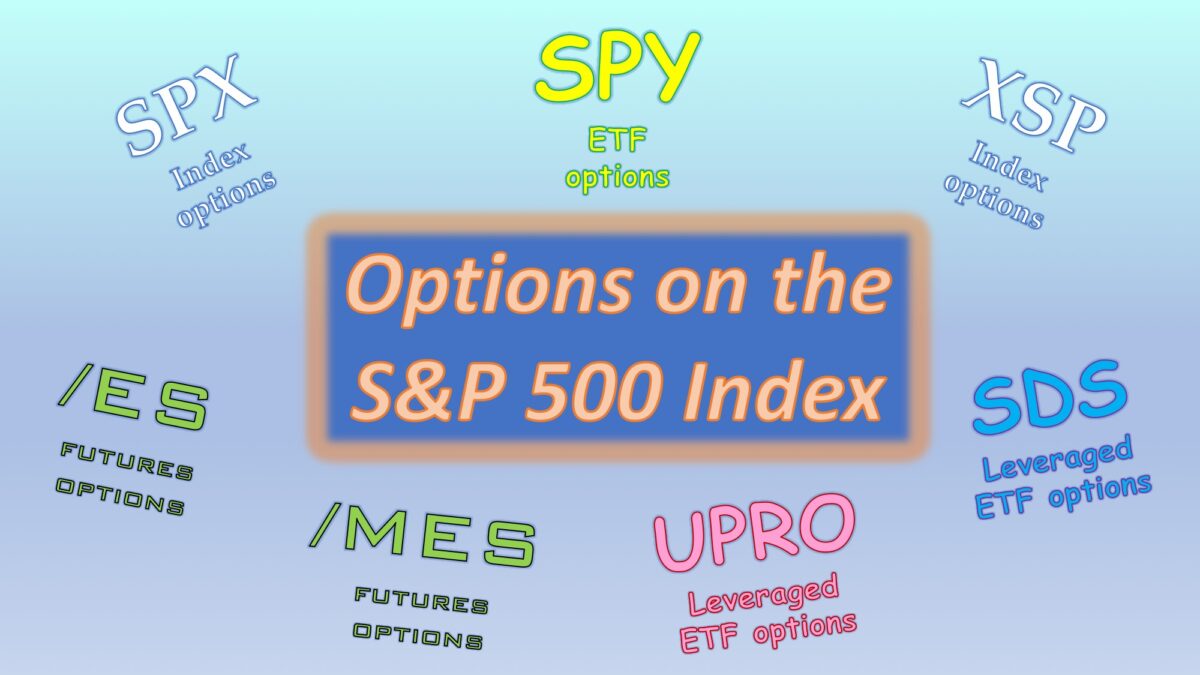

For many new options traders, trading the S&P 500 index is very appealing for a number of reasons. But most new traders are not aware that there are at least 7 different great choices for options tied to the index. Most have multiple expirations each week and are very liquid. Each choice has unique differences from the others that may make it appealing in certain circumstances. For a long time I was only aware of one way, and when I now tell others about these additional choices for options, it’s usually a pleasant surprise.

Background

The S&P 500 index is the most quoted benchmark of the stock market for good reason. It is made up of the 500 largest US publicly traded companies. The index is weighted by market capitalization of each firm, so the largest companies have more impact on the index than smaller ones. In fact, as of this writing, the seven largest firms are responsible for 30% of weight of the index. While the news media often leads market reports by sharing the Dow Jones Industrial Average, most traders and asset managers pay little to no attention to the Dow because it only includes 30 stocks and has a bizarre price weighted averaging system that gives the most weight to companies with the highest price per share.

If a trader can choose only one investment to own, some form of the S&P 500 index would be the most logical choice. When selling options, unexpected moves outside of expectations can lead to large losses. Many studies have shown that the S&P 500 index is much less likely to have an outsized move than individual stocks or even other indexes. TastyTrade has done numerous studies on this that are free to review. So options on the S&P 500 index can be a large part of a trader’s strategy. Understanding the variety of choices for trading options on the S&P 500 can be very helpful for traders of all experience levels.

Mutual Funds?

Almost every employee retirement account offers a mutual fund that mimics the S&P 500 index. While mutual funds are great for retirement accounts that rarely change holdings, they aren’t that useful for trading in general, and specifically not for options. There are literally dozens of mutual funds based on the S&P 500, but they share the same trading issues- they only trade at the closing price of the day which isn’t known until after a trade is submitted, and there aren’t options on any of them. Active traders want to be able to buy and sell at any point in the trading day and have options for hedging or amplifying returns, so mutual funds just won’t cut it.

Exchange Traded Funds

In recent years, exchange traded funds (ETFs) have grown in popularity. These funds are structured to match the holdings of underlying indexes or other trading strategies. The funds actually hold shares in the index that they are matching performance with. By far the largest ETF is the SPDR S&P 500 ETF Trust, which goes by ticker symbol SPY, and follows the S&P 500 index. It is priced at approximately 1/10 the price of the index per share. So, if the S&P 500 index is priced at 4500, the SPY ETF will be priced around 450. The SPY price isn’t exactly 1/10 of the S&P 500 index price, but slightly less by varying amounts. The variations are due to fees that come out of the ETF, and the impact of dividend payouts. SPY pays dividends once a quarter, and the price of SPY gets closer to 1/10 of the S&P 500 index as the dividend payment approaches and then drops after the dividend is allocated. Generally, the variation is less than one dollar in SPY, so if the S&P 500 index is trading 4500, SPY is likely to actually trade at somewhere between 449 and 449.50. For most traders, this difference isn’t a big deal, but just a minor factor to be aware of when comparing SPY to the S&P 500 index. Because of its name and ticker, SPY is often referred to as the “Spiders.”

SPY option contracts are based on 100 shares of SPY. If an option is exercised or assigned, the option seller will either be forced to buy or sell 100 shares of the SPY ETF. Because SPY pays a quarterly dividend, traders who sell calls on SPY need to be aware of the risk of having the call option exercised on dividend day. If a trader has a call near expiration that is at the money or in the money, it will likely be exercised because the dividend can be captured by the owner of the stock. If the call seller doesn’t have shares to be called away, and the option is executed, not only will the seller be short shares of SPY, but the seller will have to pay the dividend to the broker that they are borrowing the shares from. Only call sellers have to worry about this, but it is a real consideration four times a year.

Both SPY and options on SPY are extremely liquid with bid-ask spreads normally at one penny. I’ve found option trades that include four legs, can usually be filled immediately for two cents away from the mid price of the combined bid-ask spreads of all the legs. Options are priced in increments of one cent, so pricing can be fairly precise. SPY options have 3 expirations per week, with contracts for every Monday, Wednesday, and Friday. Adjustments are made for holidays when markets are closed. Every expiration has dozens of strikes, going several expected moves above and below the current price of SPY.

While SPY isn’t the only ETF to track the S&P 500 index, it is the predominant one, and really the only ETF to really consider for trying to match the performance of the actual index. There are a couple of other ETFs to consider that are designed to magnify or reverse the performance of the S&P 500 index. For some strategies, these might be helpful.

UPRO is an ETF from ProShares that is leveraged to deliver 3x the performance of the S&P 500 index. Officially, it is called the ProShares UltraPro S&P 500 ETF. So, if the S&P 500 index goes up 1% in a day, UPRO will go up 3%. However, the reverse is also true- if the S&P 500 index goes down 1% in a day, UPRO will go down 3%. To keep this relationship working, the holding in the ETF are adjusted each night, so over time the ETF won’t exactly keep pace at 3x the performance. The ETF relationship is more precise day by day than longer term, but will be relatively close to 3x. UPRO has options expiring every Friday and is somewhat liquid with wider bid-ask spreads than SPY. Because of large swings in price, the ETF has occasional splits to keep the share price reasonable, and the daily adjustment of holdings can alter the precision of the leverage factor, so the share price isn’t consistently convertible to a multiple of the S&P 500 index.

The opposite effect is achieved from the SDS, or Proshares Ultrashort S&P 500 ETF. SDS is set up to delivery -2x the performance of the S&P 500 index. So, if SPY goes up 1%, SDS goes down 2%. Over time the price of SDS tends to get lower and lower, and a reverse split is needed to get the price up to a reasonable level. Options on SDS also expire weekly. Both SDS and UPRO options are based on 100 shares of the corresponding ETF.

Options on leveraged ETFs are much more volatile than on non-leveraged ETFs. Because traders of these options know that there is multiple times price movement, options are priced accordingly. Because of this, strategies with options can perform very differently than with options based on the non-overaged SPY. The switch from SPY options to UPRO or SDS options is not as simple as it might appear, so research thoroughly before jumping in to these unique options.

There are other ETFs that follow the S&P 500 index as well as others that leverage the S&P 500, but they don’t trade with as much volume, and their options trade less frequently. Why trade a product that is less liquid, with fewer options, and much lower option volume when a better choice is available? I see no reason to use anything but SPY, UPRO, and SDS.

There are also ETFs that represent sectors or portions of the S&P 5oo, or weight the 500 stocks of the index equally. So, for value vs. growth, or Finance stocks or Utilities, there’s are ETFs with options of every flavor. But none of those represent trading the full S&P 500 index, so we won’t dig in any further into those products, because the point of this discussion is ways to trade the benchmark index.

For most traders, SPY options are the only options on the S&P 500 index they use, and many traders aren’t aware of any other choices for trading options on the index. But, we’ve only just begun.

Index Options

Why trade options on an ETF based on an index when you can simply trade options on the actual index? Index options remove the ETF from the mix and link options directly to the index. For the S&P 500, there are two index options available, SPX and XSP. SPX is literally the S&P 500 Index, and XSP is the Mini S&P 500 Index.

Traders are often not aware of these ticker symbols or the fact that options are available for these two indexes. There are a couple of reasons for this. There is no way to actually buy or sell the actual S&P 500 index directly, a trader can’t buy or sell shares of SPX. Additionally, since SPX is an index and not a stock or ETF, many brokerages don’t show it as SPX. For example, Schwab lists it as $SPX. Other sites may show it as ^SPX or .SPX. The point is that you have to know what you are looking for to even find it. Since SPX is literally the S&P 500 Index, it is priced at the full price of the index. So, if the S&P 500 Index is at 4500, SPX is at 4500. They are exactly the same.

Okay, SPX is the S&P 500 index. But, what is the Mini S&P 500 index, you may ask? XSP, or the Mini S&P 500 is simply an index that is 1/10 of the S&P 500. However, unlike SPY, which is approximately 1/10 of the S&P 500 index, XSP is exactly 1/10 of the S&P 500 index. Why do we need an index that is 1/10 of another index? It’s all because of options and sizing of positions.

Options on SPX don’t represent 100 shares in SPX because SPX doesn’t have shares. Instead, SPX options represent a value of 100 times the value of SPX. Think of it as if SPX had shares and the options represented 100 shares, even though there aren’t any shares. XSP options represent 100 times the value of the XSP. So, in both cases we still have a multiplier of 100 as we do with ETF options. This is where the similarity in options end.

One difference is that dividends are not part of the S&P 500 index. Many of the 500 stocks in the index pay dividends at various times throughout each quarter, and those payments have an impact on the individual stock price, which will then impact the price of the index. But the index has no mechanism to pay dividends because it is just an average of the prices of the 500 stocks it tracks and isn’t tradable itself. So, option buyers and sellers of SPX and XSP don’t have to consider dividends as an event, like traders in the SPY ETF.

Since index options can’t be settled in shares, they settle in cash when they expire. In many ways, this can be a lot easier. If an option expires $5 in the money, a call buyer will receive $500 from the account of the call seller at expiration because of the 100 multiplier. If an option expires out of the money, it is worthless and there is nothing to settle.

Cash settlement can be a bit confusing at first, so just realize that there is nothing to actually buy or sell from assignment- a put seller that is assigned doesn’t have to buy 100 shares, they just have to pay the difference in the current price at expiration from the strike price of the option. If the trader sold a put on a stock or ETF, they would be assigned shares that they would buy for more than the current price, which they could turn around and sell at a loss. Index options eliminate the step of buying and selling shares, and just settles the difference in price with cash.

Index options use European style option assignment, while stock and ETF options use American style options. American style options can be executed at any time by the option buyer, and this becomes a consideration for option sellers that have positions in the money before expiration. However, European style options can only be executed at expiration. So, sellers of index options don’t have to worry about having an early assignment before expiration, and buyers don’t have that option. And since index options are cash settled, there really isn’t an “option” at all. In the money index options are simply “settled” at expiration.

SPX options have lots of different expirations. Originally, these options only had expirations once a month on the third Friday of the month. Later, month end and quarter end expirations were added. Then weekly expirations every Friday were added. And now there are Monday and Wednesday expirations. Soon, maybe by the time you read this, there will be options expiring every trading weekday when Tuesday and Thursday are added.

One holdover from the original monthly expiration is that monthly index option expirations are different than all the other expirations in a couple of ways. First, and most importantly, monthly index options expire in the morning (AM) of expiration, while all other expirations expire at the close (PM) of trading. For SPX, there are actually two option expirations on the third Friday of the month, the monthly AM expiration, and the Friday PM weekly expiration. The settlement price for AM expirations of SPX is based on the opening trade price of each of the 500 stocks of the S&P 500 index. After each of the 500 stocks has traded on expiration morning, the prices are calculated to determine a settlement price for expiration. However, trading on the expiring option is stopped at the close of trading the day before. So, SPX option sellers and buyers are stuck with their positions from Thursday afternoon until Friday morning not knowing what the index price will be for settlement until the market actually opens and sets the price. For PM expirations, it is simpler, when the market closes, option trading stops and expiration settlement is based on the price of each of the 500 stocks in their last trade of the day. If you watch the price at the closing bell, you will see it change slightly by several cents after the close as all the different orders that execute at the market close get accounted for. The second way that AM and PM expirations vary with index options is that when the option contract is listed, monthly contracts use the ticker symbol SPX, while all other expirations use SPXW. The W is for weekly, even though the expirations may be quarterly, monthly, Monday, or Wednesday, and soon Tuesday or Thursday. So for S&P 500 Index options, just know that SPX listed options expire in the morning (AM) and SPXW listed options expire in the afternoon (PM). Either way, when you are searching for option listings, most brokers list SPX and SPXW options together under SPX.

XSP options are a more recent creation, and only have PM expirations. There aren’t different naming conventions either. Settlement works the same, with prices set by the final trade of each of the 500 stocks of the index when the market closes.

Another difference between SPX and SPY options is that SPX options are traded in increments of 5 cents. Since SPX is 10 times the price of SPY or XSP, trading increments or tick size is actually more precise on a percentage basis for SPX. XSP trades in increments of one cent like SPY. SPX options are also very liquid and orders can usually be filled 5 cents away from the mid price, even in multi-leg orders. There is a little difference based on trade volume of different expirations. Monthly expirations typically have the most volume, followed by Friday PM expirations and month-end expirations. Monday and Wednesday expirations have the least volume and can sometimes be slightly harder to fill, especially for strikes away from the money with more than a week until expiration.

XSP have a lot less volume than SPX or even SPY options, so they can be a little less liquid. Because of their pricing, they trade very similar to SPY, but with a little less liquidity. Since XSP is an index option, there is no worry of assignment, and dividends are not a consideration.

Some brokers don’t allow trading of index options in their accounts, and some strategies are not allowed with index options in certain types of accounts. Some brokers charge higher commissions and fees for index options than for stock and ETF options, so watch out!

Finally, index options get a different tax treatment and have a different accounting treatment at the end of the calendar year. Index options fall under Section 1256 of the tax code which allows a trader to classify 60% of the gains from trading index options as long term, while only 40% are short term. For taxable accounts of traders in mid to high tax brackets, this can be a significant advantage! It doesn’t matter if the option was held for a minute or six months, the 60/40 tax assignment applies. The other part of 1256 treatment is that index option positions are “marked to market” at the end of the year, meaning that a trader considers the option to be a profit or a loss at the end of the year even if the position is still open based on the price at the end of the year of open positions. In stocks and stock options, only positions that have been closed are evaluated for a profit or loss. Using mark to market can be a bit confusing the first time around, but most brokers do all the calculations and provide them in a year end tax statement.

The CBOE has announced another index option on the S&P 500 index to start trading very soon, call Nano options. This index will be 1/1000 of the SPX, or 1/100 of XSP, to allow very small option trades on the S&P 500. Supposedly the ticker symbol will be NANOS. Stay tuned for more details.

Futures Options

There are two futures contracts on the S&P 500 index that offer options. The primary one is called the E-Mini S&P 500 Futures, which uses the symbol /ES at most brokers. In listings of futures contracts and futures options the symbol will be followed by a letter to designate the month the future expires and a number for the year of expiration- for example /ESH2 represents the future contract expiring in April of 2022. The other futures contract is called Micro E-Mini S&P 500 Futures, and uses the symbol /MES. Some brokers may use other characters to designate futures instead of the forward slash, and some may require approval of futures to even see the ticker symbols. Consult with each broker for details.

Futures are tradable contracts based on the price of the underlying index at the expiration of the contract. Futures contracts in general expire at a variety of times in the month with /ES and /MES expiring on Wednesday mornings and settling to opening prices of the S&P 500 index. Since the futures contract is based on what the market expects the price to be at expiration, the price of the future is usually a little less or sometimes a little more than the current value of the S&P 500 index. However, it generally doesn’t vary that much because the current price is one of the best indicators of what the future price might be and futures buyers and sellers won’t let the prices to diverge that much because it presents an opportunity for arbitrage between the different values, knowing that at expiration they will converge. At any given time, there are many different contract expirations available to trade, going months out in time. The contract month closest to expiration is called the front month. Buying a front month futures contract is as close to directly owning the S&P 500 index as you can get. The value of the futures contract goes up and down with the index.

A single /ES contract is valued at 50 times the S&P 500 index. One might think of it as owning 50 shares of the S&P 500 index if the index price were the price of a share. A single /MES contract is valued at 5 times the S&P 500 index. These values are known as the notional value. However, futures contracts are priced at prices similar to the actual S&P 500 index, regardless of the notional multiplier.

Let’s take an example. Let’s say that the S&P 500 index is currently at 5010, and front month futures contracts for both /ES and /MES are trading at 5000 as they are slightly less. The /ES contract would have a notional value of $250,000, and the /MES would have a notional value of $25,000. If the market went up 100 points on the S&P 500, and both /ES and /MES went up to 5100, the owner of one contract of /ES would make $5000, and the owner of /MES would make $500. For most people $250,000 for one contract is too expensive, but futures contract owners aren’t required to have the full amount in their account, but just a fraction due to the assumption that the price will only move within a small percentage of the index price. If the price moves more than expected against a contract owner or seller, additional capital will be required. This practice is called span margining, and can be very helpful to allow traders to leverage a position, but also very dangerous if over-used and the market moves against a position. For example, if a trader buys an /ES contract priced at 5000 and has $50,000 in their account, a 20% decline in the market to 4000 would wipe out the account. While /MES is one tenth the size, the problem can be the same for a trader with a smaller account.

So far we’ve talked just about the futures contracts themselves. The topic of this post is trading options on the S&P 500 index, not trading futures on the S&P 500 index. So, let’s talk about how options on futures work. In particular let’s look at options on /ES and /MES. One key difference from other options we’ve looked at is that /ES and /MES options don’t use a 100 multiplier, like stocks or index options. Instead, futures options are an option to buy or sell one single futures contract. Which futures contract is the option associated with? Typically, it is the futures contract that is next to expire after the option expires. So, an option on /MES expiring on the first Friday in March is tied to the March futures contract, which will still have time remaining when the option expires.

So, buying an /ES call gives the buyer the option to buy one /ES futures contract at option expiration, and buying a /MES put gives the buyer the option to sell one /MES futures contract at option expiration. So, settlement of the option at expiration doesn’t settle in stock or in cash, but in a futures contract. The price paid for the futures contract is the strike price of the option. For example, if a trader buys a call option for /ES with a strike price of 5000, they would get to buy an /ES futures contract at options expiration for $5000, multiplied times the /ES futures multiplier of 50, or a total of $250,000, assuming that /ES is trading above 5000, making the option in the money. On the other hand if the price of /ES is below the strike price of the call option, the option would expire worthless. Similarly, if a /MES 5000 put expired in the money, the settlement would be to sell a /MES futures contract for $5000 multiplied times the futures multiplier of 5, for a total of $25,000.

There are futures options for /ES and /MES that expire every Monday, Wednesday, and Friday, so there are plenty of expirations to choose from. And futures and futures options trade virtually around the clock, from Sunday afternoon until Friday afternoon. In fact, the price of /ES in the overnight hours moves around quite a bit based on news and as the opening of the market approaches, it is a fairly accurate indicator of where the market will open. Meanwhile the S&P 500 index stays the same during the overnight, because it is based on a calculation from the trading of the 500 stocks in the index, which don’t broadly trade at night.

The span margining ability to trade using the buying power associated only with a calculated expected move applies to futures options as well as futures contracts. As a result, traders can put on highly leveraged trades without consuming a lot of buying power. With this capability comes significant risk. Traders have to be very aware at all times of the true total risk that comes with trades in futures options. With futures options, the buying power used is not a good indicator of the capital at risk in the case of a very large move of the market up or down. Some brokers allow selling of naked futures options for very little buying power, where selling the same notional value of SPX or SPY could easily require ten times more capital even though the true risk is the same. Many trading strategies with futures options may seem very safe because they are high probability trades- perhaps they win 90% of the time- the problem is when the losing 10% happens and the trader is not prepared for the damage that occurs to the account. Risk management is critical in all options trades, but particularly in futures options using span margin. Stops and hedges become the difference between staying solvent and going broke.

Like index options, futures and futures options also use section 1256 tax treatment with 60% long term gains and 40% short term gains, and are marked to market at the end of the year. There are no dividend risk issues.

One final unique advantage to futures options is that they are exempt from the Pattern Day Trade rule. For accounts under $25,000 where trades are opened and closed the same day, a trader can have severe limitations placed on an account. Generally, the limit is five day trades in a rolling seven day week. This can be stocks or options. Futures and futures options are governed by different regulations, so many day traders favor futures.

Many brokers have significant approval processes to be allowed to trade futures or futures options. Some limit them only to standard taxable margin accounts. Other brokers don’t allow them at all. Go to the office of your broker and see if anyone there has any experience trading futures or futures options- it is likely no one there has a clue and they will tell you not to do it. If you have friends that trade in the market, chances are that almost none have ever traded a future or futures option, so you are likely on your own. Your best source for help will be specialist from your broker’s headquarters, specialized training materials, or online resources from your trading community as I discussed in an earlier post.

If trading futures options is so complex, hard to understand, and risky, why do it? For many strategies, futures options can fill in gaps at a low capital requirement. Some hedging strategies can be too expensive with stock or index options, but more affordable with index options. Because of the unique multipliers, futures options for the S&P 500 index may be just the right size for a particular need. And finally, because the futures prices move and trade all night, futures and futures options allow trading on that information at some brokers.

Review of choices

After a lot of discussion and explanation, we have come up with seven choices for trading options on the S&P 500 index. Five of these are directly correlated to the index, and two are leveraged. Remember that the UPRO ETF moves up and down with the S&P 500 index, but three times as much each day. SDS, the UltraShort ETF not only moves the opposite direction of the S&P 500 index, but twice as much in the opposite direction on a percentage basis each day. Because of this leverage, the options on these two ETFs behave in unique ways which can be helpful for some strategies. However, most traders are more likely to want options that are based on underlying entities that move on a 1:1 basis with the S&P 500 index. So let’s review those choices.

| Ticker | Type | Index vs Strikes | # of Shares or Multiplier | Notional Value @ SPX = 4000 | Settle as | Tax Treatment |

| SPX | index | 1 : 1 | 100 | $400,000 | cash | 60/40 |

| /ES | futures | 1 : 1 | 50 | $200,000 | one contract | 60/40 |

| SPY | ETF | 1/10 | 100 | $40,000 | 100 shares | short term |

| XSP | index | 1/10 | 100 | $40,000 | cash | 60/40 |

| /MES | futures | 1 : 1 | 5 | $20,000 | one contract | 60/40 |

While SPY is the simplest choice because it is most readily available, there are reasons to consider each of the other listed choices to best meet the needs of a specific account or strategy. From biggest to smallest, SPX controls 20 times as much capital as /MES, and the other choices provide increments in between. I was personally reluctant to trade futures options at first, but for no good reason other than I wasn’t familiar with their nuance. As I write this, I currently have at least one contract of each of these five choices open amongst the various accounts I manage.

For all of our choices, we currently have the ability to select expirations three days a week, and potentially five days a week in the near future. Each choice has an extensive selection of strikes available at each expiration, although one can expect Friday expirations and month end expirations to have more choices and more trading volume than Mondays and Wednesdays. We expect third Friday (monthly expirations) to have more choices and trading volume than any other expiration in the month.

My personal preference in most situations is SPX due to its large size. Even though commissions and fees are more on a per contract basis, the fact that SPX is 10 times bigger than SPY or XSP makes commissions and fees almost negligible in most trades of SPX, where they can be a substantial consideration with SPY and XSP in some strategies that deliver narrow profits. For futures, I like /ES over /MES for the same reasons. However, when I’m trying out a new strategy or working with a small account, I often have no choice but to use SPY, XSP, or /MES. For most new traders, SPY is the first and easiest choice, but eventually there may be a need to use another choice. For example, if you start trading 10 option contracts at a time, it might make sense to use SPX. If SPY is too big, you may want to get approval to trade futures and trade options on /MES. If you have a taxable account and are in a higher tax bracket, XSP may be a good alternative to SPY to reduce short term capital gains. So, learn the differences and make the choice that makes the most sense for the situation.

If you want to investigate strategies for trading options on the S&P 500 index, take a look at some of my favorite strategies. You may also want to read my page on how different option strategies have very different risk profiles.

6 thoughts on “Options on the S&P 500 Index”