knows how much his crop will sell for and doesn’t have to worry about prices dropping. The food companies know what they will pay and don’t have to worry about prices going too high. Futures contracts trade somewhat like a stock in that they are bought and sold on a price that fluctuates based on the market and expectations of the future. They can be traded anytime until the futures contract expires. At expiration, the contract is settled. Some commodities actually settle with the physical commodity that the contract calls for- sellers actually deliver the product to the buyer. Some contracts are cash settled. Traders need to know what is expected of them at futures expiration and be prepared if physical delivery is required. As a result, most traders close out their futures positions before expiration to avoid physical settlement.

Futures trade on different exchanges and have unique ticker symbols compared to other underlyings. Most broker show a symbol preceded by a forward slash (/). For example the base symbol for gold futures is /GC.

While stocks, ETF, and index options have standard expiration dates of the third Friday of the month, futures contracts vary all over the place. Each different commodity has its own calendar of expiration dates to be aware of. Futures contracts don’t have any standard multiplier. Prices are tied to a unit of measure that is specific to the commodity- oil is priced to the barrel, gold is to the ounce, indexes are in dollars. But, how many units in a contract? Crude oil contracts (/CL) are 1000 barrels of oil, gold contracts (/GC) are 100 ounces of gold, Silver futures contracts (/SI) are 5000 ounces of silver, and E-mini futures on the S&P 500 (/ES) are based on 50 times the S&P 500. It can be very confusing.

Often it helps to consider the notional value of a futures contract. If the S&P 500 is priced at $4000, a futures contract on the E-mini S&P 500 would have a notional value of $200,000. Most major futures trade with notional values of $100,000 to $250,000. Because these values are so high, many products are offered in smaller contracts called micro contracts, which generally have a multiplier of 1/10 of the standard contract. For example, the Micro E-mini S&P 500 futures contract (/MES) has a multiplier of 5 times the S&P 500 index, which would have a notional value of $20,000 if the index is valued at $4000.

At most brokers, traders don’t have to come up with the notional value of the futures contract to buy it or sell it. The broker uses a system called SPAN margin, which stands for Standard Portfolio ANalysis of risk. Essentially, the brokers looks at future products in a trader’s account, and determines a worst case scenario for a one day loss and makes the trader have at least that much buying power to have the contracts in the account. Usually, this is a fraction of the notional value, and often is roughly around three times the daily expected move. Futures traders have the ability to hedge their positions with other futures or options to reduce risk and also reduce buying power required based on the SPAN margin calculation. However, this calculation changes and may often cause the broker to require more capital than originally allocated if the futures position loses money.

Futures Options

Futures options give buyers the right to buy or sell one futures contract at expiration of the option. The hard part is understanding the futures contract to know what the option on the future is based on. Futures options may expire before the future contract expires or at the same time. If it expires earlier, settlement is one futures contract. If it expires at the same time, settlement is the expiring futures contract which then has to be settled to the underlying contract specifications. So, for traders not wanting to settle in a commodity, they should avoid expiration.

For traders of options on stock index futures like /ES or /MES, expiration settles to cash, so expiration isn’t a major concern. In some ways, options on index futures are very similar to index options. The most noticeable difference is the multiplier. For index options, the multiplier is always 100. For index futures options tied to a futures contract, the multiplier varies from index to index. While /ES is 50, the E-mini Nasdaq 100 futures (/NQ) multiplier is 20, and the micro Nasdaq 100 futures (/MNQ) multiplier is 2.

Futures Option contracts have extra fees compared to other options contracts. Most brokers charge about twice as much for futures options as other options to account for the added exchange fees. This can start to add up in some trades, especially for out of the money spreads on micro futures-commissions and fees might be a significant percentage the amount collected or paid in option premium.

Futures options traders also benefit from SPAN margin. This is especially true when selling naked options. However, traders have to be aware that the margin required does not represent the total amount of capital at risk. As mentioned earlier, futures options can be traded in combination with futures contracts to reduce volatility and also decrease SPAN margin requirements.

Many brokers don’t offer futures options or severely restrict which accounts can trade futures or futures options. Usually, a trader will have to fill out a specific application to their broker for approval to trade futures and futures options. So there are lots of hurdles to being able to trade futures options.

Like index options, futures options are European style options with no early assignment and no dividends to deal with. They also feature Section 1256 tax treatment, which underlying futures contracts also enjoy.

One big advantage of futures options for small accounts is that they are exempt from Pattern Day Trading rules. Traders can buy and sell futures and futures options as many times as they want without day trading restrictions.

I traded options for years avoiding futures options because I didn’t see the benefit and thought they were just too complicated. Over time, I’ve come to appreciate that they provide a lot of leverage because of SPAN margin, and also provide the benefit of Section 1256 capital gains tax treatment. Options in general have a significant learning curve, and futures options add several layers of additional complications to understand.

Option Underlying Takeaways

In the end, regardless of the type of underlying, option strategies all work the same way. Some option strategies can be extremely risky, while others reduce portfolio volatility and risk. To compare the risk of different types of trade, see my post on different risk levels. Each underlying type provides choices that may be suited for certain objectives more than others