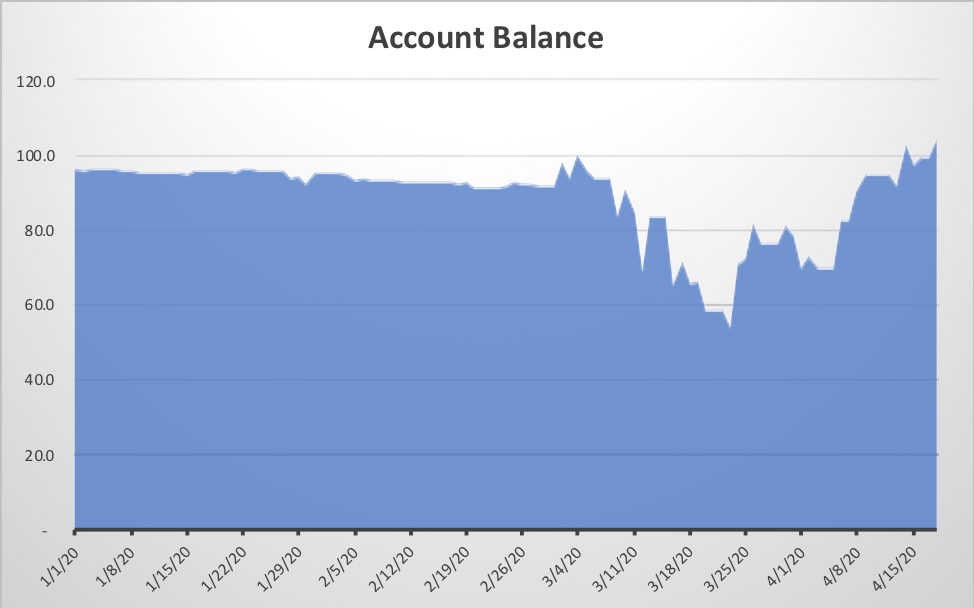

What a difference four weeks can make. From the end of February until March 23, my account dropped over 45% in value, worse than the stock market. However, since March 23 the account has gained back all of the loss and then some, a much better performance than the overall market. At the end of the day Friday, my account was up around 9% for the year, and up 4% from the high value at the end of February. All this from an account of mostly short option spreads, specifically credit put spreads. What happened, and what can be learned?

I’ve used my go to option strategies of credit put spreads, complementary back ratio call spreads, and using call spreads to cover calls to take advantage of the reversal from the mid-March lows. It’s been a fight every day, and a different approach than normal, but the positions are working.

Lots of mistakes on the way down

I made a number of strategic errors along the way that accelerated my losses. For months preceding the COVID crash, I maintained a negative Delta position in my portfolio as the market moved up to new highs seemingly every day. I watched my short calls go deeper and deeper into the money, while I sold puts just below or at the strikes of my short calls for lower and lower Delta values. I took some losses and reset my positions with more neutral to positive Deltas to go with the run up as the new year started. As the news of the coronavirus started hitting the news from China in late January, I scrambled and went negative Delta on a down day, which backfired when the market proved resilient after a one week drop. I discussed this error in a previous post. The market went on to hit new highs in mid-February and I held my own, moving to a positive Delta as it appeared that the coronavirus would not be that big of a deal. I even let a large group of underwater short call spreads be assigned for a big loss after many earlier rolls had kept hopes alive for getting my money back if the market went down.

The following Monday, the market started making big drops down. Initially, this worked out okay. I still had a number of short call spreads deep in the money that benefitted from the initial drop. But at strikes just below these call spreads were short put spreads that started growing big negative values. I had sold these to collect premium to offset the rolls I did to the call spreads, thinking that they would never approach being in the money.

In the early weeks of March I was worried that a whipsaw up would drive my call spreads back negative, so I bought the call spreads back when they reached 25% of the width of the spread, a nice improvement from values of over 90% of the width of the spread, but a loss compared to selling them originally for 15-20% of the width of the spread. Meanwhile, I let the put spreads keep going deeper into the money. I even sold some additional put spreads at what seemed like high volatility and low Deltas, only to see them get swamped a few days later when the market dropped 5-10% multiple days in a row. By this time, whatever the market lost, I lost double. One day the market went down 10% and I lost 20% of my account- in one day! Those were hard days to keep a positive attitude.

The data that kept me going

I never really considered cashing out to stop the losses. If anything, I knew that getting out would simply lock in the losses I had in my account. The losses were paper losses- once the position is closed, the loss or gain is real. That doesn’t mean that there is any guarantee that a paper loss will reverse- in fact, the raw option probabilities at the time suggested otherwise. But other data gave hope for better days.

Volatility is mean reverting. When volatility is at historic highs, it is likely to come down sooner than later. At its peak, the VIX was just over 80, implying an 80% move in the S&P 500 in the following year, based on option prices. Normal VIX values are around 18. It will take time to get back to normal values, but values in the 50s, 60s, and 70s are unsustainable. The way the VIX comes down is for the market to go up. The only question was when it would turn around.

The VIX almost always overstates what future moves will be. And volatility skew drives put premiums to high prices in all market environments, but especially in times of high volatility. The only time that owning puts makes money is while the market is dropping quickly, and that is the only time that being short in puts loses. My position lost money due to both changes in underlying prices that moved my put strikes into the money, but also due to increased volatility that made the premium go up. Knowing that these premiums were unsustainable, I felt comfortable that I would get my put premium back if I could hold on long enough.

The options I sell are typically 5 to 8 weeks out from expiration. That gives me time to wait for a reversal, time to adjust positions without panic. Normally, I close positions 2-3 weeks prior to expiration, but conditions will sometimes drive me to either act earlier, or go closer to expiration. The key is that having time gives me choices. Normally, I look at time decay as my primary consideration for how I manage my positions. During this crash and partial recovery, price movement was my main concern. In Greek terms, Delta (price movement) was the primary concern, while Theta (time decay) and even Vega (volatility changes) took minor roles.

All of these factors have been drilled into my head from watching and studying the research of the great folks at TastyTrade.com. They have presented numerous studies that show how market downturns are opportunities for those who can take advantage. Of course, you have to have capital to really take advantage, and I was pretty tapped out by the time we hit bottom.

I have my own approach, and I also build a variety of models and studies to help guide my strategies. I’ve never been comfortable with undefined risk strategies, the use of naked options. This recent period has re-inforced that point of view. My research has focused on how to use spreads to define risk, but also provide a profitable rate of return. Spreads behave differently than naked options, and require different strategies. Ideally, I get the majority of my profit from far out of the money credit put spreads. On the other hand, I mostly sell calls as part of a back ratio spread, because I’ve found credit call spreads to be problematic due to long periods of market up movement.

My recent winning approach

As we approached the bottom on March 23rd, I closed the remaining credit call spreads in my portfolio. My sense was that we were getting to a point where upside risk was greater than downside risk, and I didn’t want to lose on the way back up.

1. Rolling the credit put spreads

With the market down 20-30%, I had many credit put spreads that were deep in the money with strike prices as much as 20% above the underlying price at the time. I figured that if I could move the spreads even half way closer to the current trading price, I’d have much better odds of getting some or all of my money back. On the worst down days, I rolled my put spreads down, either widening the spread, or paying to be closer. This meant rolling short puts with Deltas of 90 or more and moving them to around 70 Delta. Many of these moves paid off big within a week of the move when we had a 10% move up of the market in a day. I used up days to roll out put spreads that were at the money or slightly out to later expirations, collecting premium and giving myself more time. I wrote a separate post on this strategy a few weeks ago.

2. Adding delta neutral back ratio call spreads

I generally take both sides of the option spectrum in my trades. I sell puts and calls on the same underlying at the same expiration. I use the same amount at risk capital on each side. As I got rid of my call spreads and rolled my credit put spreads down, I wanted to double-dip with calls, but without the risk of getting beat up with a whipsaw move up. If I sold credit call spreads, I feared that big up moves would drive these new call spreads into big losses. I didn’t want to lose on both the way down and on the way back up. So, I used back ratio spreads instead. The way I set these up is I find call strikes that have the same width as my put spread, and have Delta values where higher strike is half the Delta of the lower strike. I sell the higher Delta call and buy TWO of the lower Delta calls. The call position is Delta neutral and takes on no additional capital risk, because I use the same width as the put spread I already have. For example, I may sell a 30 Delta call and buy two 15 Delta calls. If my puts are out of the money, I may even sell calls in the money, for example sell a 60 Delta call and buy two 30 Delta calls. I collect a premium, which I keep if the strikes end up out of the money. If the underlying goes up, I make money from owning twice as many calls as I sold. For more details, read a further explanation on my web page on back ratio spreads.

I do have some long stock positions where I have sold covered calls in the past. Most of those calls have gone deep in the money a long time ago, and I rolled them periodically to collect a small premium. The recent COVID crash gave me an opportunity to finally get out of these positions and reset for a turnaround. Even out of the money, these positions still had a lot of time value due to volatility being at high levels. As I looked at each position, I generally did one of two non-traditional things- I sold a credit call spread, or even a back ratio spread in a later expiration. What this means is that while I still sold a call on my position, I used some of the proceeds to buy higher strike calls. By doing this, I have choices if prices go up substantially, but I’ll still keep premium if prices go down or stay flat. The back ratio spreads have the potential to create additional profit, with two long calls outgaining one short call, on top of the return from the underlying shares that are being covered. There are some minor downsides to this, but in a period where price movement is the key consideration, back ratio spreads are a great use of calls, even when covering long shares of stock.

How it worked out

From late March through the middle of April, the market has gone back and forth, up and down, with more up days than down. The market is up substantially from its low on March 23, but still well below the highs reached in late February. My positions have taken advantage of these moves.

My put spreads get more and more healthy as the market moves up. Almost all of them are now out of the money, although I still have a few under water. I’m rolling them out as they approach 21 days to expiration, and only for a credit. I actually rolled up a put spread that had gotten too far out of the money- the short strike had a Delta in the single digits, so I reset the spread to a 19/13 Delta because expiration was still 35 days away. I now use down days to open put spreads with slightly higher volatility. It feels more like normal times.

The call back ratio spreads have generally worked out great. They benefit from big price swings, but are vulnerable to decreases in volatility. They work best with long expirations- 4 to 10 weeks, so I’m pushing my expirations out to accommodate them. I also adjust them frequently, rolling up when the market goes up and rolling down when the market goes down. I collect premium both ways, moving to Delta neutral each time. In a declining volatility environment and an up and down market nearly every day, collecting additional premium keeps me ahead of Theta and Vega decay.

I do have a few regular credit call spreads where the width of my put spreads were too small for a corresponding back ratio call spread. These are my new problem positions because the big up moves have put some of them in the money. I’m determined to fight these, and one by one, I’m converting them into back ratio spreads or closing them before they get out of control. I’m also only opening new put spreads that have a width that a optimal back ratio call spread can match.

Of the upswing back, I’d say that 50% of the gains have come from put spreads getting out of the money, 25% from my long stock/ETF shares, and 25% from call strategies.

Looking ahead

Now that my portfolio is getting closer to my normal strategies, I’m starting to pay attention to Theta values and work toward a more neutral Delta position. I’m still negative Theta because of how many long calls are in my back ratio call spreads, but I’m working these down by going to strikes further out of the money where Theta is more in decline. The underwater put spreads also have negative Theta, which should reverse when they get out of the money. I’m still long Delta, but my call positions are slightly negative. As my puts get more out of the money, Delta will go down. I’m also working to free up capital, so I can have funds to jump in if volatility spikes back up.

Conclusion

While I’m not happy with how I got into this mess, I’m feeling quite fortunate to have beaten the market back to positive for the year. The challenge is to keep up the positive momentum.

Great articles on the site, really appreciate your work. Just one question: why don`t you buy teenies as a hedge? If the VIX is very low, for example at 12-14, I buy deep OTM Long Puts on the SPX which profit from IV spikes and deliver good hedging during black swan events.

I used to be extremely cavalier with risk as you can tell from write-ups like this one. Some would say that I still am compared to most option traders, but I’ve tried to dial it back and also look for good ways to hedge off at least some risk. Your suggestion is a good one.