An updated analysis after several years of trading

A back ratio call spread is a strategy where one call is sold and two are purchased. In a Delta Neutral version, it profits from market moves up or down. It pairs well with put selling strategies to balance risk and potentially increase rewards. Sound too good to be true? – well, there are risks to the downside and it works best with active management.

I first wrote about this trade in 2019, and ever since this has been one of the top 5 strategies that traders have read about on the Data Driven Options Trading website. I’ve kept the original write-up on the site, with only a few updates- you can read it here. One of those readers was my new trading friend John Einer Sandvand, who runs the YouTube channel and website, ThetaProfits.com. I was honored when he asked me to join him to discuss the trade, and here is the video:

I first started trading this strategy after reading about it in classic options book, McMillan on Options, considered by many to be the bible of options trading. In the book, McMillan has an extended section on neutral strategies, ways to neutralize option Greeks in various ways. One is a Delta Neutral Back Ratio Call Spread.

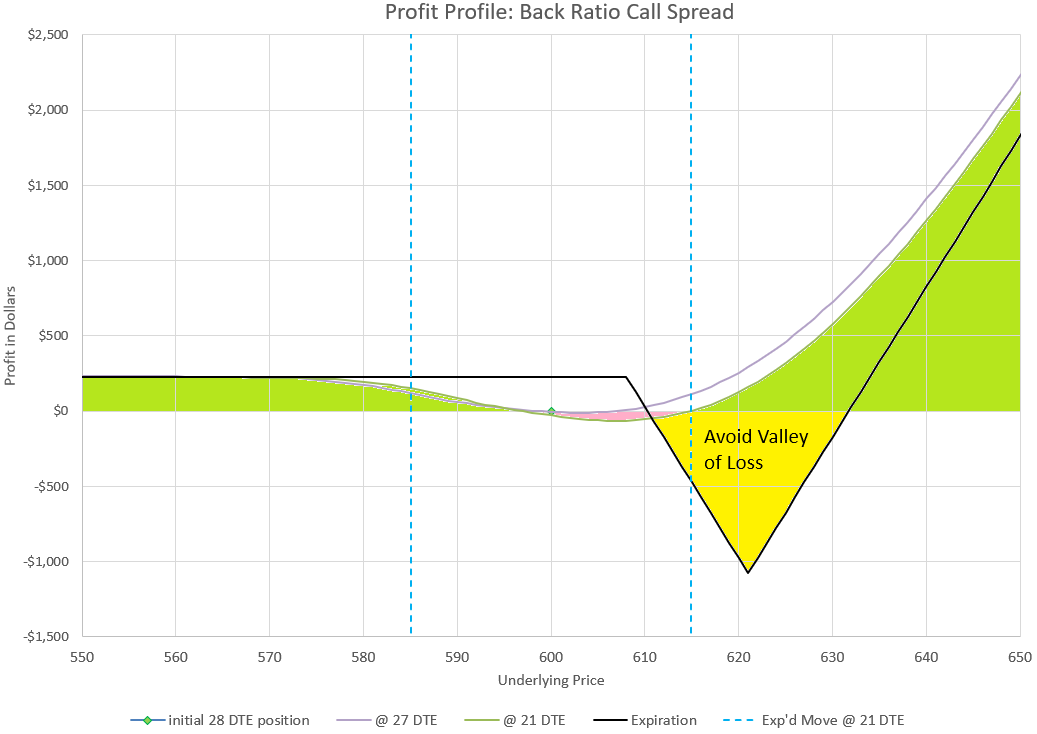

Most option traders are not familiar with the concept of a back ratio spread. Most references to a ratio spread are referring to a FRONT ratio spread, where traders sell more options than they buy. Classic examples include the 1-1-2, a popular ratio spread where traders buy one put and sell 3 at different strikes. Front ratios count on decay and often have an extremely profitable but small “tent” where big rewards await. The back ratio typically profits on big moves, but has a “loss valley” to avoid when moves are small. In many ways, a mirror opposite version of ratio trade outcomes. But in both cases, there are setups that improve probabilities, and management strategies to keep losses from getting out of hand. So, let’s get to it.

Why trade a Delta Neutral Back Ratio Call Spread?

The main attraction to the Delta Neutral Back Ratio Call Spread is that it makes a good alternative to other choices in call selling strategies. What’s wrong with other call selling strategies? Have you ever sold a call and had the underlying blow through your call strikes for a big loss? I’ve had it happen when I’ve sold covered calls, when I’ve traded Iron Condors, and other call variations. I know that losing on the call of a covered call isn’t technically a loss because the underlying shares profit more than the call loses, but still the call loses, and I don’t like it when that happens. Iron Condors are more annoying- the call side is supposed to provide a downside hedge and extra premium profit compared to selling just a put spread, but I find it fails more spectacularly than it ever succeeds. Before we are done, we will look at back test data to back up this claim.

Back in the Covid crash of 2020, I was desparate to find a trade to help shield my losses from put spreads and I wasn’t comfortable making them into Iron Condors, so I tried adding Delta Neutral Back Ratio Call Spreads with great results, during the bounce back after the Covid bottom, I quickly erased my losses in large part to the gains from the Back Ratio Call Spreads I added. I wrote a whole post on it at the time that you can read here.

In comparison, during the bear market of 2022, driven by interest rate hikes, I decided to trade using mainly Iron Condors. While the call credit spread side of the Iron Condor helped stem losses as the market went down, it failed miserably on rallies and the eventual recovery. Only in hindsight can I see that I probably would have fared much better with a Back Ratio Call Spread.

Why did I stop using the Delta Neutral Back Ratio Call Spread? It’s because I found near the end of 2020 after the rapid recovery of the market, this Back Ratio Call Spread started losing money consistently as the market switched to a more measured steady increase, with the trade ending in the loss valley almost every trade.

In preparing to discuss the trade with John, I went back to the basics and did a new analysis of the trade to determine once more the advantages and disadvantages of this trade. I found a couple of key insights. First, this trade performs much better during periods of high market volatility including bear markets and the immediate recovery, but not so well during steady climbing markets, matching my experience. Second, picking the right timing and setup, along with good management practices can greatly change the outcomes of the trade. In many ways this new analysis has changed my view of the trade, so I thought it was time to re-write an analysis of the strategy.

The basics of the set up

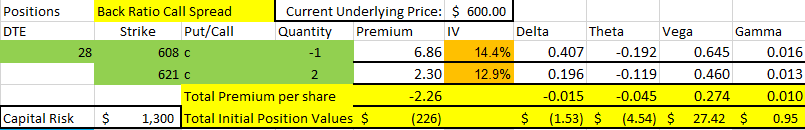

Let’s look at an example of a set-up. We’ll use an example of an underlying trading at $600 per share, where SPY is hovering as I write this. This strategy can be used on virtually any underlying, and is best with securities that have put skew, or have higher implied volatility for puts than for calls, which is the vast majority of stocks and exchange traded funds. Let’s look at the initial set up:

For this trade, we are opening at 28 days until expiration (DTE) or four weeks. This timeframe seems to be close enough to expiration that the strikes can be close enough to have a good potential for the underlying price to move through all the call strikes, but not so short that decay is overwhelming.

That brings us to the biggest downfall of the Delta Neutral Back Ratio Call Spread, negative Theta. Because we purchased more calls than we sold, the long calls have more decay than the short, and decay works against us. But, where there is Theta, there is also Gamma, which is what makes the trade work.

While the trade starts with essentially no Delta, with any move up or down Gamma will increase or decrease Delta. A down move turns Delta negative, while an up move turns Delta positive. The bigger the move the more positive or negative Delta becomes.

On down moves, the trade makes money because the options lose their value and the trader can keep premium that was collected at the opening of the trade. On big up moves, the two long calls start making more money than the short call loses as the underlying price increases.

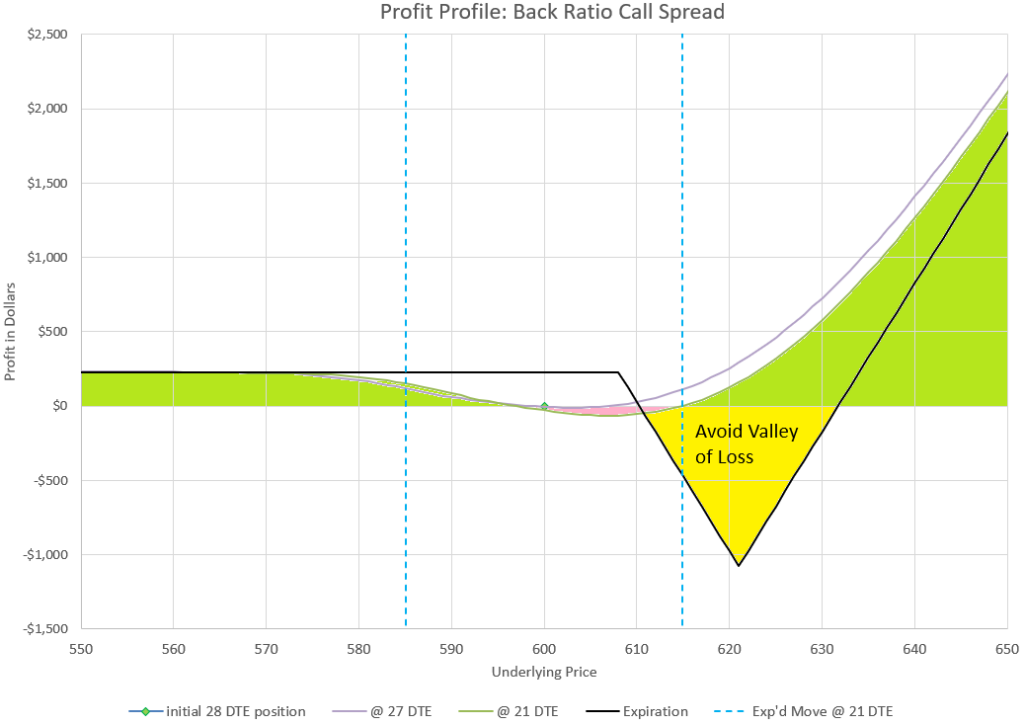

In between is where the problem occurs. The worst case scenario is for the underlying price to move up a little to the point that the short call gets in the money, while the long calls just decay- a lose-lose scenario that gets dramatic as expiration approaches.

This chart shows three different profit points in time, one day into the trade, one week into the trade, and expiration. Here you can see the profit profile for back ratio call spread opened at 28 DTE and closed at 21 DTE, plus illustrating valley of loss at expiration. I’ve highlighted the potential big losses if this trade is held to expiration. However, I prefer to close or roll the trade much sooner, within a week which limits the potential loss to a much smaller amount, highlighted in pink, while still have profit potential highlighted in green.

Managing the Back Ratio Call Spread

While this version of Back Ratio Call Spread has unlimited upside, we generally aren’t going to see huge moves that run away to the upside, and the odds of ending in the valley of loss are high if held until expiration. So, while tempting to wait for the big up move, I find it much less volatile to manage this trade early.

In the example shown above, we’ve opened at 28 DTE with a plan to be out of this trade by 21 DTE. When we get to back test results, the assumption is that the trade is purely managed mechanically, opening at 28 DTE and closing at 21 DTE, and repeating over and over. The trade can be managed that way, but there is also the potential to take profit, particularly on big down moves where much of the premium has been eliminated.

On a big down move where over half the premium has been eliminated before the 7 days have passed, I like to roll up my strikes back to a delta neutral position. When rolling up, I can almost always collect a credit. Depending on what expirations are available and how much time has passed, I may choose to roll to a longer duration, or stay with the one I already have.

On big up moves, it’s a bit more nuanced. If I can roll down and out for a credit, then I’m likely to do that, but if not, I generally will wait until 7 days have passed and then roll out and up back to a Delta neutral position. Since upside moves have unlimited potential for profit, I’m hesitant to act too quickly as higher Delta levels kick in. It also matters what the market environment is. If we are bouncing up off of a big decline, I’m more tempted to ride the move up than when a random uptick happens during a stable period of trading.

Result probabilities from expected moves

From the profit chart above from a 28 DTE position closed at 21 DTE, you can see that the trade is profitable with almost any move to the downside, or a move to the upside greater than the expected move. So, approximately 45% of the time, we will make money from a down move, and approximately 16% of the time, we will make money to the upside. So, with a one week holding period, we would expect to profit 60% of the time, and we would limit our losses to a fairly small amount of what was collected in the 40% of the time that the trade lost.

If we hold to expiration, and consider our Delta values as our probabilities, with our short at 40 Delta, we have a 60% probability of the options expiring out of the money where the entire premium can be kept. There is an additional 2-3% probability that the short call ends up in the money, but not as far as the premium collected, so the trade is still profitable. For us to profit to the upside at expiration we need to have an up move of over 10 points above the long strike values, about a 7-8% probability. So, we have a 70% overall probability of profit. The problem is that the 30% of the time when there is a loss, the losses can tend to be much more than the gains of other times, due to the steep valley of loss. Add in positive drift and the probabilities are less favorable.

Results from Back Testing

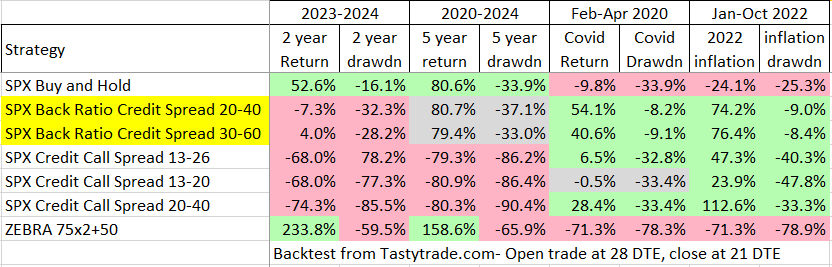

I took a look at this trade using back testing. I compared different starting and ending durations for the Delta Neutral Back Ratio Call Spread, which showed that best results were in timeframes starting between 21 and 28 DTE, with holding for 7 days in the trade. I then compared results to other call strategies. While back testing has a lot of potential faults, including the ability to cherry-pick data to back up almost any conclusion someone wants to make, looking at results over different market conditions and time periods can be helpful to see how strategies compare. As always, past performance is no guarantee of future results, so take these back tests with a healthy dose of skepticism.

Part of the concept of this strategy is to see how it performs in different market environments. I chose four different time periods.

- 2023-24: A generally bullish two year period where the market was up over 50% with very few downturns.

- 2020-2024: A five year period with two bear markets mixed between otherwise bullish market conditions. The total gain over 5 years was 80% with a 34% maximum drawdown during one of the bear markets.

- February-April 2020: The three months of huge decline and initial bounce back from the Covid pandemic. The market ended this period down nearly 10% at the end compared to the beginning, but down 34% at its worst. This is the fastest bear market downdraft and recovery in market history.

- January-October 2022: This 10-month period was marked by rapidly increasing interest rates by the Federal Reserve to fight inflation. The market responded with a bear market, down 24% over 10 months, and down 25% at the lowest.

Comparing Call Strategies

For this list, I compared results of a couple of different versions of Delta Neutral Back Ratio Call Spreads to several other call strategies that a trader might consider. I chose a 20-40 Delta version, like what has been discussed in our example trade, as well as a 30-60 Delta version. I then chose basic credit call spreads with different Delta combinations that might be considered for generating income from decay. Finally, I added a trade familiar to Tasty Trade followers, the ZEBRA, or Zero Extrinsic Back Ratio, a stock substitute strategy using a back ratio buying two 75 Delta calls and selling one 50 Delta call- an end result of 100 Delta with virtually no extrinsic value to begin with. I included the ZEBRA just because it is another version of back ratio call spread, but with very different objectives. For all strategies, I opened each trade at 28 DTE, and closed after 7 days, repeating constantly. I used backtest software from TastyTrade.com, which is free for anyone registered at their site.

Looking at the backtest results, we can see that the Delta Neutral Back Ratio Call Spreads and Credit Call Spreads both underperformed during the 2 year bull market, but did better than the market in bear markets. However, in both good and bad markets, the Delta Neutral Back Ratio Call Spread outperformed the more standard basic Credit Call Spreads. In fact, over the full 5 year period of 2020-2024, both versions of the Back Ratio Call Spread essentially matched the return of the market, with a similar maximum drawdown, while the call spreads were all very big losers.

The ZEBRA back ratio trade in contrast was up huge during bull markets, but down huge in bear markets, a very volatile trade for the amount of capital required. This isn’t to suggest that the ZEBRA is either better or has no place, but just to contrast it to the Delta Neutral version being discussed here as a very different back ratio call spread strategy.

The point of comparing the Delta Neutral Back Ratio Call Spread to simple Credit Call spreads is to show that indeed we get better results with the Back Ratio version, with better upsides and lower downsides in virtually all markets. This was one of the initial goals of trying this trade. The other was to consider how well the Back Ratio Call Spread pairs with credit put strategies.

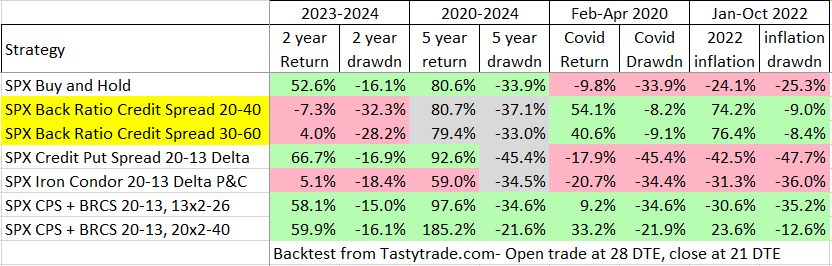

Combining Back Ratio Call Spreads with Puts

Throughout this website, it should be fairly obvious that I tend to favor put selling strategies and generally bullish strategies over others. But put selling strategies don’t fare well in bear markets. Neutral Iron Condors are often suggested for a way to balance risk up and down, but haven’t seemed to do that from my experience. Would pairing a Delta Neutral Back Ratio Call Spread with a Credit Put Spread work better in a bear market? Would it work in a bull market? Let’s see what back testing suggests.

The appeal of combining put selling and call selling strategies together is two-fold. First, we would expect there to be a neutralizing effect by essentially playing both sides. Second, we have the opportunity to essentially use the same capital twice with the same trade. If we sell a 13-point wide put spread and a 13-point wide call spread at the same expiration, we can only lose on one side, not both, so the broker will only tie up $1300 minus the credit received to be in the trade. Even the Back Ratio Call Spread is typically treated by brokers as a call spread plus a long call for determining capital requirements, so we still get the double use of capital when combining strategies.

For this test, I used the same Delta Neutral Back Ratio Call Spreads as the earlier comparison. I then compared them to the following strategies.

- A Credit Put Spread with a short strike at 20 Delta and long strike at 13 Delta, matching the explanation of optimal strikes for put spreads. I’m including this to show how it performs on its own in different market environments before combining with call strategies.

- An Iron Condor with both puts and calls selling at 20 Delta and buying at 13 Delta. The ultimate Delta Neutral Iron Condor.

- Combination of the Credit Put Spread above at 20 and 13 Delta paired with Delta Neutral Back Ratio Call Spreads of a couple of different Delta levels (13-26 and 20-40)

Not surprisingly, put spreads outperformed the market during bull markets, but lost even more than the market during bear markets. Even over a 5 year period of mixed markets, put spreads alone did better than the market, but with worse maximum drawdowns. So, if you can tolerate drawdowns, this might not be a bad choice.

Somewhat surprising to me was how poorly Iron Condors performed in back tests. In bull markets, the Iron Condor actually lost money, and in bear markets it did worse than puts alone, where it was supposed to help. It slightly helped by decreasing the maximum drawdown, but that is somewhat grasping at straws.

Finally, when we add the Delta Neutral Back Ratio Call Spread, especially the 20-40 Delta version to the Credit Put Spread we see an amazing performance in all environments. During bull markets, the combination greatly exceeds the market. In bear markets, the strategy actually makes money. And in each scenario, the maximum drawdown is less the maximum drawdown of the market itself.

These results suggest that combining a put selling strategy with a Delta Neutral Back Ratio Call Spread has a lot of potential for profit, while reducing market risk compared to puts alone. Can these back test results be replicated in real life with real money? I’ve personally seen this strategy work with similar results during the Covid crash and immediate recovery, but I haven’t consistently traded the strategy at other times, so I can’t share any personal experience. At a minimum, the seems like worth further testing and trials.

I want to thank John at ThetaProfits.com for highlighting this trade and putting it back into my regular trading routine. I look forward to sharing results as time goes on. For those coming to DataDrivenOptions.com for the first time based on John’s interview, welcome to the site- hopefully you find it helpful!

Carl,

It was great to catch your interview on Theta Profits YouTube. I’ve been a big fan of your education resources for years. I’m really excited about the backtest results you presented regarding combining BRCS with PCS. 2022 was my first year trading options, and I was lucky to learn and practice 1-1-2 throughout that year, earning an extraordinary return I can only dream of matching again some day. I was some times selling naked calls to make strangles too, since no extra BPR, and I was simply lucky that year kept going down. But as I continued the same into 2023 I was getting destroyed still attempting what worked for me earlier (really the only tool in my arsenal at the time); it took me so long to stop attempting earning premium from CCS. But now your presentation of results of BRCS gives us strong evidence not to fear the call side if approached your way. Looking forward to modifying my approach to 1-1-1 with this, and continuing to learn from the modern options guru.

Kurt

Thank you for the detailed overview. Always enjoy your content. I have been trying this strategy, but one think I am noticing: It has a downside bias (potentially expiring all the Calls out of money). But on the upside. the move has to be really large for it to make money, otherwise mostly ending in the loss zone. Was that your experience too? were there any specific adjustments you did, or conditions you looked out for, while entering this trade? I have been trying this on SPX. Thank you.

Cooper- yes, this isn’t a high probability trade. It makes money on really big moves up and on down moves. A lot of other trades win 60, 70, or 80% of the time with big downsides. This one is closer to 50/50, and can be a series of losses. You often get the really big up moves after the market bottoms out. In Feburary and March of 2025, we’ve seen a lot of movement downward, but no really big rally to kick in the long calls. The down weeks should be profitable, and slight up weeks will be a loss.

Hi, thanks for sharing your research with us. I’m thinking that this year could possibly be a down year where this strategy might run well. One question, when I run the tastytrade backtester I’m unable to recreate your results. Are you opening one of these say once a week with multiple entries going on at the same time or just open at 28DTE and close at 21DTE?

I used SPX and opened all legs at 28 DTE and closed at 21 DTE. I think I set it up for a new trade every day, so there would have been up to 5 going at a time. I will say that I’ve recently had seen issues with Tasty’s backtest, and I’ve gotten results from other trades that don’t match earlier results and also don’t match my personal experience. I haven’t had time to dig in deep, but I downloaded the raw data from a couple of studies and found some math errors in the way they did their cumulative data. I sent them a note with spreadsheets showing the differences and haven’t gotten a reply. I’m probably going to use a different backtest for a while until they get the latest bugs worked out.

Dear Mr. Allen,

thank you very much for maintaining this site!

If you could find time for a short answer on the brcs I would very much appreciate your opinion: If done with individual stocks, do you think there are situations from where the trade should work with a higher probability, like “after a downturn”, “with high iv”, … ??!

Thank you and best regards,

Dan

Yes, this trade works great if you can start it right before a big up move. That’s when it pays off big. It doesn’t really matter what the underlying is.

Thank you very much for answering!

Thx for an amazing interview! Can this be done on the put side also in a crashing market? To ride all the way down, or at least have a low risk try at it. At the “bottom” try a call and put back ratio spread at the same time? Then call ratio spread to ride back up? Or I’m I just dreaming this up?

It is definitely possible, but the put side has skew working more against a back ratio with this setup, so there is less premium to collect.

Dear Carl,

I really love your homepage – it is a fountain of knowledge.

I was doing some modelling of the PCS20/13 and BRCS40/2×20 in OptionStrat and what stood out to me was the following:

While I acknowledge the back testing results, modelling shows that this combination is, in my view, somewhat counter-intuitive: the PCS suffers when volatility increases, which is usually the case on a down move. On the other hand, the BRCS suffers when prices go up and volatility decreases. I believe this makes it harder to exit the trade profitable at 21 DTE. Am I missing something?

I would largely appreciate if you could comment on this.

Many thanks, Christian

Your analysis is correct, but think of it as somewhat neutralizing the impact of volatility between the two. The Back Ratio Call Spread does well with big moves where the impact of volatility changes are overwhelmed by the big swing in premiums. There is a trade-off for everything, however, so slow moving up markets that are good for the Put credit spread don’t work so well for the back ratio call spread.

Hi,

How do you calculate, how many of those spread you should take to cover your portfolio ?

Thanks,

I wouldn’t say that this “covers” a portfolio as a hedge, so much as it provides a way to profit from big moves up or down.

I often use this as a counter to a put spread, but it doesn’t provide a lot of downside protection. The total downside benefit is the net credit received when opening the Back Ratio Call Spread. That’s the total gain you can keep from this portion of the trade if the market goes down. There is theoretically unlimited upside potential, limited only by the move of the market in the timeframe of the options before expiration.

The only consideration for capital usage that I think about is trying to utilize the same capital on the call side as I’ve already used for puts at the same underlying and expiration. For example, if I have a 20 point wide credit put spread, I could add a 20 point wide Delta Neutral Back Ratio Call Spread and not use any additional buying power. But if my call spread was 30 points wide, that would require additional buying power because the additional 10 points of width increase the maximum loss of the total position. I also can’t overlap strikes or that means I could lose on both puts and calls, where if the calls are above the puts, I can’t lose on both.

Carl, a truly intriguing strategy. I had a question about actually executing both the BRCS and CPS. With the BRCS you start a 28DTE position and close at 21DTE. With the CPS, do you do 28DTE (closed at 21dte) or do you do 7DTE (let it expire)?

I had done some backtesting (using Tastytrade platform) and I would like to share with you my results and hear your thought. BRCS 60/30 + CPS 20/13, open 28 DTE, closed at 21 DTE, with profit taking at 20% of initial credit. This strategy seems to outperform the ‘BRCS 40/20 + CPS’, as well as outperforming other strategies mentioned in this post. Would really appreciate your thought why this might not be a good idea / whether I have missed out something.

The main reason to combine the BRCS and CPS from my point of view is to make double use of the same risk capital, so the expirations and rolls have to be done on the same timeframes to get that advantage. Otherwise, it is two different trades with no significant relation to each other. So, if I’m doing both strategies together, I either roll or close them at the same time to the same expirations, until I decide to end the combination and go with just one or the other going forward.

The higher Delta BRCS could very well outperform the lower one, depending on the market environment over the course of the study. The higher you go with Delta on the BRCS, you need less of an up move to get into the profit zone on an up move, but you also have a wider loss zone for non-moves. In a fast up trending market, the wider call side will do well, but if the trend is slower, there will be losses. But really, that’s the story of the BRCS in general, so 60/30 may be a better choice.

Thanks for the reply Carl.

I would like to learn more about managing the BRCS (especially on a slow up move in SPX) where it’s only a few days in of the trade and you enter the valley of loss immediately.

During SPX down move, I understand rolling up the short call can collect premium on the short call and also make it delta neutral. Do you keep the long call (2 contracts) as the same or do you roll them too (which I thought would incur an overall loss since the long calls lose more premium than the short).

It gets more complicated during a SPX up move. By rolling it up, do you mean just rolling the short call up (incur a loss)? Rolling the long calls up would also push up the valley of loss. Would really appreciate a bit more explanation on the practical side of management.

Also, instead of doing a 1:2 BRCS, have you considered trying 2:3 or even 3:4 ratio to try to narrow the loss of valley zone?

Trevor- You are correct that the roll down is almost always a winner in collecting a credit and locking in a profit, while dealing with an up move can be messier. My goal in rolling up is to get back to Delta neutral on the BRCS, and if I have a credit put spread at the same expiration, I’m probably rolling it up as well. So hopefully, I’ve made more on the put spread than I lost on the BRCS, assuming that I moved into the valley of loss. Whether I can collect a credit to roll the BRCS depends on how much the market has moved and how much decay has occurred, so I try to stay mechanical and just roll to a new neutral position, although my put spread would be positive Delta and the full combo is then positive Delta.

There is no restriction on what ratio to use- each one has advantages and disadvantages. You can modify the total Theta and Delta and even Gamma and Vega to get a ratio spread with dynamics from the Greeks that can match whatever your market outlook and risk profile requires.

Hey Carl, so we had a crazy pullback on 10/10/25 (yesterday) due to tariff news. SPX dropped more than 2.7%.

I know with your backrest (and mine) this back ratio spread worked well in market downturn. But in practical terms, when do you open positions? One could never time the top and if you keep opening new positions as market grinds up, this is a losing strategy in a slow upward market.

Have you opened any back ratio spread after the tariff news? Many thanks

Carl, we had a crazy down move on 10/10/25 due to tariff news again. In your backtest we knew this back ratio strategy doesn’t perform well in a slow upward grinding market, but exceptionally well in market downturn. From a practical point of view, when do you decide to enter a back ratio spread? It simply doesn’t make sense to keep putting on new trades like this in a slow upward market to try to time a top. Would like to hear your thought

A big down move like what we saw Friday 10/10/25 after months of calm could be a good trigger to enter into a back ratio call spread. And in hindsight, it looks like it would have done well right away with at least a partial recovery the following Monday. We’ve seen a lot of these kinds of events in 2025 where the president makes a comment and markets react, then the president reverses positions and the market recovers. The back ratio works well because it starts neutral and can gain in a big move either way. Since no one really knows how the market will go after a big move, the trade can adjust with the market.

Heya Carl,

I was messing around with the Tastytrade backtester and found that a variation of this strategy on SPX with the following parameters:

– 60 DTE

– 20-40 spread

– Roll back to neutral every 3 days

– Enter only with VIX above 24

Had very good returns during market downturns, being positive in 2015, 2018, 2020, 2022 and 2025, while mostly staying out of the market the rest of the time. 2022 had a return of almost 50% (9800 dollars on a max of 20000 in buying power usage).

However, in 2021, we went up in a straight line with occasional bouts of volatility, and this strategy lost big time. I wonder, perhaps some indicator, such as the golden and death cross, could be used to limit it to down markets? I’m not able to work on a backtest for that at the moment, but I think it could be worth looking into.

How does this work during earnings?

Seems to me it would be a great trade.

I’ll try today on AMD.

Implied volatility collapses after earnings on a stock are announced. If you don’t get a big move, this trade will lose due to the longs losing value faster than the short call. But a big move up well beyond your long calls could be very profitable. A big move down will make the options all lose and you’ll keep most of the premium you collected.