In the bear market of early 2022, I re-discovered a strategy that I had mostly discarded during the bull market of the preceding years, the Iron Condor. The Iron Condor is primarily a neutral trade that when managed with aggressive rolls can provide good returns in choppy, down-trending markets. My goal is to maintain a position that can tolerate fairly big market moves up or down, while benefiting from time decay.

I had discarded the Iron Condor trade because I found I was always losing on the call side of the Iron Condor. Initially, I liked the idea of making money on both sides, but I found in a constant up market, I often lost more money from calls than I made from puts. So, I switched to mainly put spreads and other short put strategies, which did great. But then 2022 came along, and it was clear that the market was no longer going up, and that we were heading for a bear market. I started adding credit call spreads to my credit put spreads to balance risk and have a neutral strategy. Over time I saw that some of my set ups and management strategies were working better than others, so I investigated and came up with a process that now works well in the current bear market environment.

The basic setup of an Iron Condor

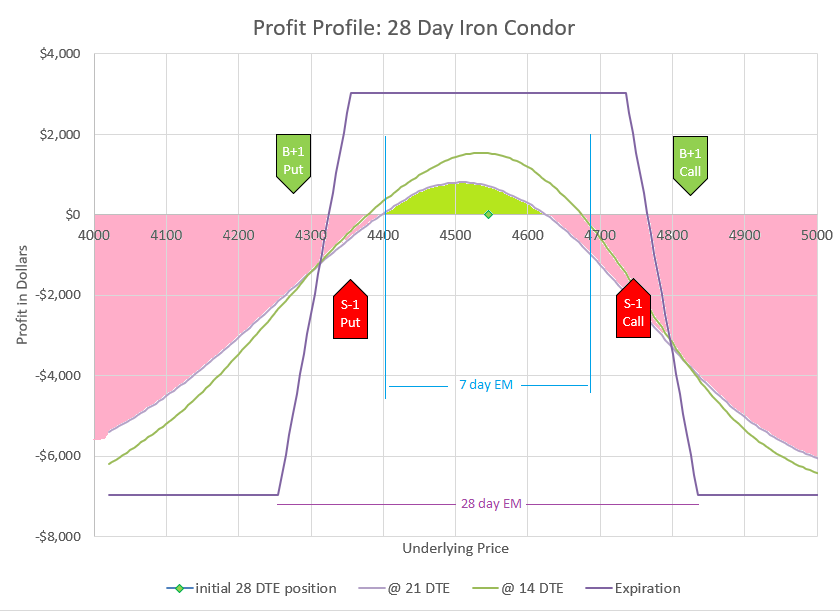

Selling Iron Condors is an extremely common option trading strategy. The strategy is a combination of two calls and two puts, four separate options working together. Usually, an out of the money put and out of the money call are sold, and then a further out of the money put and call are purchased to define the risk and reduce cost. The trade wins at expiration if the price ends up between the short strikes, and hits max loss if the price moves beyond one of the long strikes. However, I rarely if ever hold to expiration and roll my position way before expiration is a concern.

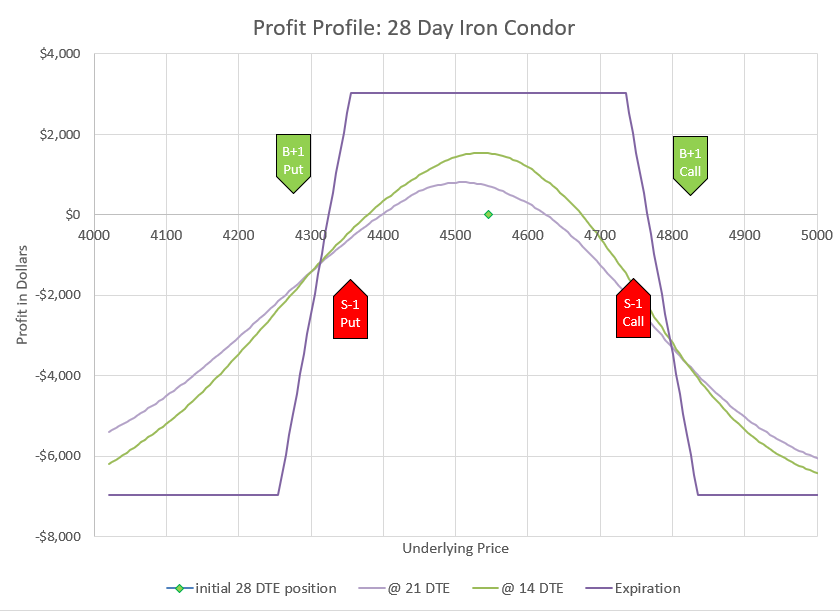

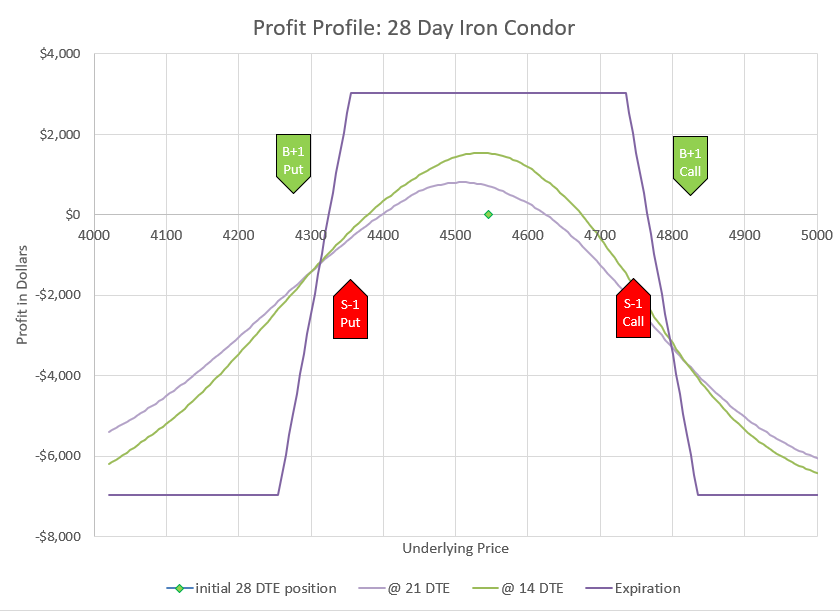

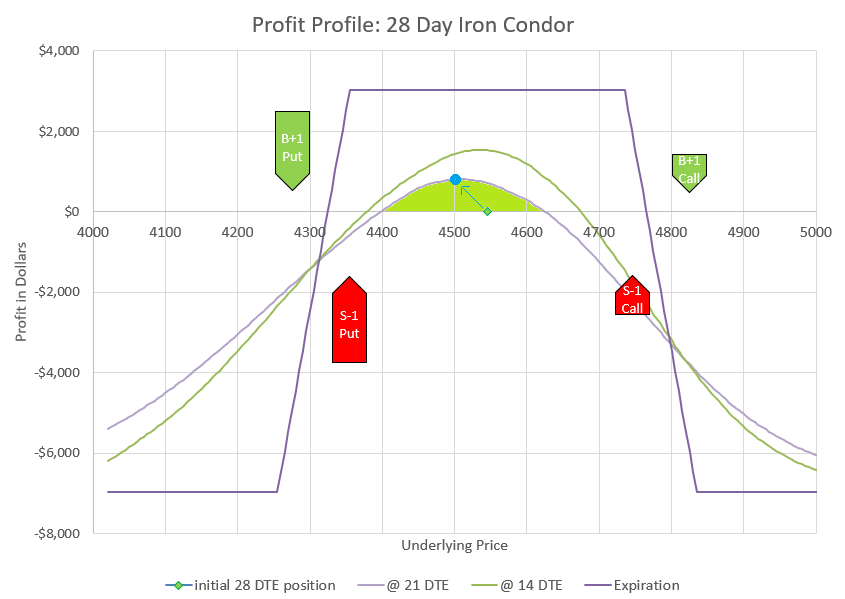

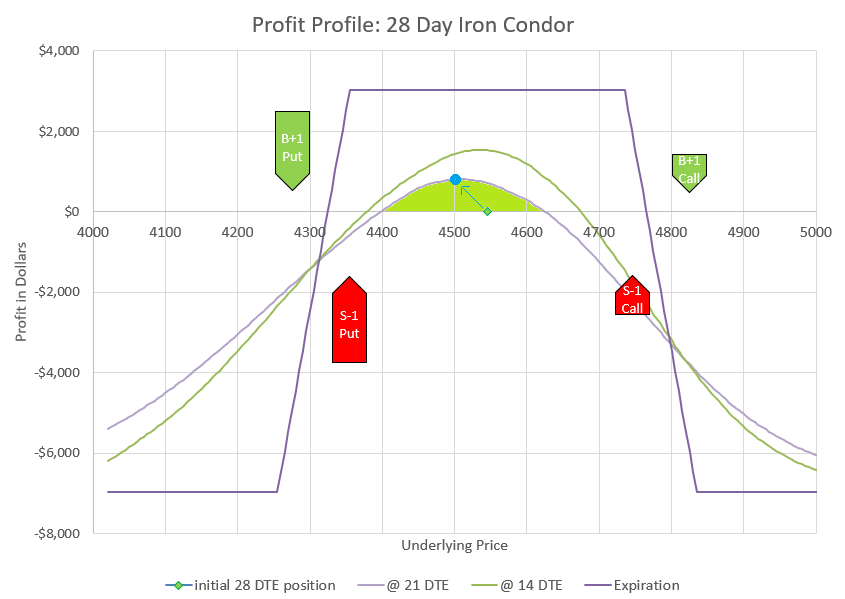

An Iron Condor is named after the shape of the profit curve at expiration, which kind of looks like a condor with a bit of imagination, kind of like how star constellations are named. The iron part of the name designates that it is made up of a combination of puts and calls, as opposed to a put condor, or call condor which has four legs of the same type of contract. An example of a put condor is the broken wing put condor strategy I have described in a separate post.

To build on the condor metaphor, the difference in option strikes are often referred to as the body and wings of the combination trade. The body is the difference between the short put strike and the short call strike. The wings are difference between the call strikes or between the put strikes. The wings on the puts may be equal in width to the wings on the call, or they may be different. Wings that are different widths might be call unbalanced, or broken wings, as the profit profile will no longer be equal levels each end of the price ranges of the trade.

My preferred Iron Condor setup

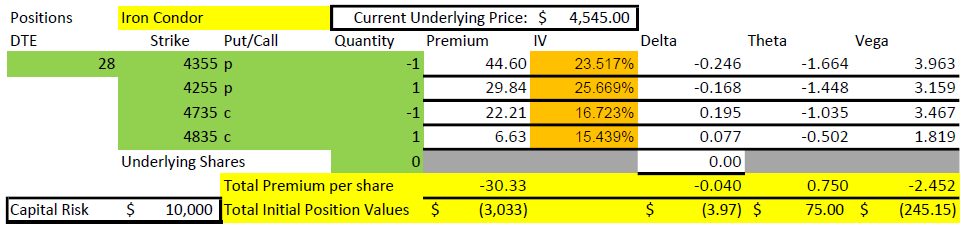

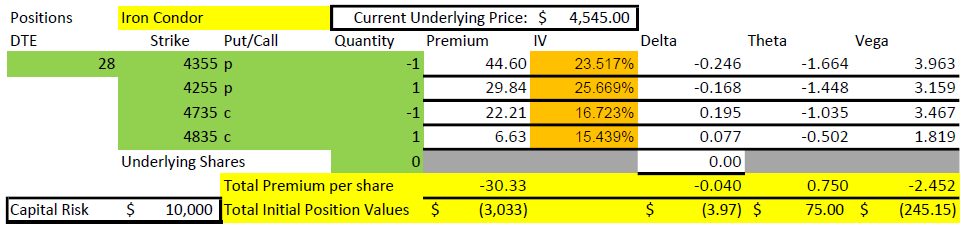

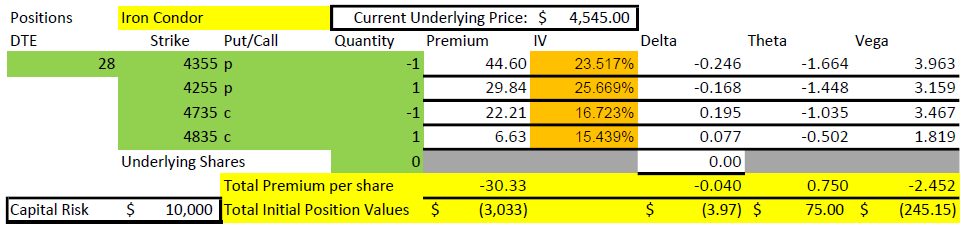

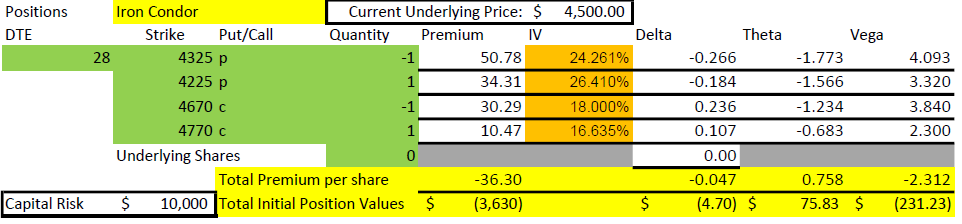

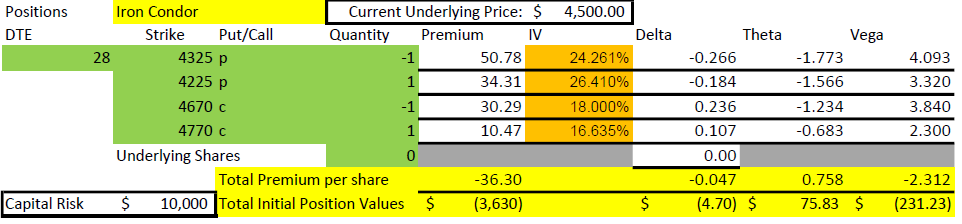

What I have determined works best for my management strategy is to use the S&P 500 index options (SPX), targeting a starting point 28-35 days from expiration, with option Delta values of 30 for the short strikes and around 20 for the long strikes. I like equal width for the put side and call side, so the Delta values for calls will be a bit wider than the put side, and the net Delta of the Iron Condor will be slightly negative. With implied volatility between 20 and 30%, I generally target 100 wide wings, with the body between the short put and short call of around 15o points on SPX.

I use SPX because it is the least likely underlying to have outsized moves. It is also very liquid to trade, has tax advantages in taxable accounts, and has expirations multiple times per week in the timeframes I trade. Depending on account size or type, other option products for the S&P 500 may be appropriate and can be used instead with essentially the same strategy. Other indexes or even individual stocks can be used, but managing can tougher with bigger moves, less expirations, and less liquidity.

I use 28-35 days to expiration (DTE) because my position can tolerate most reasonable moves while still having decent decay. I’ve used timeframes as low as 7 DTE, but find that many one day moves can push a position out of the profit zone, and I find myself fighting a losing battle too often. Longer durations of up to up to or over 100 DTE can work, but decay is slower, and there are very few expiration choices to roll to for the way I like to manage. All that said, my plan can vary to different timeframes, with the goal that I will only hold the position for somewhere between 1/10 and 1/5 of the time left to expiration- for example, a 30 DTE would be held 3-6 days before rolling, while a 100 DTE position would be held 10-20 days.

I choose 30 delta for short strikes and 20 delta for long strikes because they are the most forgiving in a move, while still offering reasonable decay as a spread. Higher deltas allow for more premium to be collected, and price movement will often be well tolerated as the long strike of the tested side will increase and the short strike of the untested side will decrease in value, compensating for much of the increase in value of the tested short strike. The goal of my management strategy is to keep this relationship intact, so that price movement has little impact on my option position value. I think of the area where deltas of the four options balance each other out as the profit zone. Staying in the profit zone allows Theta, or time decay, to do its work and deliver profits. I have used strikes with a bit higher delta values, but if too high, the two sides will get tested more often and then require more management. In the past, I often used lower delta spreads for safety and better percentage decay. However, I have discovered that low delta positions don’t actually tolerate price movement well because the untested side of an Iron Condor quickly runs out of premium to offset any of the movement of tested side. This observation has been a game changer for my use of Iron Condors.

I use equal width wings on the Iron Condor for a couple of reasons. Equal width seems to tolerate price movement, both up and down. Equal width also leads to a net negative Delta position, decreasing the total position profit when prices go up and increasing profit when prices go down, which is good in a bear market where downturns are frequent. Negative delta actually is somewhat neutral if the value is only slightly negative- Iron condors also have negative Vega, or decrease profit when implied volatility goes up. So, typically when prices go down, implied volatility goes up, and impacts of the negative Delta and negative Vega cancel each other out.

My Iron Condors are opening somewhere around 50% of the width of the wings. For example, if I have 100 wide wings, I would expect to collect $50 premium. I initially resisted this, thinking that the probabilities would be too low. However, since the time in the trade is so short, and I plan to actively manage moves against my position, I find that the risk reward ratio becomes favorable. However, the example trade that I’ve used is a little wider body and collected only 30% of the width.

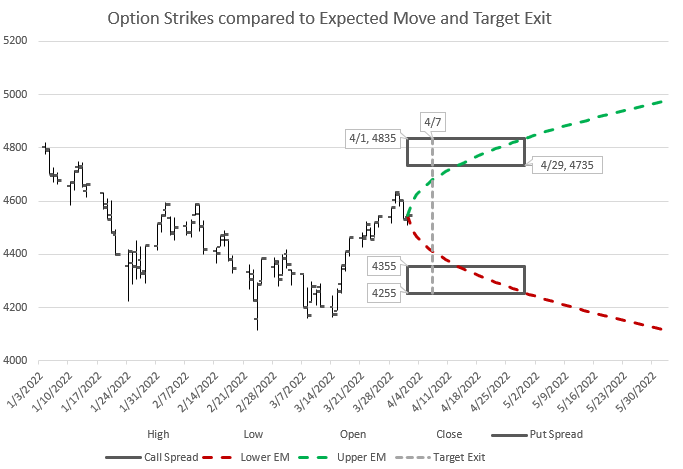

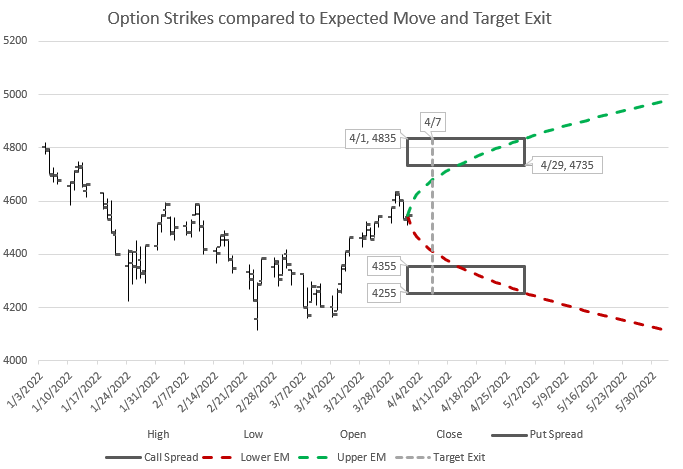

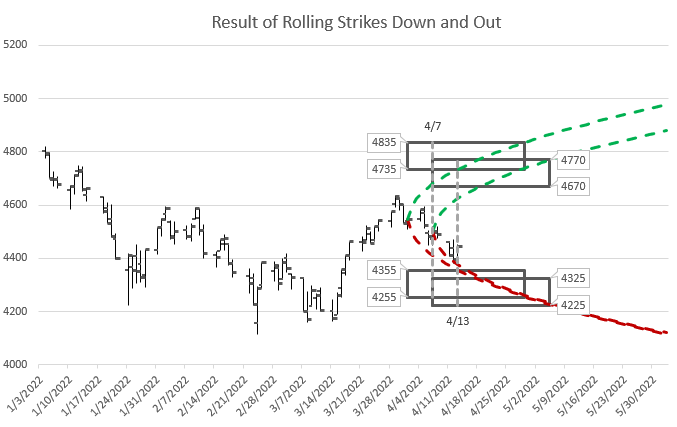

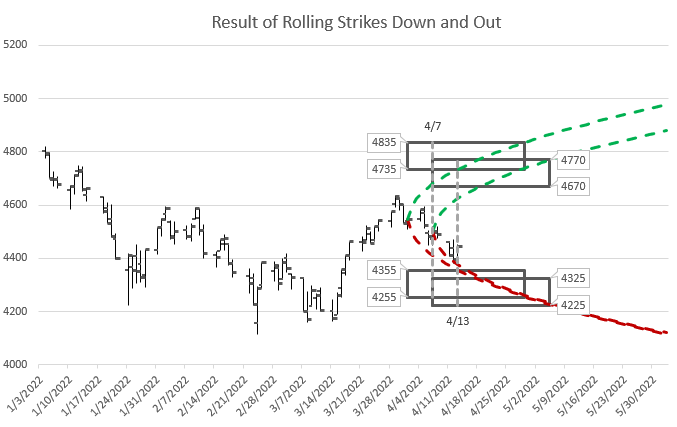

I have devised a graphic that may help to visualize this setup in regards to the expected move and time frame of the trade. The graph has several components- a historic rendering of what the index has done for the past several weeks, a curve showing the expected move for the next several weeks based on current implied volatility, and two boxes to represent the put and call strikes shown from the time of opening until expiration, and the target date to take action. My point with this chart is to show that while the strikes chosen are within the expected move at expiration, they are outside the expected move through the time I expect to be in the trade before I manage it. Said another way, if the position were held to expiration, it is very likely it would be breached on one side, but because the plan is to manage early, a breach is not likely- it would take an outsized move beyond the one standard deviation expected move.

Managing the trade with rolls

I manage my Iron Condor with what I think is a fairly unique rolling strategy. I roll my positions out in time and change all strikes in the direction that price has moved. If price goes up, I roll all the strikes up. If price goes down, I roll all the strikes down. I just roll whichever way the market goes. Here’s the interesting part- if I keep in the “profit zone,” I can roll up or down for a net credit with each roll, and my existing position will have a net profit. Usually, one side will be sitting with a profit and one side with a loss. The losing side is being tested- its strikes have higher deltas than when the trade started. The profitable side will have lower deltas than when the trade started. My profitable side should have a bigger profit than the loss of losing side. When I roll, I will likely have to pay a debit to get my losing tested side back to a good set of strikes at the new expiration. However, I should be able to collect a bigger credit on the profitable untested side than my tested side cost. Ideally, every roll is closing a profitable trade and collecting a net credit to open its replacement. All of this sounds great, too good to be true, but there are a number of details to unpack.

The first challenge is to stay in the profit zone. My general rule is that if I keep my untested short strike must never drop to a Delta value below 15. The reason is that when the Delta of the untested side gets below this point, it quickly stops being able to meaningfully contribute to offsetting price movement in the tested direction. For example, if the price drops, the short call will get further out of the money and drop in value, while the puts will go up in value. For a while the Deltas will mostly balance each other out, but as the Delta of the short call drops below 15, the put spread will start increasing much faster and the calls decreasing less. If this happens, it is time to act and roll all the puts and all the calls down to where there is again premium on both the put and call side. If price has gone up too much, it’s time to roll up all the puts and calls.

Actually, I try not to wait until the untested side gets to 15. I think of my position of having three possible states, green, yellow, or red. Green is when both short strike’s Deltas are above 20- everything is great and there is nothing to do. Yellow is caution, one of the short strikes are between 20 and 15, and probably will need to roll soon. Red is stop and take action, one of the short strikes is 15 or below, so it is time to roll immediately. So, my choice is clear for Green or Red, but I need to use some judgement in the Yellow state. If the day starts in the Yellow, I am more likely to let it ride for a while and watch to see if it recovers or gets worse. If the market has trended throughout the day and moved into the Yellow, I am likely to roll before the end of trading so I don’t end up deep in the Red overnight. If there is a strong trend pulling the position quickly toward Red, that may also be a good indication to act. Yellow is a judgement call.

I find that it is harder to have a profitable, credit roll when tested on a quick up movement. As mentioned earlier, equal width wings means that there will be a negative delta overall, and while volatility reduction can help, big up moves can be hard to stay on top of. That’s why this strategy works best in a bear environment, when the market is trending down.

Don’t over manage. Markets bounce around a lot, and it can be tempting to want to act on each little trend that happens. If I have the right strikes- the right body width and wing width for the market conditions, my position should be able to tolerate price movement. If I’m trading at 30 DTE, I want to wait 3-6 days between rolls, so I need to be choiceful about not rolling too often. If the market moves a huge amount in a couple of days, I may need to roll early, but then I’ll want to try to go longer before the next roll. The other thing to consider is that often the markets overshoot in one direction or the other, so I try not to move too far to chase moves that go on for days, and stay patient that the market will counter the trend.

If a position isn’t winning regularly and isn’t holding its premium in control, that’s a sign that the strikes aren’t right for the market and the duration. For a while I was trading 7 DTE Iron Condors on SPX with around 100 wide bodies and 50 wide wings. I would adjust nearly every day, but I couldn’t keep the position in the profit zone, and I often took losses. There wasn’t enough space in the body and the wings weren’t helping enough. By widening out the body and wings and adding more time, I found the position much easier to manage, and more likely to be profitable, and much less likely to take a big loss.

One way I can tell if I have a forgiving position is to compare my premium to the premium of the same position a few strikes higher or lower. For example, with Schwab StreetSmart Edge, I can pick Iron Condor as a strategy, pick an expiration date, pick a body width and a wing width. The application will then give me a list of strike combinations and premiums for those parameters. If all the choices around my preferred strikes have similar premium, then I know that price movement will have minimal impact on my chosen position. If there is a rapid change in premium for other strikes above or below my choice, it means my Iron Condor parameters are not very forgiving, and I should adjust time or widths or both. Other brokers will have similar ways to compare prices by shifting up or down all the strikes.

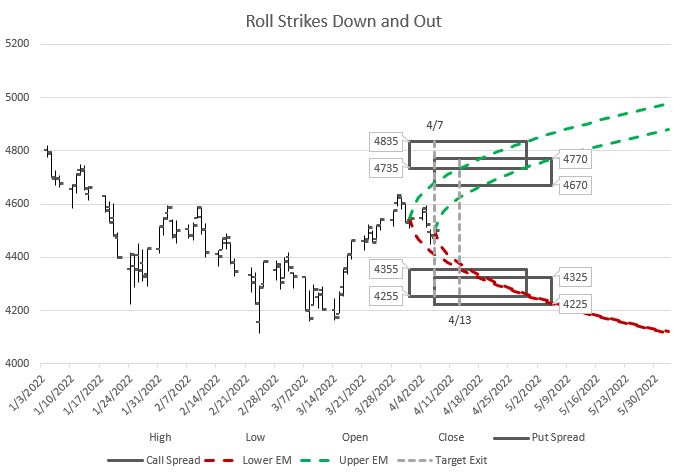

I have updated the earlier graphic to illustrate how a change in price over time will dictate the choice of a new position to roll to. The new price now dictates a new expected move, and new ideal strikes and expirations. Hopefully, this chart will help those that are fond of graphical illustrations.

Eight legs in the Roll

Since an Iron Condor has four legs, rolling involves closing four legs and opening four new ones. I don’t think any broker or exchange allows a eight-legged trade, so at a minimum this will take two trades to complete the roll. My preference is to roll the puts as a trade, and roll the calls as a trade. I usually start with the side that is being tested and might need a debit to roll to a new expiration and strikes. Then I do the other side, usually moving the same amount and keeping the same width, expecting to collect more to roll the untested side than I pay to roll the tested side.

At times, I may have a situation where I don’t have enough buying power to roll one side while the other side remains in place. If that happens, I’m probably using more of my buying power than I should, or the position is just too big for my account. It isn’t that big of a deal to manage the situation, however, I just close the untested side out and roll the tested side, then open a new position on the untested side. Worst case scenario, I can close the whole Iron Condor at once- freeing up its buying power, and then open a new one with the same buying power. As long as the wing widths are the same and the new Iron Condor collects more to open than the old Iron Condor cost to close, there should be a net gain in buying power. But again, any time buying power restricts a trade, it is probably time to pare down some positions in the account.

How Iron Condors tolerate price movement

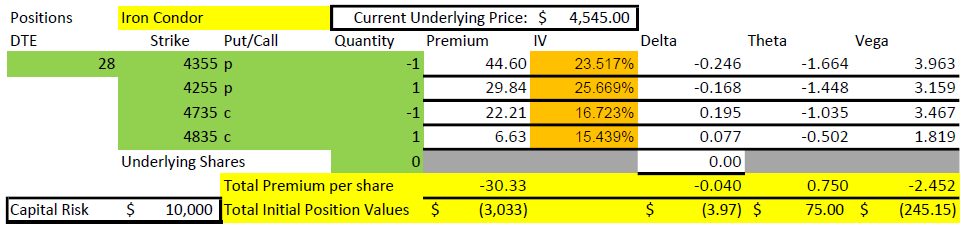

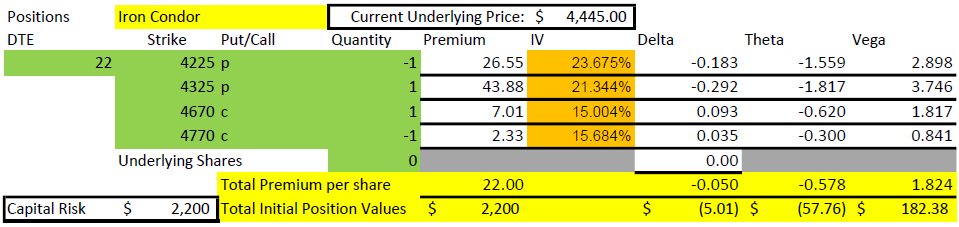

Probably the best way to explain how an Iron Condor tolerates price movement is with an example. Earlier in this post I showed an opening trade from April 1, 2022. Let’s look at it again and look at how it fared after 7 days.

Notice that the premium collected is approximately $15 each on the put side and the call side.

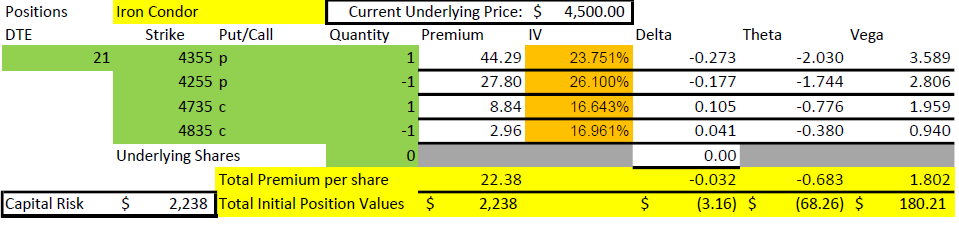

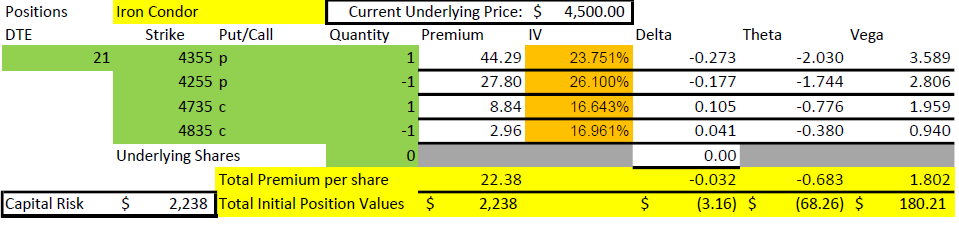

The premium on the put side has gone up to around 16.50, while the call side has dropped to just under $6.

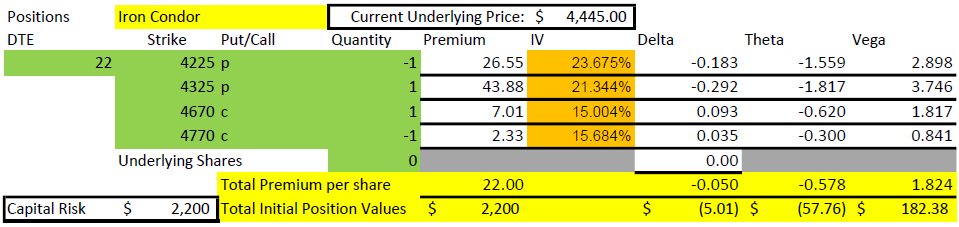

So, after 7 days, the trade made about $800 on $10,000 risk, an 8% return. But, that’s just the start- the plan is to roll, and so the closing trade above was combined with the following opening trade:

The combination of closing the old trade and opening the new trade is a net credit of just under $14 premium. This is the result we are looking for- a profit on the trade being closed, and a credit to move out in time and get to better strikes for the latest situation.

And just to finish the example trade, let’s look out another week and see what happened to the market and the trade that was rolled to.

By April 13, the market had dropped even further, approaching where the puts from the original position had been. However, the roll down gave the new position plenty of space and the trade was sitting at a profit, and ready to roll again.

This trade made $1430 in 6 days, a 14% return on capital. Since the market went down, the put side of this trade lost money, although not that much since the price didn’t end up that close to the put strikes since our new strikes were lower than the old ones. Time decay helped counter the price movement against the puts. The money was made on the call side through both price movement and time decay. In the end time decay, represented by Theta, eats away premium as long as price doesn’t get too close to the strikes.

These are examples of trades I did during the Spring of 2022 in the face of a bear market. Not every trade faired this well. Some market moves were too fast and too far for me to be able to roll before the position went too far to one side. But more often than not, this rolling methodology has kept me from having positions blown out, and keeps day to day portfolio value from varying out of control.

You may notice that the example trades shown here don’t exactly follow all the mechanics I’ve described. Since those trades I’ve become a little more likely to intervene early, although it’s a balance with avoiding over-adjusting.

Finally, I don’t always get my rolled positions re-centered, like I did in the example I presented here. Often, I’m happy to just move in the direction of the market and make sure my new strikes are a bit out of the money on the tested side. In this crazy bouncy market, we get lots of reversals, so I let my positions stay a little off when the market has moved a long way and technical indicators suggest the last several days move may be about finished. However, these choices come down to individual trader preference and market outlook. No one knows what is happening tomorrow or next week, so we each have to decide what trade is best based on the information available. For a real life example of this type of decision making in action, see my post on the Goals of Rolling an Iron Condor.

Good luck trading and rolling Iron Condors!

Thank you, Mr. Allen … as always, very informative information on options. I also just went back to using the Iron Condor and you have giving me some insight on doing adjustments. I have also been using your 6% weekly rolling for bull put spreads and has been very good to me. Keep up the GREAT work!!

Thanks for the interesting article!

But I need one more tip to stay in the profit zone. In the article you only refer to the delta on the untested side. Do you also have a green/yellow/red recommendation for the deltas on the tested losing side? At what value should you roll them up/down and out? In some of my IC-trades, I’ve been underwater faster and deeper with the calls than I could hold against this with the puts. Or do you have another tip on how to prevent this?

Thanks for the comment and question.

Equal width wings will make an iron condor inherently bearish. The position will have negative delta unless the price goes into the money on the put side. So yes, a move to the upside can be a challenge. As I write this, the market has gone up almost 10% in the past 2-3 weeks and despite rolling up my iron condors several times, my positions are in the money on the call side, marked to a significant loss. Which brings me back to your question, what can be done to prevent this?

First, realize that short call positions will lose in moves up that are several times the expected move. Quick back of the envelope math- 23 days is approximately 1/16 of a year, and the square root of 16 is four. So, we expect the market to move within 1/4 of the VIX in 23 days. Assume that VIX is 24, that means that we will likely stay within 6% up or down in 23 days. We just moved up almost twice that in less time at the end of July 2022. There is virtually no way to counter losses on a short call in a rapidly moving up market. However, I have two approaches to consider for this situation.

I can continue to fight and wait to be right. As discussed in the original post, I roll up all positions and roll out at the same time. I find that if I roll before my calls get into the money, generally I can find rolls where I can collect a credit rolling up and out without narrowing the body of the iron condor. If the market is moving up a lot, I likely will be taking a loss on the trade I’m closing, but if I can collect a net credit, I’m set up to profit when the market reverses, and make up what I lost. The extrinsic value of the position has grown and a net credit means that I will have more extrinsic value to decay. After the roll, I likely still have significant negative delta, so I’m counting on a reversal. My assumption would be that we are still in a long-term downtrend, and the recent up move will shortly be countered by a down move. In a bear market, this is generally true. I can take big moves down easily, but not big moves up.

A second approach is to set up the iron condor much more neutral than equal width wings. To do this, initial strikes could be picked with identical deltas on both the put and call side, or equal delta width. For example, one could pick 25-15 delta on both sides, or maybe 25-15 on the put side and 20-10 delta on the call side- either way the initial position would have zero delta. The risk of this trade is equally balanced in each direction. Up moves will take longer to impact, but as the market moves up, the position delta will turn negative, and require adjustment. Down moves will likewise switch the position delta to positive. Big moves either way will show a loss, while small moves will show a profit.

In any case, my goal is for time decay to outpace price movement, and price movement to swing back and forth. To profit, I need to be out of the money and avoid over adjusting. I let my positions float somewhat and when I adjust with a roll up or down, I don’t move all the way back to neutral. I don’t want to roll down one day and need to roll up the next because I over adjusted. I count on all short term trends being short term and giving my positions time and space to be right eventually.

Specifically, back to your question of defending calls, my first roll up with equal width wings is when the short call delta gets higher than the short put delta. For example, if my short put has a delta of 30 and my short call is 31, I would look to roll up and get my total delta closer to zero, as the delta spread on the call side would be much bigger than the put side. If the up moves continue, I try to be patient and react next when my long call goes in the money with a roll up and out. Next I wait for the price to get half-way between the long and short call and then roll up and out. Finally, when both strikes are in the money I roll up to get the short out and keep theta on the call side positive. Each roll I look for my put side roll credit to be more than the call side debit, although sometimes I may have to either narrow the gap between short strikes, roll up less than I’d like, or pay a small debit to get to a better probability position. I take on more extrinsic value (and risk) as the market continues to move in one direction, all the time expecting a reversal back to the long-term trend.

At some point, bear markets end. In a true bull market where the long term trend is up, Iron Condors are a losing trade because the calls can’t be defended even with narrower wings than the put side. In a bull market, credit put spreads make more sense.

So when you decide to roll, you always roll to next week options? (like from 21 days to 28 days) if so, if there are 3 big drop in a week, you may end up with rolling to +21 days? (so you are holding 42 days options in this example)

Great questions. I generally roll to the weekly (Friday) expirations. Since I’m usually a number of weeks out, the other weekday expirations don’t have much volume and often are missing strikes and have a hard time getting mid-price fills on trades. I will use month end expirations, as they have very good volume and liquidity.

Because I currently trade mostly Iron Condors on indexes using fairly equal width wings, I can often roll down for a credit in the same expiration on down moves. That’s why I like Iron Condors for a bear market, and not for a bull. For the past few weeks, I’ve rolled down several times in the same expiration, gaining all the advantages mentioned in this post- recognizing profit, collecting a credit, reducing delta, and widening the body for improved probabilities. If I’m mostly centered in price, I usually have a slight negative position delta which profits on down moves.

If I get tested to the upside, I have to roll out to have a chance to collect a credit. So, if we have a series of big moves up, I may find myself rolling out several times in a matter of days. I try to keep my expirations between 14 and 42 days, but in big run ups, I’ve found myself with positions expiring beyond 45 days.

There’s no hard and fast rules, and I just use my best judgement. As I mentioned in the original post on Iron Condors, the less adjustment the more likely it is to stay profitable. So, if I’m undecided as to whether to roll or not, I try to default to not adjusting. The challenge is that in this very volatile market, I can go from being tested on the downside one day, to tested on the upside the next.

Hi Allen,

Great post on your strategy on the ICs. I was wondering if you are still getting decent credit in the current market 6/2023. I notice that based on the distance and width on your trade in current market, the premium collected combined is only about 10 dollars total. (that’s 100 width between the shorts and longs and 380 pts between the 2 shorts. Am I pricing it right? Seems that the premium has dropped dramatically. Could you shed some light on it? Thank you!

Ken- Thanks for the nice comments.

Actually, I tend to base my strike choices on Delta and the Expected Move more than a fixed width in dollars. As Implied Volatility has been reduced, it means I have to bring my strikes closer and sometimes make the width between short strikes and the long strikes smaller. My go-to value is almost always 20-21 Delta for my short strike on puts and 12-13 Delta for my long strike. I look for something similar on the call side, but then I have to decide if I want to be Delta neutral or have negative Delta, so I make choices based on market conditions and what the rest of my positions are set up with. To be neutral I have to have narrower width on the call side.

In any case, the mechanics of managing works the same, I just keep rolling out, keeping both sides out of the money. The challenge is to not get too caught up in every little move but have enough time to let the market bounce up and down.

With implied volatility low, we are also seeing mostly small moves in the market, so it’s not a significantly bigger risk to keep getting decent premium and decent profits.

Hi, thank you for this article. I noticed in the article you said you would put your short strikes at 30 delta, and then defined what your green, yellow, and red zones would be for those deltas. In the above comment you said you like to be closer to 20 delta for your short strikes. Has your strategy changed since originally writing the article? If you have 20 delta short strikes, what are your green, yellow, and red zones?

Thanks, I appreciate all the transparency with your strategies. Reading them has helped me form a trading plan.

Brandon- for a strategy that rolls up and down regularly, the original article guidelines gives the best maneuverability. The goal is to avoid having one side losing substantially more than the other side is gaining. Active adjustment makes this work.

Trading with positions further out of the money is less adjustable, but is less likely to go into the money quickly. So, it can be an alternative if a trader doesn’t have the desire or time to frequently adjust.

There are trade-offs for every choice we make. The key is to understand what changes in terms of risk, reward, and tradeability with each decision.

Hi Alen

I just had a chance to go over your article. I have been doing IC for a while and I found that having equidistance wings and being delta negative may be hurtful in bull market. What do you think of being more delta Neutral trade ( or slightly negative delta ,maybe around -0.005) ?

@Ron- Thank you for the comment and question.

I thought I had written an article about setting up Iron Condors with different Delta values with exactly your question in mind, but I don’t see it on the site anywhere, so it must have been a topic I never actually wrote about. First, I agree with you that equal width wings on Iron Condors with lots of negative Delta can be hard to have during a bull market. They tend to work better in a bear market or sideways market. So, 2022 was a good year for them, 2021 or 2023 not so much.

In a bull market, the question for a trader is whether it is worthwhile to trade the call side with a short position at all. The disadvantage is that you have your gains on the put side cancelled by the call losses as the market goes up, but the flip side is that with anything close to neutral delta, you don’t see big swings in the position value every day. So, if a trader wants to be more neutral than equal width provides, what differences in strategy make sense?

There are two ways I like to keep my Iron Condor portions of my portfolio neutral. One way is to make the call side of the Iron Condor narrower than the put side, so that the net Delta is near zero, slightly positive or negative, depending on what I’m aiming for.

Another is to have an additional credit puts spread to accompany the Iron Condor, so that I have two put spreads for every call spread. This tends to be positive Delta overall, but less positive than just having put spreads. I get the benefit of Theta from the call spread, but I can tolerate an uptrend and still make money. Sometimes I’ll do three put spreads for every call spread to be closer to neutral, but the idea is the same. A lot depends on the underlying and the amount of capital I want to tie up in the position.

Whatever we do, the market is going to change our Delta with every up or down move. Down moves make Delta go up and up moves have a negative impact on Delta, a natural way to make a position fade the current trend and make the option seller a contrarian. Given how much the market over-reacts day to day and week to week, that isn’t a bad thing.

I really like your website. My understanding is that when market moves quickly and your short deltas get away, the decision to roll your 35DTE iron condors depends on how many days are left to expiration. I sort of feel like 38 delta on puts 30 days from expiration is still acceptable. Same delta 7 days to expiration is too high and i would roll immediately. What does your science say?

Another question.. you mentioned in your posts that iron condors are best for bear markets. I am struggling to understand this. They have negative delta with same width wings, but you do not have to have same wings to get positive overall delta. In bear markets the volatility increases and in order to make money on iron condors the volatility has to decrease. The price move is irrelevant, at least it should be if the position is close to neutral. The bottom of a bear market is ideal for iron condor, I think. Any comment?

Gabriela- Thanks for the nice comments and great questions. On your first question, you can always let the a position play out, given that probabilities are still better than 50/50 of profit. However, I tend to want to give myself more time when a position gets tested, and more space from the money if I can. I can get a little lower delta, improving probabilities as well.

My aversion to iron condors in bull markets is that I’ve found that the call side tends to get blown out over and over, much more than the delta values would indicate. If you back-test the call side of iron condors, it is a losing strategy over time for that half of the trade. However, that said, starting delta neutral makes for a low amount of volatility in the position. On average, the average gain on the put side is greater than the average loss on the call side, so it isn’t a horrible trade-off.

The more I trade, the more I tend to favor low volatility of returns with lower risks in exchange for lower potential upside. Swinging for the fences can be thrilling, but slow and steady wins the race.

If you knew you were at the bottom of a bear market with super high IV, I’d load up with out of the money puts, and roll them up and out over and over. I wouldn’t want to fight the call side. But as they say, no one rings the bell at the bottom, so you don’t really know.

Thank you for your response. I really appreciate you taking time. In the first half of this year I did great selling put spreads and condors while the market was trending upward. In the current market I have been burned more on both sides, put and also call spreads. I tend to like condors to keep my portfolio’s volatility under control. You have mentioned that when you trade condors you immediately roll if one side’s short delta gets below 15. Your explanation makes a complete sense. However, because the current market has had some huge fast moves recently in both directions I find myself rolling loosing positions quite often with no time decay built up to help offset the price move. I tried not to overshoot but still got burned on the call side when the market immediately bounced back. I have backtested few of my condors to see what would have happened if I had left them untouched. It turned out that I would have made profit as the price did bounce back up few days later. I am wondering if I should let my newly opened condors sit untouched at least for 5-6 days regardless of the 15 deltas rule. Or, perhaps my positions are not appropriate for the current market if I can’t keep them in the profit zone during the first few days? Most of my condors are 28-45 DTE, 30-20 deltas on put side and 30 -15 deltas on call side ( same wing size) .

The advantage of having some time before expiration is that quick reaction isn’t necessarily required. As you point out, the market often reverses itself. Too much adjusting can often do more harm than good, so finding a balance is important. Evaluating performance and tweaking trading rules over time can be a very helpful exercise.