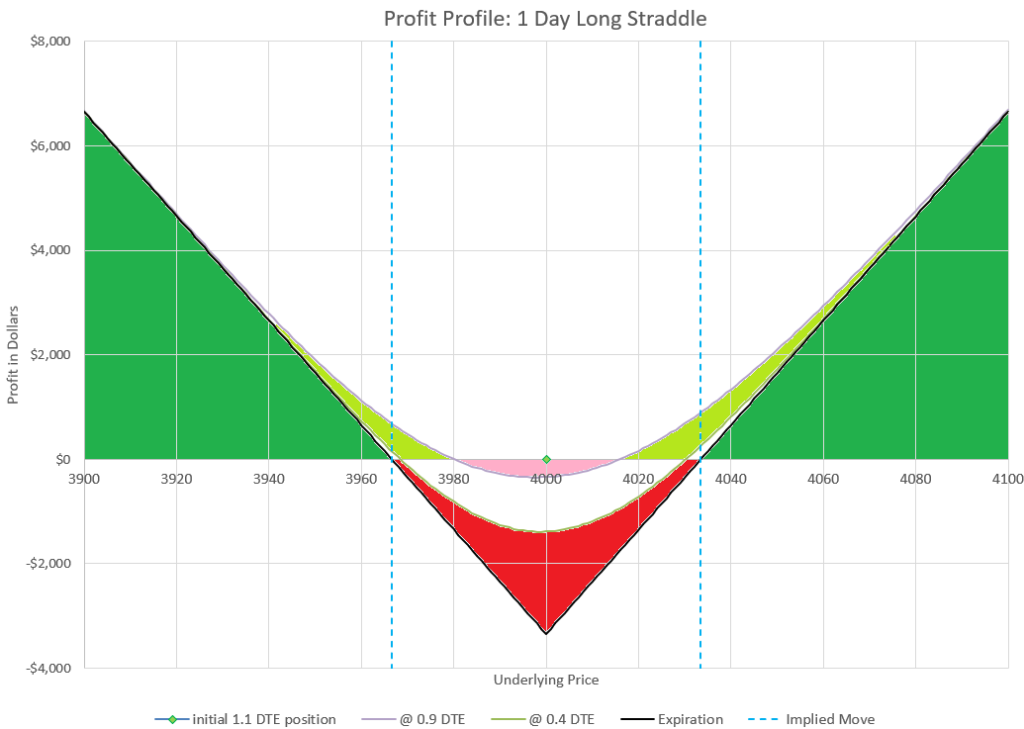

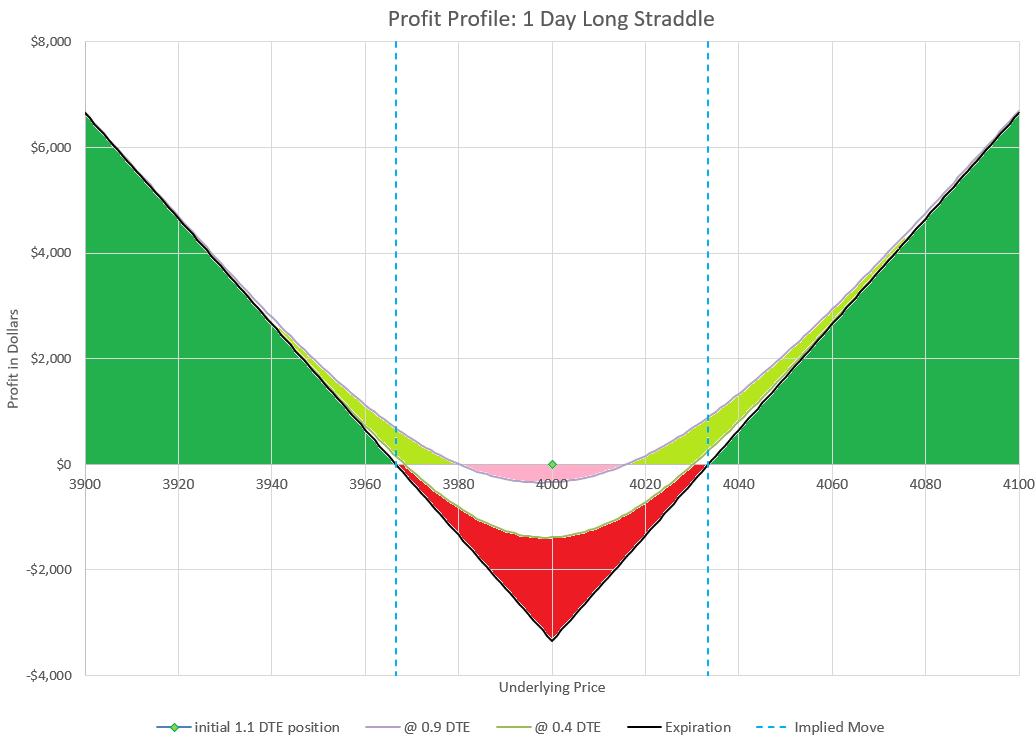

I’ve started buying 1 DTE straddles on the S&P 500 for two reasons. First, this straddle trade has a positive expectancy- over time it has made more than it has lost. Second, and perhaps more importantly, the straddle is a great hedge against my many short option positions further out in time. How I came to these observations and how I manage this trade are the topics of this discussion.

A straddle is buying a call and a put at the same strike price and same expiration. When traded at the money, it roughly represents the expected move of the underlying for that time period. So, buying a 1 DTE straddle for $30 would mean that the market expects the SPX index to move around $30 plus or minus the next day. Buying a straddle means the buyer is hoping the market will move more than expected, and the seller is hoping the market will move less than expected.

Normally, I only sell options or spreads for a net credit and wait for the value to decay away for a profit. I mostly sell options with expiration dates weeks or even months out and a decent distance out of the money. Those trades have a high probability of profit. However, they also carry the risk that an extended big move in the market could result in a big loss.

Profiting from the trade outright

With 2022 being a bear market year, I have studied more about ways to manage positions in downturns. One interesting book on the topic is “The Second Leg Down: Strategies for Profitting after a Market Sell-Off” by Hari P. Krishnan. One observation in the book is that options under 7 DTE tend to be undervalued and have good potential to make money or protect a portfolio in the midst of a downturn. The book has numerous interesting strategies to help navigate downturns. I’ve toyed with a few of these, but I couldn’t find a trade strategy that achieved the type of positive outcome I was looking for.

As I’ve noted elsewhere, I’m a big fan of the TastyLive.com broadcast site. Just before Christmas at the end of 2022, Jermal Chandler interviewed Dr. Russell Rhoads on his Engineering the Trade show. The topic was short duration options that are now quite prevalent. One key point is how very short duration at the money (ATM) straddles on SPX (S&P 500 Index) and NDX (Nasdaq 100 Index) are actually underpriced. If you buy a 1 DTE straddle at the end of the day and hold to expiration the next, it has averaged a positive return in the past year, which says these options are actually undervalued, counter to what we would normally expect.

I’ve added the presentation, which is broad ranging on the topic here:

(Press the red play button to watch)

I decided to try buying these as a one lot and so far I’m seeing this work out with a positive return. And this has been during a few mild weeks with little movement. The straddle never expires worthless as one side is always in the money- it’s just a matter of how much. I have generally closed these early, selling the side that is in the money when I can for more than I paid for the straddle. So far, this has worked better than holding to expiration because we have been range-bound. When we get into a trending market one way or the other, it will likely make more sense to hold.

The hedging benefit

However, I found a second benefit that may be much bigger. I decided to switch over and buy a 1 DTE /ES (S&P 500 mini futures) option straddle in an account with a lot of short futures options for a 1 DTE straddle- not sure why I even decided to other than the size is half as much. Anyway, I noticed that buying one straddle greatly increased my buying power by over $27K, which didn’t make sense initially because I was paying a debit and I thought that would reduce buying power by what I paid-about $1500 ($30 x 50 multiplier).

It turns out that the futures SPAN margin saw this as a big risk reduction. (For more on futures options and margin, see the webpage on different option underlyings.) Buying the /ES straddle gives me 500 equivalent shares of SPY notional in either direction of price movement. This will counter several short options out in time and out of the money. So essentially it is a shock absorber for my futures positions.

Many traders are nervous about the overnight risk of holding short options, due the possibility of a big gap in price overnight. Having a hedge like this can help mitigate that risk.

The biggest question is how big of a position is appropriate? Well, keep in mind that if the market doesn’t move at all and closes very close to the strikes of the straddle, the straddle will be nearly a complete loss. So the size of the trade should be a very small portion of a portfolio, as this trade will be very volatile, going from losing nearly 100% some days to returning several multiples of the initial value others. Think of it as a volatile side trade that can reduce volatility of a much larger set of positions. Kind of a contradiction.

Futures make this obvious, but the same logic applies to any portfolio full of short option premium. The S&P 500 and Nasdaq 100 indexes have a variety of options underlyings at different costs to allow traders of virtually all account sizes to utilize this kind of trading strategy.

So, I think there are a number of angles to pursue this from a trading and portfolio management tool. I thought it might make a good topic to discuss with this group- the gamma of this trade provides a lot of protection at a low cost, essentially free over time, although likely to have periods of loss.

Essentially, I look at it as a great hedge that can still make money on its own. If I have out of the money longer-dated short options in a portfolio, they will make money on calm days, and the 1 DTE straddle will make money on turbulent days. And if I manage each correctly, each should make money over time.

Managing the Straddle

I tend to buy these straddles right at the close the day before expiration. On Fridays, I buy Monday’s expiration, which surprisingly often is about the same price as other days. I’ve tried buying two days out and laddering, but that gets to be a lot to keep track of if I try to manage early, so I prefer to buy at the money at the close for just one day.

Like all option trades, there’s always a management choice of hold, fold, or roll. This trade has all those elements to choose from.

As mentioned earlier, probably the simplest choice is to just hold to expiration. The odds are that over time, the trade will win more than lose. However, this may mean that we have a day where a trade is profitable at some point in the day, but then moves back toward the strike price and loses money. Finding a way to beat simple holding takes a lot of effort and since we know the worst case scenario is losing all the premium we paid, we may want to just let it ride. On days where the market is on the move, this can be very lucrative, as the max move may be at the close of the day. Think of holding as the default way to manage the long straddle.

I’ve found that calm days in a range-bound environment are ones where prices explore support and resistance levels before returning to a point closer the strike price. As the day goes on and price stays constrained, I look for a chance to sell one side of the straddle for a price more than I paid for the total. Earlier in the day, I feel like I can be greedy and wait for a big profit, but as the day goes on, I’m happy to get out for any profit. So, I’ll fold one side of the straddle for a profit when it doesn’t look like we are going to close at an extreme move. Occasionally, I might get to sell the other side if there is a late move in price to the other side of the strike price.

So, that’s hold and fold. How/why would I roll? Let’s say the market has moved a significant amount from the strike price, and I’d like to take a profit but still have the possibility of taking advantage of additional movement. I can roll my in the money option toward the current price for most of the distance rolled. For example, let’s say the price of SPX is down 40 points midway through the day and I’m worried it might come back up, but want to also benefit if it keeps going down. I could roll down my put 20 points and maybe collect $18, locking in 90% of the move. If the price keeps moving, I could keep rolling. The downside of this is that I don’t get 100% of the move, and I’m paying commissions on each roll, and these trades will be pattern day trades if I close the new position before the end of the day. I also will have a hard time locking into a profit that is beyond my purchase price, unless I have a really big move. But rolling is a choice to consider for some traders and some accounts.

Conclusion

So, there you have it. A volatile option buying strategy one day before expiration that averages a profit and can hedge other positions in a portfolio. I have found expiration trades stressful in the past, but this one has been much less stressful to me despite the volatile nature of it.

Do you think xsp is liquid enough, spx feels like big boys pants to me? Im running mes 112 trades and would love to find something to soften the risk of those naked short puts

Darren- good question. I know that SPX is a big trade for a long straddle, so XSP is a logical substitute as a 1/10 the size index. XSP is getting traded more and more, especially on the last few days before expiration. It still isn’t nearly as liquid as SPX, SPY, or \ES. I think it’s a little better than \MES with smaller tick sizes.

What I’ve seen with XSP is that it is easy to get good fills on entry on common close to the money strikes, but if the market is moving against a position, it gets harder to fill as there just isn’t a lot of volume and the market makers don’t seem to be anxious to fill an order at the mid-price between the bid and the offer.

SPY is the same size with much better liquidity, but there is the issue of assignment at expiration, so you have to be out of the option position before the market closes. Even a position that closes out of the money can still be assigned. This is also true for futures option trades using /ES and /MES.

So XSP may not be great at getting good fills, but it is workable for options in the last few days before expiration. On a long straddle, it may not be that critical to get out with a good fill, but if you are rolling to take money off the table and stay in the trade, the lower liquidity may make it hard to get good value for each roll. Many brokers have very low fees for XSP, so it really is just fill quality that is a concern in making a lot of trades in XSP.

What is the risk to be assigned in a long straddle, even at 1 DTE?

If you trade SPX the index, the options are cash settled, which means there is no assignment. However, if you use SPY or /ES, assignment will be an almost daily event, because one option will always be in the money. That’s one reason most people that trade expiring options every day use SPX.

I often use /ES (futures) options to manage the span margin calculation in my account, so I need to close the trade or I’ll have futures contracts assigned to me or negative futures assigned that I end up having to buy or sell the next day. Getting assigned at the strike price kind of defeats the hedging plan of the trade as it adds or takes away a large chunk of Delta to the portfolio.

This is a great discussion, thank you for publishing this on the web.

Just to clarify one misconception.

SPY options are American style options and can be exercised / assigned at any time, they have early assignment risk.

SPX options are European style, they can not be exercised / assigned early, at expiration they settle to cash, there is no early assignment risk.

The bulk of /ES future options (dailys, weeklys, ..) are European style and can only be exercised / assigned at expiration, hence they are similar to SPX options in that there is no early assignment risk, however at expiration they settle to future contracts. The exception to the rule is /ES quarterly future option contracts which are American style and can be exercised /assigned early and settle to futures contracts.

Are tou still actively using this, im running a portfolio of 120DTE ES 1—1-2-2’s and im still looking for a decent insurance trade, happy to take some heat but don’t fancy a blow up. For a full book I have 16 ES 5 delta np’s yhat need protection. 🙏

I personally haven’t used this as much lately, mainly because I’ve moved to less trades per day and don’t have time to manage this every day. That said, I still like this as a one day and overnight hedge that tends to average out to breaking about even over time. I haven’t seen or done any recent analysis with daily volatility as low as it’s been lately as to how that has impacted results. I know the study cited in this post was done in 2022 when volatility was above average, which impacted both the premium cost and the actual market movement per day.

Even more than other option trades, trades of this duration require developing very strong mechanics that are proven over time and match the demeanor of the trader. Know the rules that work for you and stick to them.

Do you have stats on the hold management approach? It seems like a 50/50 trade, so I’m surprised it has positive expected value.

Also, have you seen or tested the call side vs the put side? I’m guessing the put side would be more profitable during outlier moves, but that is just a guess.

The stats are in the video for 2022. Yes, theoretically the odds should be around 50/50, but actually I would have expected it to be negative because of Theta decay. But the study from Dr. Rhodes showed a distinct positive return.

What I’ve found in doing the trade myself is that there are often long stretches of either negative or positive return days on the trade. And holding to the close each day makes the swings even bigger- bigger wins and bigger losses.

The tested side tends to be the direction of the trend in the market, with an occasional counter-trend day. So in bull markets, the call side is tested more, while in bear markets the put side is tested more. Overnight gaps often are the source of tests. But since I’m buying the straddle in this trade, big moves are good. I want to be tested and go deep in the money, although the rest of my portfolio will probably be getting hammered by big moves.

Great article thank you. Just a question please. Since you are buying both a PUT and a CALL and not selling, how can (early assignment) work since you have bought both sides not sold and this gives you the right to assign but not the obligation? Does this make sense?

Thanks

Sorry just a follow on, when you say sometimes you hold to expiry, how do you profit from this? Can you explain please with a small example on how you can profit from letting it expire.

I’m still learning this strategy so any help with getting my head around the 1 DTE would be greatly appreciated.

Okay, let’s say the S&P 500 is trading near 5000 at the close of the day. Perhaps a 5000 strike price straddle with an expiration the next day is selling for $23 for the combination of the put and call ($10 for the call and $13 for the put). A trader buys the contracts for $2300 (100 x $23) and waits to see what happens the next day.

At the end of the following day, one option will expire worthless and the other will be in the money. The only question is how much will the in the money option be worth? It is simply the difference in the closing price from the strike price. So from our example, if the market closes the next day at 5030, the call will be worth $30 over the 5000 strike price, and the trader has $700 ($7 x 100) profit. On the other hand if the market closes at 5005, the call will be worth $5 and the trader will have a $1800 loss. If the market closes at 4977, 23 points below the 5000 strike price, the trader will break even.

It is very unlikely that the trader will have a 100% loss since indexes trade down to the penny in value, so expiring exactly on the strike price almost never happens. But it can often come close, so always know that any day with this trade can be very close to 100% loss if the closing price is near the straddle strike price. On the other hand, profits are theoretically unlimited and big moves can be very profitable.

Note that the price of a straddle varies from day to day. When things are very calm, the price is low. In volatile times or when a big announcement is coming, like the Fed interest rate announcement, option prices spike due to the uncertainty of what might happen.

This trade isn’t a get rich quick trade, and as explained in the text, I find it most helpful as a hedge that hopefully breaks even on average over time.

First, buyers of options are never obligated to sell their option. They own the “option” to sell or execute the option contract, assuming the contract has the ability to be assigned early. So, if you buy a call and a put, you are the only one that can trigger assignment. Since the trade is done with just 1 DTE, there is no reason to want to assign early, as the point is to capture expiration day’s movement along with the night before. Most brokers auto assign options that are in the money at expiration, so usually nothing to do. And this is only a consideration for options on stocks, ETFs, and Futures options, not Index options.

For sellers on the other side of the contract, it is a different story in that a seller is obligated to deliver stock or buy a stock when the owner of the option contract executes the option.

However, since we are talking about options near expiration, there is another factor to consider as well for both buyers and sellers. Most traders of 1 DTE and 0 DTE options are trading options on $SPX, the index. These options are European style and can’t be assigned early and are cash settled at expiration, which is at the market close. If someone trades using SPY or another underlying that can be assigned early, then the contracts can be assigned the evening before expiration and even after the close of the market. Because of all the ways ETF and stock options can be assigned and the fact that they settle to shares of stock, they really aren’t a good vehicle for trading expiration every day, plus there are very few underlyings that expire every day anyway. Futures options on /ES can also be tricky in that they settle to futures contracts, even though there is no early assignment.

Bottom line is for 0 DTE and 1 DTE trades, index options on SPX are the best choice because they cannot be assigned early and are cash settled. There is nothing for the buyer of the option to do, the option settles to its cash value at the market close.

Hi

I have been testing long straddle on RUT index (a little bit more volatle than spx) buyng at the close of the day before and trying to exit next day for a profit at 25% of the whole position (which is more or less 1/3 of the required margin at the moment).

Obviously It’s hard for me apply a backtest for this strategy …… so I am testing it day by day.

We will see

bye