In June I hit a milestone trading the broken wing butterfly strategy, passing 500% return in one year. I learned the basic concept from Nick Batista and Mike Butler of TastyTrade.com. I was so pleased that I wrote the following note to Nick and Mike:

BWBF Success 500% in a year

Nick Batista/Mike Butler-

I’m writing to thank you for introducing me to trading broken wing butterflies.

A few years ago, you guys turned me on to the concept of Broken Wing Butterflies. I played around with the concept and settled into a trade that I was able to repeat over and over. Last June I set up an account with $9,000 trading only butterflies. Earlier this year I added Broken Heart Butterflies to the mix, because my strategy was a little susceptible to big drops. Not really sure why I have kept a single strategy in this account, but I’ve just kept going with it. After a year, I’m now at $54,000, which is 500% above where I started. I’m “only” up 119% this calendar year as I’m carrying around 50% cash most of the time to have for fighting downturns.

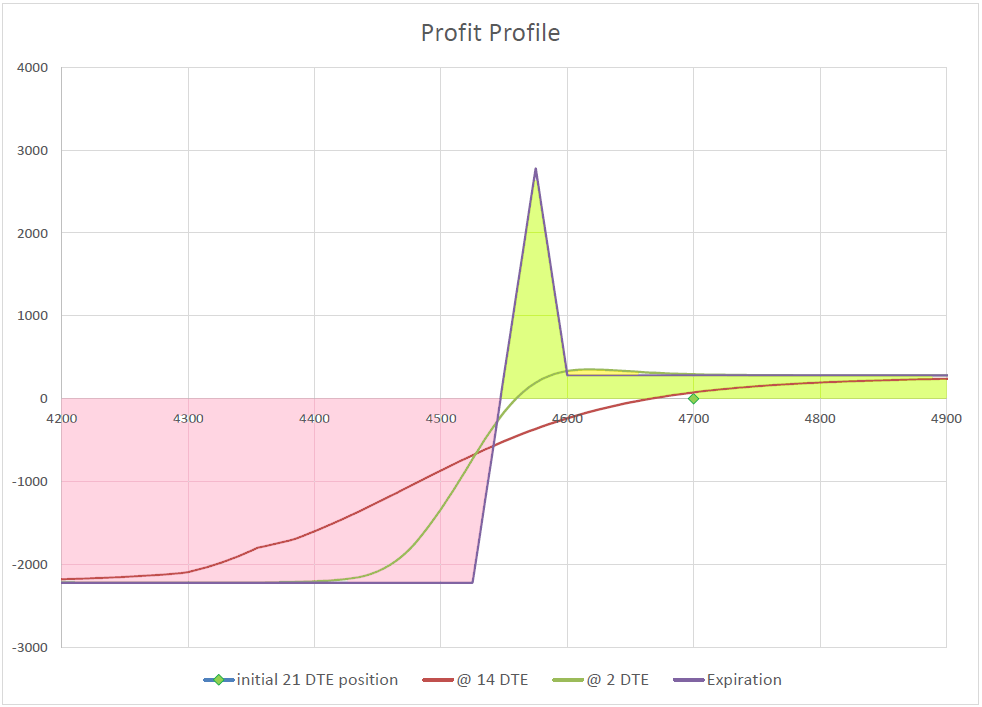

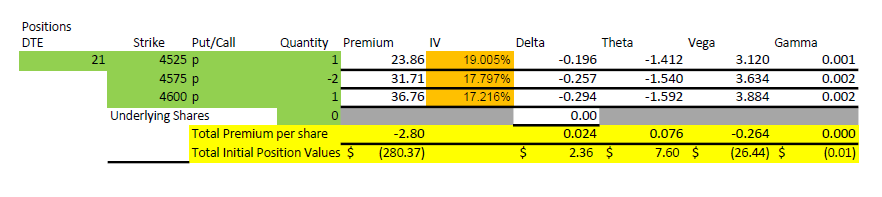

I played with this trade for over six months until I settled on this strategy in early 2020. I realized that butterflies hold value until expiration is close, so I adjusted this to a 21-day trade. I also wanted to make the trade worth my time, so I collect a lot up front. And I realized that hitting the high profit butterfly butterfly was close to impossible, so I just hold to get my premium collapse, which is much faster than a simple spread with the same risk.

My butterfly strategy is to sell two of the 25 delta puts and buy one a strike or two above, and buy the one twice as far below. I sell these 17 to 21 days before expiration and collect 12-18% of the width of the narrow spread or max risk. I close when this gets to 2%, by converting to a free butterfly. This works around 90% of the time. I was doing this in several accounts last year and had over 100 wins in a row at one point, making 10% in two weeks, over and over again. Eventually, I had some tests where I sell the debit side and roll the credit side, often for a debit. As long as I have cash to fight, I can hold out. I then wait them out for recovery.

Adding the Broken Wing Condor

I noticed that my tests were more likely when the market was going crazy up, hitting new highs every day and then a correction occurs. So, I was attracted to the broken heart butterfly in those situations for a little more probability, but less benefit. I think it is actually a broken wing condor, but whatever. For that trade I buy a 40 delta put and sell the one a strike or two below, then sell a spread three times as wide centered around 20 delta. I try to collect 6-8% of 2/3 the width of the wide spread (max risk). I open this up 14 days to expiration. Because of how this setup decays faster on the credit side, I target to collect 1-2% on the close. So I collect about 7% to open and collect another 1% to close. I can make a little more if I’m on the verge of being tested with 2-3 days left to expiration. Worst case, I sell the debit spread and roll the credit. I think I’ve only had one or two of these need to be rolled. I’m all about return on capital, so I look to make at least 10% a month on any short option strategy I do, while keeping probabilities very high.

All in all, I’m happy with how this is going and continue to watch Tasty for new tidbits every day. I especially like your show, because you are all about trade mechanics- what works and why. You also seem to venture out from standard Tasty style trades and look for creative ways to think about opportunities. Your discussions on leveraging skew and other unique situations are very insightful. Anyway, I just wanted to let you know that what you do is really helpful and that your approach to trading has given me tools to keep experimenting and try new things that have ended up being very successful for me financially.

Thanks so much-

(I received a nice note back from Nick)

If you want to see how I set up broken wing butterflies and how they work, go to the page I wrote on it here.