The Credit Put Spread or Bull Put Spread is my favorite trade, because it has the highest probability of profit of any strategy I trade. The spread is created by selling a put and buying a lower strike put for less. The result is that the person doing this trade collects a credit. Some people call it a bull put spread because there is some expectation that the trader is bullish. However, I’ve found this trade is good for almost all market conditions because of how much Implied Volatility is overstated for puts.

The Basics

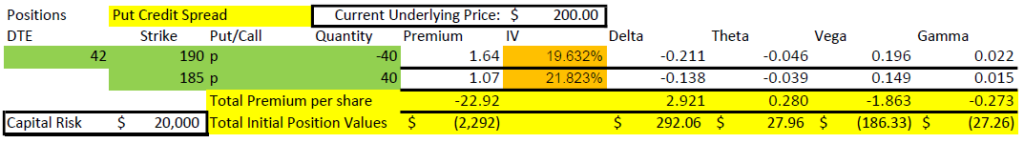

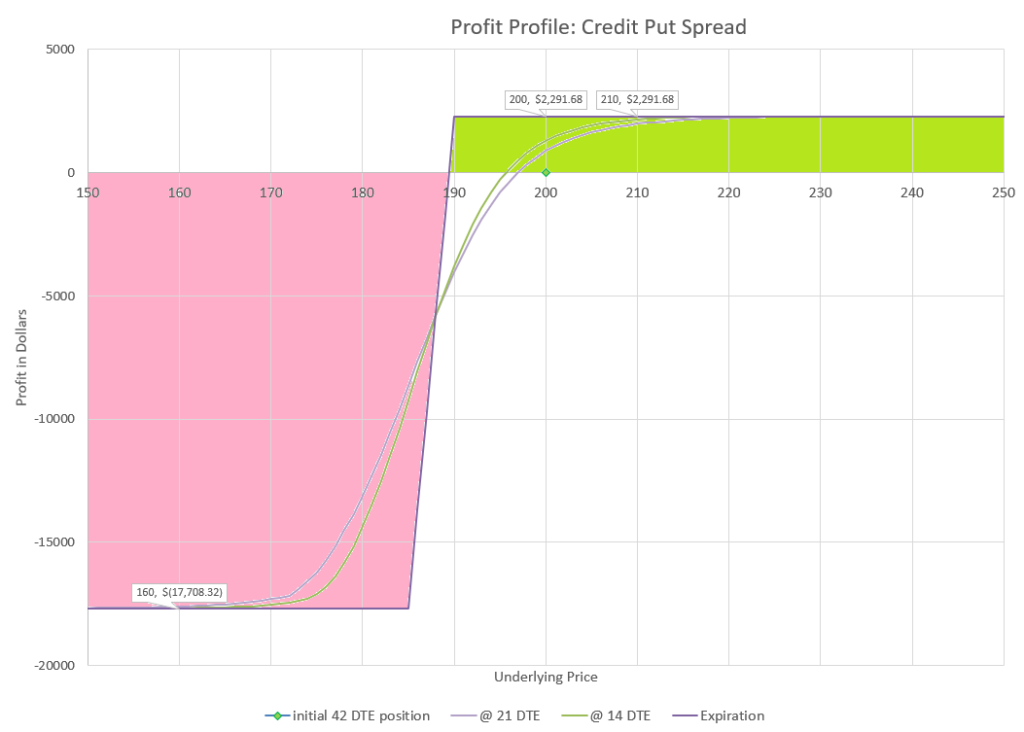

So, let’s go through the details quickly and then we’ll talk through why each detail is important. I like to stick to major stock index funds like SPY, QQQ, or IWM for predictability and liquidity. I look for puts that will expire 5-6 weeks from the time of the trade, ideally 35-45 days away. I trade puts that are well out of the money, with a Delta of around 20 for the put I sell, and a Delta of around 13 for the put I buy, or an average of 16 Delta for the two positions. At these expirations and strike prices, I expect to collect somewhere between 12 to 18% of the width of the spread, depending on the level of Implied Volatility at the time. So, if I sold a spread with a short strike of 190 and a long strike of 180- a width of 10, I’d expect to collect approximately $1.50. If the underlying security price doesn’t change much, I can buy the spread back for half or less of what it sold for in abound two to three weeks, which would be approximately 7.5% return on the capital at risk. I sometimes pair this trade with a back ratio call spread with the same capital risk- the same spread width. Then I manage the put spread and calls based on how prices change.

Why stock indexes?

I like to use exchange traded funds (ETFs) of the three major indexes as the underlying security. There are also options available on the indexes themselves as well. I trade all three for a level of diversification because while they all move generally in the same direction, they take turns over performing and underperforming. While this strategy works fine with individual stock, the rate of return isn’t much different, but the risk of dramatic moves causing a loss are much greater with individual stocks. The three indexes are the S&P 500 (SPY), the Russell 2000 (IWM), and the Nasdaq 100 (QQQ). SPY has the most options available and has more volume by far than the others with very tight bid/ask spreads compared to the other indexes or individual stocks. If you have to pick just one, pick SPY. I used to have the Dow Industrial Average (DIA) in the mix, but I find that it isn’t as liquid and behaves unexpectedly due to being a price-weighted index.

For larger accounts, I like to trade options on the indexes themselves, rather than the ETF of the index. The actual index symbols are SPX for the S&P 500, RUT for the Russell 2000, and NDX for the Nasdaq 100. SPX and RUT are ten times the price of their ETFs, and NDX is 40 times the price of QQQ. There are several advantages to using options on the actual index- less contracts cost less in fees, favorable tax treatment, cash settlement that eliminates assignment risk, and often greater liquidity.

Why 35-45 days to expiration?

When I first started trading put spreads, I traded options much closer to expiration. Most people know that options decay faster and faster as they approach expiration, so it would seem logical to sell options very close to expiration, except that it isn’t that simple. As expiration approaches the only strikes with any premium are fairly close to the current price. It doesn’t take much of a move to put a spread in the money. Option prices can move quickly in that situation due to Gamma being much higher. It makes for a lot of drama and less predictability.

I was first introduced to the 45 day concept by TastyTrade– I give them all the credit for this. I generally try to open new positions no longer than 49 days to expiration (DTE) and no less than 35 DTE. New weekly options are made available today between 43 and 46 days, while monthly options generally are available much further out. Longer duration options don’t decay as quickly, and shorter term options are more volatile. The goal is to sell the options, have them decay for about three weeks and then buy them back for much less before they become volatile. There are some statistical reasons for these dates with this strategy, but more than anything my experience is that this timeframe just works the best with very little of the drama that comes closer to expiration.

Why pick these delta values?

There aren’t many things that I disagree with TastyTrade on, but the best choice of strikes for put spreads is one. TastyTrade recommends trying to collect 1/3 the width of your spread total when you sell a spread trade strategy. I’m generally quite happy to collect 15% of the width of the spread. The reason is that I’m more concerned with what I keep vs. what I collect. Tasty likes 1/3 because the trades essentially risks 2 to make 1. My goal is to manage the trade to avoid the potential for outsized losses.

There are three reasons I settle for less premium, selling a 20/13 Delta spread instead of a 32/25 or higher Delta spread.

First is probability of profit. The lower the Delta, the less likely the put will end up in the money. A 32 Delta put has a supposed 32% chance of expiring in the money, while the 20 Delta put only has a 20% chance. Both of these odds are actually overstated based on historic performance that is well documented. TastyTrade has a number of studies that cover this point extensively.

Secondly, options on stock index funds have Skew in their Implied Volatility that makes lower Delta puts have higher IV than higher Delta puts. This increases the price somewhat of lower Delta puts relative to higher Delta puts, and means that their IV is more overstated, increasing the probability of profit more than Delta would suggest.

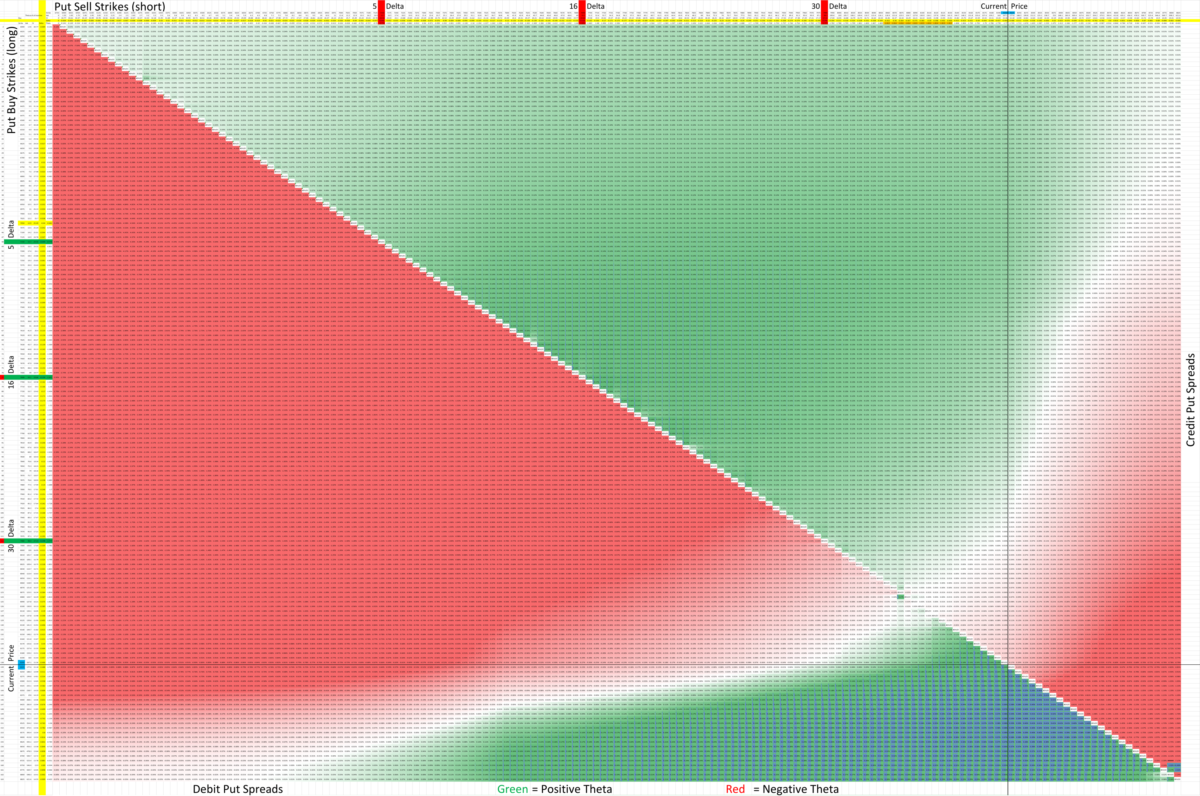

Finally, and probably most importantly, the Theta of the spread is highest when the average of the two puts Delta is around 16. This is a bit tricky to understand. Theta is the amount of expected decay from one day passing. If you look at an option table, it is clear that higher Delta puts have more Theta than lower Delta puts. However, when dealing with spreads, it is the difference in Thetas between the two options that matters, not the individual values. At higher Deltas, the difference in Theta is smaller for the same width between strikes, and the Thetas cancel each other out. Once Deltas get below 10, there isn’t enough Theta left and the difference declines. The sweet spot for the least amount of Theta cancellation is in the teens. The red and green chart on this page is intended to illustrate this point. The darkest green area for put spreads are when Deltas are in the teens. The chart takes the difference in the Theta and divides by the width of the spread minus the premium collected, which essentially is the daily return on capital for Theta. In particular, when you sell with 45 DTE, this is the fastest decaying spread combination. I’ve modeled it, I’ve tested it, and I’ve lived it.

When you sell higher Delta put spreads, the premiums decay, but almost equally for the long and short strike for some time. Over the course of three weeks this adds up. A 32/25 Delta spread may lose 10-20% of its premium, while the 20/13 Delta spread loses 50% or more in the same timeframe. While the original premium collected on the lower Delta spread was less, more is kept. And, the spread is much less likely to end up in the money. This is about as close to better return for less risk as it gets.

You don’t have to pick 20 and 13 Delta put strikes to have this benefit. Depending on the need, wider spreads will work, as will narrower. My personal reference to aim to have the average Delta between the strikes be as close to 16 as possible. That is the sweet spot. Sometimes, when IV is really high, I’ll pick a little higher Delta strikes, and count on underlying price increases to get my Deltas back into the sweet spot. However, I generally won’t buy a put with Delta below 12 in this timeframe, the reduction in the cost of the premium is too small compared to the capital that is tied up.

I’ve heard many people say that there isn’t any money in spreads, that there isn’t enough premium decay. When you pick high Delta strikes, that is true. But, with the right strikes, put spreads do very well and even can have a better return on capital than a naked put. While the absolute return of a naked put is higher than a spread, a naked put ties up much more capital, not to mention the tail risk of huge losses when the market crashes like it did with the coronavirus in March of 2020. Spreads have defined risk, which allowed me to manage through the crash in ways I couldn’t with a naked position.

A lot of this choice of strikes is based on an assumption of little movement in the underlying security. However, there are advantages to these strikes in both up and down markets as well. These strikes provide easier management than higher Delta strikes. For me, these are the best delta choices for put credit spreads.

The Greek Impacts

Let’s quickly look at how the three main Greeks are impacted by this strategy. Clearly, we’ve discussed Delta and Theta already, but Vega isn’t to be forgotten.

For most traders that pay attention to Greeks, Delta is the most important value. With credit put spreads, Delta is always positive. When the market goes up, the position makes money. Since there is an inherent positive drift, this works well most of the time. If the initial position is actually selling a 20 Delta put and buying a 13 delta put as proposed above, the Delta of the position would be +7. For every dollar increase in the underlying security, the 100 share contracts would go up by $7. Obviously, price decreases will make the position lose money due to the opposite effect.

As time passes, Delta of the strikes is likely to decrease because of the passage of time. Only if prices decrease on a pace to match the expected move will Delta increase.

As discussed elsewhere on this site, Theta is premium decay that accumulates each day. In a credit put spread, Theta will be positive as long as the strikes stay out of the money. If prices decline to a point where the average Delta is over 50, Theta will become negative, and time will become the enemy of the position, losing money every day. More likely, Theta will eat away at the premium and remove most of the value of the puts within three weeks, assuming the spread was sold with 6 weeks remaining to expiration.

In credit put spreads, Vega is always negative. Vega teams up with Delta most of the time in how it impacts a credit put spread. When prices go up, volatility generally goes down, and Vega and Delta both benefit the value of the position, by making premiums decrease. On the other hand, when prices fall, Delta and Vega both increase the premium of the options, which is a loss for the position. If this is confusing, it might help to remember that a credit spread is a short position, and the goal is to have the premium value decrease so it can be bought back for less than what was paid for it.

Because of negative Vega, many traders prefer to sell more put spreads when volatility is high, allowing volatility to decrease and make money. When prices drop quickly, IV Skew also tends to drop, which also helps the amount of potential return in a put spread. However, in most market environments, Implied Volatility is low. It can remain low for extended periods. If a trader only sells put spreads during high IV, they won’t be in the market that much. I try to have less capital in the market when volatility is low, so that I can have capital to deploy when the market drops, but I’m always in with credit put spreads because most of the time volatility is not rising much. When it does rise, it is usually quick and unpredictable. I find it best to manage those situations when they occur instead of trying to completely avoid them.

What to expect and how to manage

Put spreads do require some management, although not as much as some other option strategies. Of course, you could just do nothing and wait until expiration and get what you get. In that case you’d probably have the spread expire worthless about 85-90% of the time, assuming a starting point of 20 and 13 Delta strikes. However, 8-10% of the time, the position would be a total loss, and the rest of the time would be a loss somewhere in between.

By managing early and not letting the position stay in place until expiration, these odds can be improved, and total losses can be avoided. I think of management based on three scenarios- fairly stable prices, mostly increasing prices, and mostly decreasing prices.

If the price of the underlying security doesn’t change much between the time the put spread is sold and the time that expiration is 21 days away, the premium will likely decay by more than half of what it sold for. At this point, the position has done its job and doesn’t have much value left. It is best to close the position and open a new position that can start the decay process over. There is more potential reward for a new position than to wait to see the last of the premium decay away. As the last three weeks come into focus, there would be less time to do something. This is a good scenario. Let’s go do it again.

If the price goes up substantially, the premium on the position will be reduced even quicker. I watch my Deltas, and when both strikes of a put spread are in single digits of Delta, I know there isn’t much premium left to decay. This leaves the trader with a few choices- close and take the profit, roll up the strikes, or roll out the strikes. All of these are good choices because the value of the existing position has decayed to a point that it can’t decay much more. I consider how much time there is left, the situation of the paired call spread, and how much capital I have (do I want to take money off the table?). If there are more than 35 days left to expiration, I’ll usually roll up the strikes to get back up to delta values around the sweet spot of 20 and 13, collecting a nice additional premium. If there are less than 35 days, I’ll usually roll to an expiration close to 45 days away and collect even more. The difference is that if I just roll up to higher strikes, I don’t have to do anything with any calls that are tied to the position. If I move the puts to a different expiration, I probably will want to move the calls as well. However, just rolling up doesn’t have quite the decay level as starting over at 45 days and decay will be somewhat slower with more risk of moving into the money. That’s why I prefer to roll out to 45 days if we are getting close to the time to act anyway.

Sometimes the market goes down and put spreads end close to the money or in the money. When this happens, the premium goes up and the position is a loss. However, this isn’t the end of the story, at least not for me. First, when a position is going against me, I don’t over-react. I’ll give a position time to recover if there is a sudden large move down shortly after I enter a position. Most of the time, I wait until time to expiration is approaching 21 days. At this point, there is still a good chunk of time value in the options, so all is not lost. Usually, I roll out the position to something close to 45 days left. If the strikes are still out of the money, the strikes can likely be rolled down a strike or two, or the width between the strike narrowed, while still collecting a credit for the roll and slightly reducing risk. If the existing strikes are in the money, the only way to roll and collect a credit is to widen the strikes, taking on more risk. Credit put spreads are generally the only strategy that I will take on additional risk on a roll- I count on the market to go back up. For some traders that may be a bridge too far, and it may be best to close the position for a loss and start over with a position that is back in the sweet spot. Some people pull the plug on a position when it loses twice the amount collected. (If the initial premium was $1.50, close when the premium gets to $4.50, for a $3.00 loss). Whatever your plan, know what you are going to do in advance and stick to it. By acting on a losing position with 21 days or more left to expiration, a trader has more choices, and will incur smaller losses. At extremes, you still have choices- see my post on desperate measures in desperate times.

The only other point I want to make about losing put spreads is that most of my losing trades have been when I ventured into individual stocks or specialty ETFs. In these trades, I got caught in large unexpected moves that had no end in sight. This is the main reason I now stick to index funds for my option trading.

Puts only for this strategy

This strategy does not work the same for calls. Do not try the same strike selection for calls. Only use this for puts. In bear markets, it can be helpful to have call spreads that balance out risk, and allow two sided management techniques. Even then, we need to use different choices for delta on the call side.

Conclusion

I said at the beginning that the credit put spread is my favorite option strategy. Since I started tracking my option trades by strategy, credit put spreads have created more profit for me than all my other option strategies combined. Selling puts win because put volatility is over priced almost all the time. Even in the midst of the coronavirus crash in March 2020, I barely missed a beat due to aggressive management. The defined risk nature of put spreads keeps the potential loss limited to the width of the spread.

The rest of the time has been just smooth sailing. I collect premium, watch it decay, and roll out and do it again, and again, and again. When I have losing positions, I usually keep rolling them until they turn into a winning position. It takes some practice to get comfortable in the various scenarios, but having a steady plan will keep the returns coming.

Update

In late 2022 I decided to see if the Delta values coming from this write-up still are appropriate. I did a little more detailed analysis which is captured in a new post on Best Deltas for Put Spreads. Spoiler- the results are mostly the same, with a little nuance.

In late 2025, I decided to write a new version this article from scratch with a focus on rolling and disciplined mechanics. Read it here. I didn’t refer to this article a single time until after the new version was released. I was surprised that the new article mostly agrees with the details of this older version, while focusing in on a few different nuances.

Your articles are great! How has the trading been going? I noticed you haven’t written in a while. I like the idea of pairing the put credit spreads with the call ratio back spreads. That must have been working out great this past 6 months.

Thanks for the kind words. Yes, trading has been going well. I got busy trading and stopped writing. I’ll get back on it soon, as I have continued to optimize my trading style and test new strategies.

Is there a strategy out yet for the credit call side and which delta is best ?

Great question- generally credit call spreads are losing trades. I’ve done some analysis of highest Theta for the money, and even though there are combinations with high Theta, the problem is that these trades tend to end up in the money too often. Pick any credit call spread set up and back-test it, the result is a net loss.

There are winning debit spreads on the call side, see the post on debit call spreads.

Since we have been mainly in a bull market for 15+ years, this would be the expected result – that bear call spreads on the indices would underperform. But what about during periods of a bear market (e.g. let’s say when the 50MA is below the 200MA to keep it simple)? During bear markets, I would expect that everything would flip on its head and the bear call spread would do well, and then the question about optimal deltas would become relevant.

Personally, I employ bear call spreads on individual stocks I want to short, as part of a long/short portfolio. So very curious to know if I am choosing the most efficient strikes.

Great article btw

Thanks

Yes, during bear markets bear call spreads will perform well. However, the problem is that the beginning of a bear market is unpredictable, and once you are in a bear market, the market tends to whip up and down a lot which can cause problems for bearish call positions. That’s not to say that it isn’t a viable strategy- I just have found it very difficult to effectively manage.

We haven’t experienced an extended bear market for a long time. When that happens again, we won’t know that it is an extended bear market until it is over.

What we do know is that during bear markets, implied volatility is high, so selling premium tends to be a good strategy. But, there is often a lot of actual volatility, so positions can quickly get into trouble.

I am slowly getting a grasp of your strategies. I wanted to try your strategies with 50K capital. My goal is to double it in 1 year. What strategies would you suggest? Just 45DTE put credit spreads or a combo with others? I understand the risks involved particularly if there is a market crash. Thanks much.

Keep in mind that I am not an investment advisor, and nothing I write is to be considered investment advice.

Doubling in a year is a very aggressive goal. I’ve done it- see my post on how I made 500% in an account in 12 months but it was a small account and wasn’t a large portion of my overall net worth, so I was willing to take a lot of risk and accept huge swings in account value on an almost daily basis. I also used a large percentage of the capital in my account, and was fortunate that there were no significant market corrections during the time I pulled this off.

I generally like to have a variety of strategies in place that don’t move the same. Put spreads are my bread and butter, at a variety of expirations, and I also like using put condors and butterflies with broken wings that collect a credit and have a very high probability of profit.

During rising markets, I’ve had good success with replacing long stock with long calls and call debit spreads. However, these kinds of trades are a bit different risk/reward than other trades. I discuss them in a page on risk, and I plan to write more about comparing ways to replace stock at some point.

For every strategy, there is an upside and a downside. Most strategies I use have a high probability of making a nice return in a somewhat short amount of time. However, they also have a small but significant possibility of losing much, much more in a market downturn. So, having a plan to manage losing positions aggressively is critical. I try to talk about management of trades in discussing strategies, but sometimes it is easy to overlook and get complacent. When trades win 80, 90, or 95% of the time, it can seem like a no lose trade. But losing situations can quickly be overwhelming when they hit. That’s why I keep much of my buying power available to help me work out of tough situations.

My general expectation for the 45 DTE credit spread is to make 5% every two weeks on average. If that actually played out and had no compounding, that would total 120% in a year, but that would also be 100% invested to start, which is way too much for me. If I started with 50% in the trade and 50% in cash, I’d potentially make 60% overall. If I re-deployed half of my earnings into new trades and kept the other half in cash, the return would go up more. By working with a variety of different choices and expectations of returns and balancing risks, I can set up what I expect to get in a return for a time frame. My experience is that as more aggressive trades are added and more capital is deployed, it becomes more likely to have a big loss that can derail the plans.

Understood.. thank you for your insights.

Do you check any technical indicators or check support/resistance before starting a 45DTE trade? Also when you close the trade say at 50% premium profit do you right away start the next one 6 weeks away (roll)?

I personally don’t make much use of technical indicators. However, I will often add more positions when the market is low and implied volatility is high. For traders that like to trade based on technical analysis, it can only help the probabilities, so I have no objections.

I almost always roll winning trades into new positions- closing the old winner and opening a new trade at optimal delta values. The main reason not to would be when I’m trying to reduce my capital usage because I’ve let it get too high. My goal is generally to have positions decaying all the time.

Makes sense. Thank you.

Thank you so much for your insight. As a beginning trader, I’ve learned a lot here, and almost feel guilty asking for more– but I crave knowledge and have no shame, so I’ll ask anyway! My biggest question is, if you could go back in time, what would be the most important advice and information you would give to yourself as a beginner in the options world? (At this point I am focusing on put credit spreads, but am open to other strategies discussed here.) Thanks again!

Thanks for the kind words. I appreciate all questions and comments, because it helps me think about what else I need to write about. You ask a great question.

One of the reasons I started creating this website is because it seems like there are so many things I’ve learned here and there that I haven’t found in one place and had to learn almost by chance encounter. So to a degree, this whole site is information I wish I knew when I started trading options. But that’s a bit of a cop-out, so here’s a couple of actionable things that I think apply to all option traders.

First, keep a log of all your trades. When did you enter, what strikes, what was the strategy? When did you exit, and what was the result? The format isn’t really important, figure out a tracking system that works for you. Then over time, modify it to capture what is most important to you. Most of my key learning about what works for me came from me analyzing my trades to see consistent trends in trades that mostly win and those that mostly lose. I also go back and review my biggest losers and try to determine how I could have entered at a better point in time, or maybe managed the trade differently once I was in it. One of the reasons I favor put spreads over Iron Condors most of the time is that in looking over my trades, the put side of my Iron Condors regularly outperformed the call side. This recognition forced me to study the phenomenon more and realize that short put spreads perform better most of the time and short call spreads tend to have a low win rate.

The other advantage of logging trades is that you may find that there are trades that you try and just can’t get to work. Maybe you always close too early, or too late, but in any case, it just doesn’t work for you. I’m that way with 0 DTE trades. I know many people that have great success with their expiration day trades and have a mechanical approach that puts probabilities in their favor. But for whatever reason, I can’t do it myself. I might win 10 of these trades in a row, but lose all my gains in one bad day. I tried for a long time, but the data doesn’t lie- I can’t manage these trades profitably over time, so I quit doing them. That doesn’t mean they are bad trades, they are just bad for me, based on a significant amount of sample data of my own trades.

That brings up a final point to this recommendation. It takes time to collect data from enough trades to know that it is a good trade for you. Especially if you trade an extremely high probability trade, it may be a long time before the trade goes against you and you have the opportunity to assess if you have the right mechanics to consistently manage when it loses. Some trades I’ve done have a 95%+ success rate, so winning 10 times in a row isn’t anything to get excited about because I expect that. It’s the 2-3 times out of 100 when there is a loss that will determine if the trade is a net profit and whether it is worth doing long term.

The other advice I give all traders starting in options is to keep trades small. Know the worst case scenario and make sure that the worst case won’t wipe out your account. Sometimes that means trading just one contract of a cheap underlying to keep risk low for your account. I’ve tried to present a variety of ways to trade the S&P 500 index for example that allow even small accounts to trade an amount that will not break the bank in a total loss, while traders with bigger accounts may use a different choice. One watch-out with very small trades is that commissions and fees can become a high percentage of the cost and potential profit of a trade. If the cost to get in and out of a trade is $8.00 in total fees and the expected profit is $10.00 but the possible loss is $200.00, then it probably isn’t a good trade to try. So, stay small, but watch your fees.

In the end, I think option traders need to own their trades. They need to understand the strategies they trade, be able to balance the risk of the trade with the potential reward, and have a plan to manage win, lose or draw. My goal is to share as much information as possible so that readers can independently make their own decisions on strategies they want to use. Logging trades and staying small are ways to get the experience and understanding needed to make good decisions going forward.

Hi,

I’m dropping you a line to say how useful I’ve found your writing on credit put spreads, which is how I’m trading on S&P500.

I’ve looked at 45 DTE and was very interested in your work on 7DTE, though I did find it a bit racy for my risk tolerance. In view of the fact that I wanted to trade shorter term than the 45 DTE strategy, I looked at creating a 14 DTE strategy of my own, with many takeaways from what you’ve done.

This is my plan, which I’m forward testing on a small scale using XSP currently. I have the resources to trade SPX if and when I want to.

So: Open 14 DTE credit put spread with short strike at 20 Delta, 50 points wide which gives about 13 Delta on the long strike. I note this hits your researched optimum decay strikes in terms of Delta.

What I’m then doing is closing for in excess of 50% of the credit (which by the way is reliably about 15% of the max risk or spread width), and writing a new 14 DTE trade immediately. This can happen in a rising market within a day or two.

If it goes against me, at worst case I will close for a loss at 3x credit received, i.e. 45% of max loss / spread width giving a loss of 200% of the credit once the credit has been deducted from the equation.

I will close regardless around 7 DTE.

Where I think there is a real edge here (I hope, I’m testing it!) is that there is still quite a lot of value in the spread at 14 DTE, so you take in a fair premium, but that it really starts to fall apart from there on, from 14 down to 7. I think I’m combining the advantages of both 45 and 7 DTE strats?

Basically you end up trading a minimum of 1x per week, possibly more so commissions are lower too.

What do you think of this please? I’d also like to discuss position sizing but perhaps not on a public site.

Once again, many thanks, this has been really helpful.

David-

Thanks for the kind words and thoughtful question. You are right to be concerned with the 7 DTE trade being a bit too aggressive. The 7 DTE trade works well in a full-on bull market, but when we have moves down of 5% in a week like we saw just last week, there’s no defense. Using a 3x stop loss along with a 50% profit target is a fairly common management strategy and exiting at half the entry time frame also avoids crazy stuff around expiration. It comes down to the number of outright wins vs. stop outs- you need 6+ wins for every loss and a gain on average for when you hit 7 DTE. So, that’s 86% of trades that hit limit that need to be winners.

Theoretically, 13% should expire fully in the money, but since you are holding to expiration that would drop to 9% being fully in the money when reaching 7 DTE with half the time. But at 14 DTE, the implied volatility is usually overstated, so the odds improve somewhat. The biggest problem is the probability of touch that would trigger a 3x stop is likely going to be somewhere in the low to mid teens, which in our current bear market is a concern to meet winning math for the trade. You can improve the odds substantially by waiting for down moves to sell- likely if you are stopped out, you’ll win the next one as IV is up and you can sell further away.

I’m personally trying to move out further in time because I’ve been burned by the big down moves. There’s less theta, but I can get more cushion from big moves. The traders I know that have done well in 2022’s bear market are selling longer times to expiration, often 45 days or more.

Many thanks, that makes sense.

I have no objection to 45 DTE and in fact prefer the idea of this, the thing that concerned me is that if you take a 200% loser (I appreciate less likely than for the 7 or 14 DTE strats), you’re looking at potentially a number of months to get back to where you were. I guess there is also the possibility to roll out and down to 75 DTE for example for a neutral trade / roll?

The only thing for the 45 DTE strat is that with the spread being 100 points wide you’ve got a max loss of $10K whereas for the 14 DTE it’s $5K on SPX. I can and presently am trading on XSP but of course the commissions are more expensive, much more as a % of the credit received.

The idea of trading only after a down move is a good one, and I may incorporate that into the longer term strat.

Thanks again.

Thanks for this great article! Super informative. I would be really interested in your experience with the best delta parameters for bear call spreads.

Benjamin- Thanks for the kind words. The problem with bear call spreads is that most of the time the market is trending up and the calls end up in the money too often. Skew makes the call strikes closer than equivalent put strikes in Delta and in premium, so the risk/reward is less favorable. Back tests generally show negative returns from any credit call spread on an index that I have ever done.

That said, in a bear market call spreads can be a great balance for put spreads. The maximum theta as a percentage of the width is generally a little higher delta than with puts, with short calls in the low twenties and long calls in the mid-teens. That makes the probability of profit less, so I don’t think that is the best metric for calls.

Another issue with bear call spreads is that they have the most premium when the market goes down and is likely to rebound up, and the least premium when the market is at a high and likely to have peaked and not go up much more. The opposite is true of puts, where premium expands at the best times to sell them.

Just found the site about two weeks ago and find it very informative. I do have a question about the put spreads you speak about. A lot is written in other places about keeping your risk/reward in the 3:1 range so when you do suffer a loss it does not devastate your account. From what I see on your site, your focus is the 16 avg delta for the two spread puts used. So does that mean risk/reward range can be quite high at times? Thanks for your help in making better decisions about one’s life savings.

I choose the strikes I do because they have the highest level of Theta per amount of capital at risk as can be had. I also don’t ever hold these positions to expiration where worst case scenarios can happen. If you back test this version vs any other, you will be hard pressed to find a better average return on capital.

This isn’t to say that this strategy doesn’t have significant risk. By collecting 15-20% of the width of the spread, the trade leaves 80-85% of the width as a potential to lose if the market drops substantially, something that can and does happen.

Managing risk is key to long term success. This is not a trade to put all of an account’s capital into. One big move down can be devastating. While risk is defined, the risk of losing a large percent of capital is there, and there for moves of only two standard deviations. This trade wins most of the time, but don’t let it lull you to sleep. There is significant risk.

I stumbled on your site and this all looks like what I need! I started trading options in November (with a “guru” in a paid Discord, just like you said) and it was going great on 1,2,3DTE SPX – until it wasn’t. I had become overconfident and sized improperly and lost all gains back to November plus some more.

I like the article about trading with a day job – yes, even though I am in I.T. and work from home permanently, I don’t want to have to sit here and monitor another computer screen all day, every day.

Question: this favorite method here, does there happen to be a video or series of graphics on how to set up such a trade, manage it and close it? Hopefully on Tasty?? I am very much a visual learner so trying to figure this out from a wall of text is difficult.

Thanks for the kind remarks.

Interesting question on a video or series of graphics… The write-up on credit put spreads was one of the first ones for the site, as the details of this approach was something that developed over lots of analysis and frustration with the lack of data behind other explanations of ways to execute and manage this kind of trade. Since then, more of the trades write-ups on this site tend to have more graphics to illustrate what to look for and explain the concepts. Maybe it is time for a re-write of this page with more illustrations and charts.

When there is more time, I’d like to start making videos to explain each concept and embed them into the pages, but I’ve done enough work with videos to know that making quality videos is a lot harder than it appears. Some day.

Thanks, I didn’t see this reply until now! I managed to study your info in detail and got it all figured out. Part of my problem was trying to use a poor platform (Fidelity); I moved my buying power to Tasty and it’s so easy now.

Can you give your opinion on position quantity, sizing, etc. I get you’re not an advisor, I’m just looking for information from your experience. The account for options is about $165k from long stock, and I’m ok with usual risk advice of 3-5% per trade. This stuff is completely separate from my retirement accounts.

How many positions is reasonable? I was thinking of doing 1 on SPX on Tuesdays and 1 on RUT on Thursdays, for 3 weeks to get into a regular pattern. Do you think this is too much? And like I said, I don’t want to have to sit and watch the stuff constantly, I am still sitting here so looking at it quickly once or twice a day is no problem.

Rob- It’s hard to say how many positions someone should have. Each trader has a different tolerance for risk and a different threshold for becoming overwhelmed. The thing I try to avoid is having so many positions that I can’t keep track of what they are doing. It’s easy to get too many going, so I suggest starting small with an amount that is easily manageable and a small percentage of your overall portfolio- an amount that if it was lost would not be catastrophic.

A lot of people want to multiply their many quickly, and risk big amounts. Eventually, those traders blow up their accounts when the market moves in a way they didn’t anticipate. This can be particularly true with trades that are high probability where it seems almost every trade wins. The day eventually comes when not only is the trade a loss, but a total loss that can’t be recovered.

One way to make it a little easier is to keep good records of each trade. Write it down, put it in a spreadsheet, whatever works for you. Note everything that is important to you about how you chose the trade you did. Track the results. Notice if the results match what you expect based on probabilities and the trade strategy. Know the plan for how you are going to manage each trade. What will you do if it is a winner? What if it is a loser? How long will you hold it? Note what you ultimately did and why. Regularly review the trades you’ve done and decide if the strategy you are using is working. Make sure you’ve seen the bad results before you determine the long term effectiveness of a plan.

At one point early in my trading journey, I took the Tasty motto of “Trade Small, Trade Often” to mean I should add a new trade every day to get as many occurrences as possible. It didn’t take long to realize that I couldn’t keep up with all the different expirations and often multiple positions in the same expiration. I adjusted to less and found a point that was manageable for me. There’s a lot of factors that determine how many trades is the right number. Only you can determine that for yourself.

Hello,

first I want to say “thank you” for your insights given away for free! The last months I was going through a douzen of blogs and youtube videos regarding trading options. I am more familiar within the crypto industry and first tried to trade crypto-options mostly with the help of technical indicators. But after hours and hours of finding the optimal indicator to improve my probabilities I didn’t make substantial progress. Besides that it is way to volatile for me.

That’s why I wanted to focus on the stock or ETF market. I never before read so many in-depth analysis which I can follow like on your blog. Really appreciate your articles – especially your way of doing bull put spreads. “Trading” without indicators is a new concept and may be the key factor to become successful.

Lastly what I wanted to ask you is how do you do a backtest? Can you recommend tools/webpages/software to do backtests on different strategies (with different DTE, Delta etc)?

Chris- thanks for the kind words.

There’s a lot of backtest services you can pay for. A free one that I like to use is from TastyLive.com. You have to set up a free account and then you can use their backtest. They have videos to show how to use it. I find it helpful for testing ideas.

Also, it’s not that I have anything against technical indicators. If you find technical analysis useful for entering and exiting trades, then use them by all means. But, choose strategies to enter and exit based on best probabilities and have good trade mechanics so that you can maximize your potential profits.

I don’t think this is released to the public yet…what’s the direct link ? It was not easy to find on their web site.

Here’s the link. https://www.tastylive.com/backtest

The last I knew, you had to have a TastyLive account to access the backtest software. But their accounts are free, and good for lots of other resources as well on their site.

I found out that the data is only end-of-day prices. You should consider that when backtesting. However a great tool without any subscription fees.

At 20/13 delta it seems like the max profit vs max loss is like 1 to 8….vs higher delta max loss is less…

Steve- That’s the beauty of options- you can adjust strikes and opening Delta to whatever is most important to you. You are right, higher Deltas mean less max loss compared to max profit.

However, probabilities of winning also go down with higher Deltas, and the rate of decay as a percentage of the credit collected also goes down. What I have found is that 20/13 best balances risk, reward, and decay to get the best overall return on capital at risk over time. Having a good management plan for winners and for losers can improve results further.

TastyLive.com likes to set up spreads at risk 2 to make 1, which amounts to around 30/20 for Delta values. I find this is a slow decay and gets in the money way too often, but the max loss is only 2x the credit received, so there’s that. Limiting max loss is the primary benefit of that set up.

There are pros and cons to different entry points. The key is to understand what you are trading off and set up the trade for the benefits that are most important to your personal trading style.

Hey, Carl,

I just found your website 3 days ago and I’m devouring one article after another. Super read, thanks a lot. I have traded options in the past, mainly condors, strangle, credit put spreads mainly following tastylive ideas ( mainly open 45DTE, PT 50%, exit 21 DTE, with premium spreads about 1/3 width). Although I followed the plan, I was not successful and equity went slightly down or sideways.

I was intrigued by your approach of listing put spreads in different widths by delta, not fixed in points. This approach seems logical to me, for example if I write 3 times a week , I open tighter spreads in the face of low IV, which also automatically reduces overall risk and allocation. I consider the period of low IV to be the riskiest when writing out. If the market falls or IV rises these open spreads will go into loss, but the newly opened spreads will be wider, below the current price and with a higher premium. I have never thought of it this way before.

And I think ( although I can’t check it now on backtest, tastylive is working on a new version of backtester and it is broken) that this will improve RRR very noticeably, because after bigger losses ( but in narrower spreads) will come bigger gains from wider spreads.

What are your experiences or results? Could you share some metrics like win%, avg. P/L, max. loss, avg loss…..

Thank you and I wish you all the best

Thanks for the kind remarks.

The credit put spread has been my most consistent trade. It provides a great rate of return and has a high win rate the way I like to trade it. The watchout is when the market turns bearish and drops through the strikes, a total loss is possible, and there aren’t a lot of good defenses once that happens. So, it isn’t wise to have a majority of an account tied up with this, even though the risk is defined, because all of that capital has a very real possibility of loss.

As I’ve shared, 2020 was my best year with an 80% total return, 2021 was a 40% return. Things turned a bit ugly in 2022 when I didn’t manage the market downturn well and lost 20% on the year. 2023 left me a little gun-shy and I made about 20%, not getting back my losses from the previous year and underperforming. This year I’m up about 10%, but I’ve been planning all year for a decline that didn’t come and didn’t come until I finally got complacent at the wrong time, so I’m disappointed in not sticking to my plan and being in the wrong spot at the wrong time.

It goes back to being mechanical and having a plan, understanding the percentages and the market risk at different points in the market cycle, choosing the mix of different strategies that perform, and having a management plan for every position for when a strategy doesn’t work. Bottom line, I need to follow my own learnings from the past and not get excited about the latest shiny object or “can’t lose” trading fad.

Thank you for sharing your thoughts and results.

Hi, I would like to thank you for your posts in this blog. Really insightful stuff and I’ve learnt a lot.

May I ask you a question about the credit spreads in your experience how do you manage “fear of losing more as this down trend goes” emotion as a lot of the times the market corrections made the position starting from -100% within a week. I find it hard to weigh between “should I wait for 21DTE to roll or wait it to rally back up” or “should I just close for a loss to avoid losing more”. I am fairly new to credit spreads and given the risk/reward, it seems difficult to handle emotions. That’s why I find success in trading short puts as I always think the worst case scenarios first and see if I can live with it or not. Assigned shares of SPY or QQQ in vol expansion is not too bad in the short put situation. Curious to know how do you NOT “over-reacting”:) thanks!

Liu- Thanks for the kind remarks.

What you are asking about is a very common scenario for traders, no matter their experience level. There’s really two answers for this from my perspective.

1. Don’t trade a strategy that makes you fearful. There are lots of different strategies that can have great returns. I know many traders that only trade level 0 covered options, and do great at it. The more I trade, the more I appreciate the beauty of this approach, and I’ve started adding more posts to this effect.

2. Have a plan and stay mechanical. The best way to avoid stress in trade management- the “what should I do now?” feeling is to have a plan ahead of time. If the market goes up a certain amount or the option gets to a certain value, close or roll to lock in the profit. If the market goes down or the option loses a certain amount, have a plan to close or roll, and then have a plan of what to do if the market keeps going against you. If the market doesn’t move, have an end game plan. Make sure you are comfortable with each way the management plan can play out. Then follow the plan. Over time, evaluate how well the plan is working, especially after times where you took a loss and followed your plan. Don’t rely on a single data point, but a number of situations to see if you managed the best you could have given the situation. Then tweak your plan if needed.

When you look at back tests, these are the ultimate mechanical strategy checks. If a trader entered trades at a certain point and managed a certain way, over time what would have been the return and the worst case scenarios with the largest drawdown? No thought in the analysis is given to the emotion of the trader. So, can you stay mechanical to your plan, or should you stick to trades that don’t cause you to make emotional decisions at the wrong time?

Thank you so much for your reply. I agree this takes practice staying mechanical to trade the plan before entering the trade. I like put spread as well and agree with you I don’t try Tasty method to risk 2 to get 1 – too aggressive for me. So I am trying your 21/13 delta strategy and see how it goes.

Quick question, when do you usually enter put spread position? you only trade index option like SPX or NDX right? Do you just do it mechanically regardless of the market conditions or charts?

Any resources you would recommend to read up on index options selling strategies?

Thanks again. I often come back to this post and your Broken Wing Butterfly post to learn how you manage the trades, which give me great insights!!

Hi,

Great write up, and fantastic blog!

I have been looking for a monthly options strategy, so may try this out.

Just wondering what your overall return has been for this on SPY or SPX? I have been trying to backtest some similar strategies, but can not seem to get anything close to actual market returns.

Would love to hear your thoughts.

Cheers,

Larry

The target is to make around 5% return on capital before I roll. I probably median average between 2-3% and a mean average of closer to 1%. A few big losses can knock out a lot of winners. That’s assuming a timeframe of around half way to expiration to adjust, and using the 20-13 Delta spread.

Thanks for the quick reply. After re-reading the article, I notice you did mention target returns it in the first section, as well as in another comment above.

Will try this out and see how it goes. Thanks again for the great content!

Hello and thanks for the write up. Question for you. When backtesting this in TastyTrade, I am using stop loss at 200% of premium, take profit at 50%. As for entry conditions, what would you recommend in order to get proper backtest inline with the way to trade this? Every day entry, on exact DTE, On specific day of week? Also would you turn on Limit trade count to a specific # of open positions?

Thanks in advance, just trying to backtest what you have written here.

Chris- you should get similar results no matter which of the choices you make. However, because index options have only traded on a daily basis for a few years, any long term test should take into account that there were limited choices in the past compared to what there is today. So if you pick exact DTE, you probably would have 5x as many entries for the past few years compared to 10 years ago. I like to look at long time frames as much as possible, but then you also have to look at percentage gains vs dollar gains which can be very different when indexes were a fraction of the price then from what they are now. So, lots of caveats in the data. Try for apples to apples equivalent numbers of trades over the length of the timeframe you choose to backtest in.

Back tests are great for giving you a good idea of how a strategy has performed. There is a danger in trying to cherry pick the absolute best scenario for a strategy or the absolute worst, in that there are periods where you can show about any result you want if you try enough different values. So, I like to look at broad time frames and adjust around settings a bit to make sure that the results are similar, no matter what I do. I like to get time frames that include both good and bad markets, so I see it all in the test.

Back testing has often shown me that certain strategies have a long term positive bias, where others are negative. This usually has been after seeing matching results in actual trades. For example, I’ve found it difficult to sell call spreads for profit, and when I back-tested this, I couldn’t find any set-up that showed a winning strategy. On the other side, I’ve seen selling put spreads as a very positive profit strategy in back tests, and have used back tests to re-enforce some of the theoretical optimization I have analyzed. Back-testing is not a predictor- it just gives you a view of how something has done in the past.

This might be the best article on bull put spreads i’ve read so far! I’ve been trading solely bull put spreads with shorter duration but I will definetly try out your approachin the future.

One question: You mention that you modeled and tested the theta behavior in relation to strikes. Since I’m interested in making my own backtest models I wonder if you can recommend any environments/ platforms/ apps etc. for making these models (I know a bit of Python but I’m a newbie when it comes to using it in the financial field).

Thank you for sharing your strategies and best regards

@Bjoern- Thanks for the kind words. I keep things fairly simple and just use Excel for most of my own analysis.

As of Jan 24,2025 when I go out about 35-45 days on the SPY, the lowest deltas on puts I am seeing are in the low `30’s . Am I doing something wrong?

Don- Something must be wrong with your feed from your broker. Even on Weekly options, you should have SPY options going hundreds of points out of the money, with numerous options at 1 Delta or less. I know that occasionally the feed from my broker will stop working, and I sometimes need to re-boot my computer to get everything to work right. Also, your broker may have been having issues on their side. But for SPY, there should be lots of strikes to choose from.

You probably aren’t selecting enough strikes.

Great point. Many platforms have a default to show the closest 8 or 16 strikes to the current price. You can probably change the default or at least change it when you go to look at the available strikes. Usually there is a “select all” choice, or something like that.

Thank you for the awesome articles!

I’m wondering if dedicating 50% of portfolio for this strategy and keeping 50% cash to roll/manage is too risky? Or do you find that this kind of mix can survive covid-like scenarios?

I’m just getting into it and planning to be a bit more conservative at first of course. But wondering what’s a safe % of portfolio to play with ultimately if I still want healthy profits.

Thanks again!

I’d say 50/50 is way too aggressive, especially if you want to survive a Covid-like drawdown. If you collect 15-20% of the width of the spread, that means that the other 80-85% of the spread is at risk. In a big downturn, even like what we have seen in March and April of 2025, spreads would be in very deep trouble if they didn’t have a stop loss.

The good thing about starting with the market low and IV high is that you can sell much farther out with put strikes and collect more premium at the same time, which are both good for improving probability of profits.

Appreciate all that you do. A couple of questions for you.

1) Credit Spread Strategy – what is you historical win rate percentage?

2) Credit Spread Strategy – what is the highest number of consecutive times your short strike has been challenged (i.e. 3 consecutive losses or rolls)? All initial option purchase, no rolls. If you have the data, how many times in the last two years did this happen (any consecutive losses – 2,3,4 etc.).

Thank you

Thanks for the kind remarks.

1. Using 20 Delta for the short strike, I’ve seen around an 80% win rate. There are periods that are better and times that it is worse. During bull markets, it almost never loses. During bear markets, it is hard to win.

2. I really don’t know how many consecutive times I’ve been challenged, but in 2022 it was fairly constant. Lots of losses with an occasional win sprinkled in. That was probably the worst because it was a slow grind down. During the past few years, I don’t have data. You could probably do a backtest and get a good idea. Tasty’s backtest application is good for tests like that.

Appreciate you and thank you.

Would you open a bear call credit spread in a down market (bear mkt) to hedge against a loss from the bull put credit spread which is open (same strike width as put cr spread)?

Thx

I’m not a big fan of selling a call spread when the market is down. There is a high probability of a snap back rally that can blow through the calls.

I’m saying this from experience, both in the past and current times. Even today, I have an iron condor that started as a put spread that I added a call spread to when the market was tanking during the tariff scare in April. I sold the call spread to finance a roll down of my puts, but then the market went up 10% in a day and blew through my calls. I knew that this was a risk, and did it against my better judgement. Now I’m rolling up my puts to try to pay for rolling up calls and just hoping to get out without a huge loss. I’ve had better success adding a back ratio call spread, which provides some downside protection, but also does well in a big up move.

Thank you.

so what do you trade in credit spreads. and how do you manage risk – and is the below a good summary that we can make 5% every two weeks. what has been the probabilty and what do you trade? what do you do when its not going as per plan? does one loss eat into subsequent/past profits. I am new to this and now dabbling into credit spreads. having being burnt by both covered calls and cash secured puts – that one loss eats up quite number of wins

from you “My general expectation for the 45 DTE credit spread is to make 5% every two weeks on average. If that actually played out and had no compounding, that would total 120% in a year, but that would also be 100% invested to start, which is way too much for me. If I started with 50% in the trade and 50% in cash, I’d potentially make 60% overall. If I re-deployed half of my earnings into new trades and kept the other half in cash, the return would go up more. By working with a variety of different choices and expectations of returns and balancing risks, I can set up what I expect to get in a return for a time frame. My experience is that as more aggressive trades are added and more capital is deployed, it becomes more likely to have a big loss that can derail the plans.”

Covered calls and cash secured puts are two of the least volatile, lowest risk option strategies available- less risky than simply owning stocks outright when managed correctly. As you trade other option strategies, including credit put spreads, greater returns are definitely possible, but with significantly more volatility and risk. If you found the losses from covered calls and cash secured puts to be too much to bear, other option strategies will likely be more stressful.

A general rule of investing and trading is that strategies that have higher returns on average also have higher risk. A successful trader with higher than market returns will have periods of greater than market losses. So, keeping risky trades to a smaller percentage of your portfolio is key to survival during bad times. It also takes the right mindset to withstand the ups and downs of the market.

Another key principle of option trading is that the higher the win rate of a strategy, the lower the average return per trade and the bigger the loss will be when a big loss eventually hits. There is no trade that constantly wins and never loses. Some do better than others, and the mechanics of the trader can make a big difference over time.

I’ve stated many times that the credit put spread and rolling of credit put spreads is my personal favorite strategy. It has a mechanical flow in the way I trade it that aligns well with my demeanor and my risk tolerance. However, this doesn’t mean that it is the best strategy for everyone.

Your question about 5% returns per every 2 weeks seems to be asking, how sure is this? I’d say that I’ve seen long periods of time where I have averaged 5% every two weeks or 10% per month with this strategy. They key word is “averaged.” Some periods are a little better, some much worse, but on average I’ve had good results. In extended bear markets, credit put spreads do poorly- the rest of the time they do great. The question is whether a trader can stay mechanical long enough to let the averages play out, and they can withstand extended periods of losses to eventually gain outsized returns.

The beauty of trading and options is that there are virtually unlimited strategy choices at every level of risk, with different levels of involvement to match with a trader’s expectations, time availability, and risk tolerance. My goal is to share as many different possibilities as possible and help traders understand the advantages and disadvantages of each one, so they can try different ones with a knowledge of what they are getting into.

thanks a lot for the reply Allen. You have provided amazing wealth of information on your site. It was not that the losses from CSP/CC were too much to bear, it was that I didnt roll them away properly (knowing the perils ending up selling something which I didnt want to sell, or the market value of assigned shares less than assigned value). So for me spreads was a way to potentially reduce risk (as losses are defined, and also not to tie that much capital) . What do you trade on credit spreads? SPX, SPY or stocks? would you have a recent example of a successful case of spread i.e. symbok/strike/date/credit and also a rolling of a credit when things were smooth so I can learn from your experience. Do you also wait for market conditions to be optimal after a down day?

With credit put spreads, I like to stick to index options to reduce the risk of an outsized move. With individual stocks, big moves due to news or earnings can move the strikes into the money with little warning. While this can also happen with indexes, it happens less often.

With virtually all strategies I like to roll my positions and avoid expiration. This is true for spreads, but also for covered calls and cash-secured puts. While I can’t completely avoid assignment, I can greatly reduce the chances by knowing which positions are most at risk of assignment and rolling them to expirations with enough time value or extrinsic value that it doesn’t make sense for an option owner to exercise their option.

I tend to roll mechanically, win or lose. If my credit put spread position has moved to where my Delta values are low and profitable, I look to roll out to my target expiration and up to my target Delta values. If my position has lost and has Delta values higher than my target, I roll out in time and try to roll down as much as possible toward my target values while still collecting a credit. With a losing situtaion, my goal is to extend the trade while getting paid a little and moving my strikes away from the money. This type of move can be pretty routine in managing a credit put spread, and I don’t really think much about it.

My biggest concern is when my strikes end up in the money. At this point, the market and decay are no longer working for me. I also no longer have the possibility to roll down for credit. So, to keep the trade alive, I have to roll for a debit to buy more time. This doesn’t happen often, but when it does, it can be a bit un-nerving, but all of the many credit trades should have banked up enough to cover these losing rolls.

thanks again for such an insightful response. I was looking at SPX prices for credit spreads for e.g. currently priced at 6877, and 20 delta put mid point being 59.30 (59.10/59.50) at 6500, and 13 delta mid point being 38.90 (38.70/39.10) at 6300 for 39 DTE. so that essentially give $20.40 credit for 179.60 maximum loss. so this roughly gives 106% if expire worthless at expiration so roughly 9% every month. Risk reward of 1:9. so can you explain do you wait for some good days (VIX high or following down days). and do you take a profit at 50%? and at what time do you decide to roll over? Again sorry if I am being specific – I am trying to get into details of a trade to experiment with.

Again thanks in advance for being so patient in your responses

I’m not sure what amount of DTE you are using to pick your strikes, but the amount of spread premium for that width seems reasonable. I typically would not hold until expiration, but roll about half-way through when the premium has decayed 50% or so- sometimes more decay, sometimes less, depending on what the market has done.

thanks again and really appreciate it. I was using 39 DTE. And do you time the market in general – high VIX or this is mechanical regardless of market conditions and average it out.

I tend to stay mechanical for the most part, although I like to take risk off by reducing my positions when the market is high and approaching seasonally weak periods. I then have more “dry powder’ to add to positions when the market is down and VIX is high. So, while I don’t go all in, or all out of the market, I do look for opportunities to adjust my exposure depending on what is going on.