Since early January 2021, I have been trading a continuously rolling 7 DTE put spread on SPX. I finally took time to separate the data for this trade from my other trades to show how well it has worked. I’m averaging greater than 6% per week return on capital. The basic 7 DTE trade is that I sell a 40-50 wide spread one week out at 10-12 Delta for the short strike. I usually collect over $1.50 in premium, and I try to buy it back 2-3 days later as part of a roll for something under $1.00, usually by collecting around a dollar. For the most part, I roll the position every Monday, Wednesday, and Friday. No matter what happens, I roll and try to collect additional credit.

Said another way, I’m in a trade for a couple of days and collect about 2% on average for the effort. For example, a 50 wide spread collecting a net $1 on a roll has collected 2%. The profit comes mostly from time decay (Theta) and somewhat from upward price drift.

What is a roll?

For those not familiar with rolling, it is a trade where one position is closed while a similar trade with better profit probabilities is opened all in the same trade. In this case, I might buy back a position with 5 days left to expire for $0.75 and sell a similar position with 7 days to expire for $1.75, a net credit of $1.00.

Managing when the market goes down

Most of the time (76%), the trade wins outright and I close for less than what I sold the spread for. When the market goes against my position, I roll down and out as much as possible while collecting more premium.

In the few events where I end up in the money, I use debit rolls to reposition out in time at lower strikes. In this situation, I may pay more to close my 5 DTE position than I receive for opening a new 7 DTE position. The idea is that SPX will eventually turn around and the roll won’t cost that much if I stay within a reasonable distance. I’ve used this technique on many put positions last year during the Covid crash and now on this trade. Since the trade should generate lots of credit most of the time, I’ll take the risk of a total blow-up, and use profits to protect the position however far is needed. Probably not everyone’s cup of tea, but it’s my plan- roll, roll, roll, no matter what. I don’t know where I would want to set a stop for this trade- it’s defined risk, and rolling gives me the possibility and probability of full recovery, eventually.

Historically, 98% of my rolls with this strategy are for net credit, and only 2% are a debit. That’s a lot more cash coming in than going out.

Why does this work?

The general concept is that this trade is selling a spread that starts with about a 90% chance of expiring worthless. Essentially, it would take two expected moves in the full time-frame of the trade to put the short strike in the money. It also decays quickly and approaches zero well before expiration in the majority of the time. So, my expectation is that most of the time I can get around 1/2 of the premium collected to decay in about 1/3 of the time to expiration, then get out and do it again. By always being in the trade, I take advantage of the fact that time is always passing, which is the only sure thing with options. Being two expected moves away to start allows the position to filter out a lot of noise and still make money without a lot of stress over where the market is going. When we get the expected move down, the position is still in good shape because that’s only half-way to the short strike. By rolling down and out, we can re-establish further away from the money and still collect a credit. Even several down days in a row can be absorbed, as this happens somewhat regularly. My experience is that defensive rolls work out back to a full win without getting in the money 80-90% of the time. To be really problematic, it takes a move of over 5% down in less than a week that doesn’t recover at all to move the position into the money. I’ve been in survival mode several times with this trade and recovered fully each time. I expect that there will someday be a scenario where I can’t roll enough to recover, but I have saved back cash reserves to allow starting over if that time ever comes.

On the other hand, this trade generates 4-6% return on capital per week most of the time, so it should double its value in about a five-month time frame if there is not a major drawdown and even with no compounding re-investment. I’m not sure how to calculate the probability of a winning week, but I’m pretty sure it is well above 90%. The probability of an in the money scenario is likely in the 2% range, and I expect this scenario a few times a year, with a position that drags out without recovering for over a month happening in the once every few years timeframe.

I’ve adjusted my mechanics a few times during the time I’ve been trading it. I started this the second week in January, at 100 wide and switched to 50 wide contracts when I realized that the extra width wasn’t gaining much, and was extra risk and extra buying power. I’m now trading 40 wide. I’ve gradually gotten more methodical in my approach, although I’m still not that rigid. Originally, I was selling 4-5 DTE and rolling 3-5 times a week. Since I switched to 7 DTE, I’ve found the trade much less time consuming with more premium and time cushion, but slightly less decay. However, the concept is the same- sell way out of the money put spreads and roll out every two days or more often to collect additional premium.

Why SPX?

I trade SPX only for this, and I think it is perfect because it has less price swings that almost any other underlying, and it is big enough that the commissions/fees are negligible. I tested RUT and NDX and found them to be too volatile for my taste. I’ve tried SPY, but I find it hard to get filled near the mid-price on my rolls, and commissions are a much higher percentage of the trade. I got the original idea from a post in a Facebook group last December, and tweaked it until it fit with my style. There are a lot of ways to vary this, but this strikes me as a nice way to trade fairly near to expiration options with a high probability of success without a lot of drama. I know several people who now also do their version of this trade, some using stops, some getting in and out based on the market, some using technical indicators to inform their decisions.

Results summary

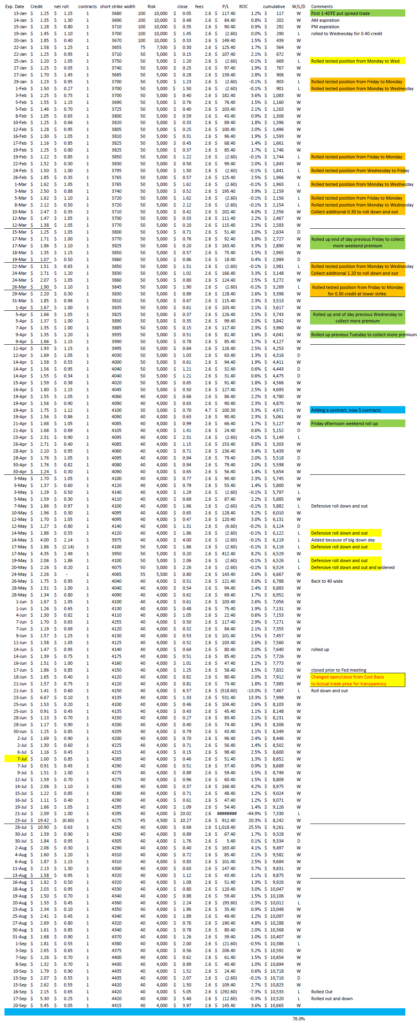

The sheet at the end of this post shows each individual trade. At the first of the year, I showed trades that I rolled out that were losing by their cost basis to me. So, if I sold a spread for $1.50, bought it back for $2.10 and sold the new position for $2.50, I would show closing at 1.50 and opening the next trade at $1.90, my adjusted new cost basis. In June, I decided that this wasn’t very transparent, so I switched to showing the actual closing cost and opening sales price when I have to roll out on a tested position. Either way, these were my actual trades. I think that is easier to see how the trade works when the market is challenging. I’ve scaled up the number of contracts I trade, but for simplicity, I’m showing just one contract. The dates are the expiration date of the position- I don’t track which date I actually roll.

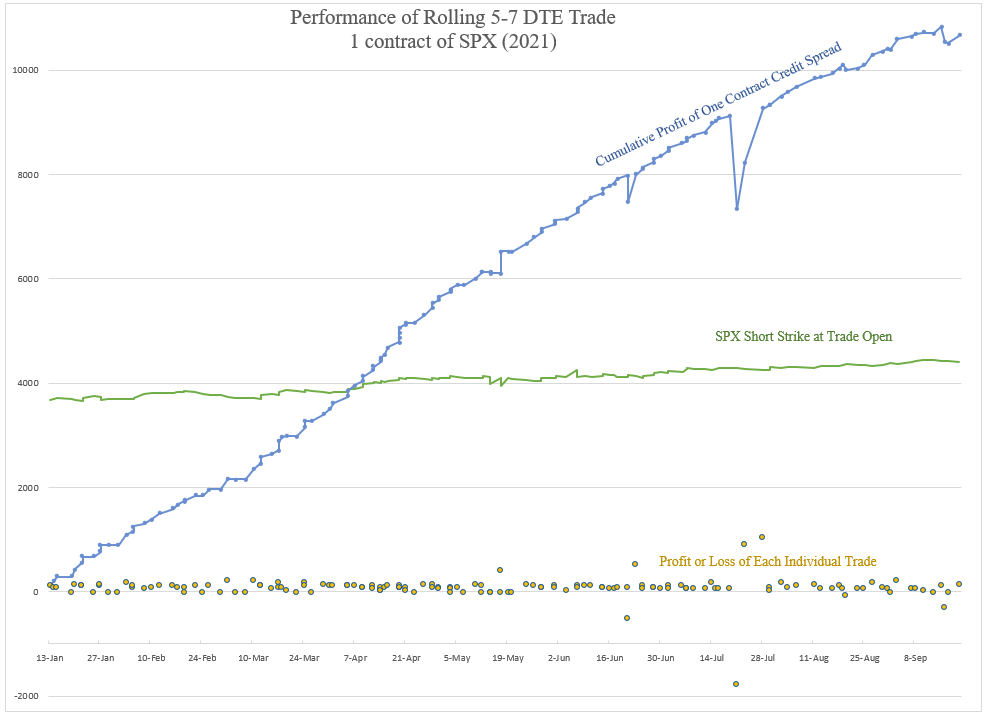

When I charted this out, I was surprised to see how consistent this trade has been in accumulating profits. Keep in mind that my results are just for the trade, and don’t take into account having cash on the sidelines to use for defense if the trade goes into the money. My goal in this trade is to consistently generate cash as time passes by, and for the most part that is what has happened.

My results for this trade are in line with these expectations so far. In over 8 months, I have made money every single week on this trade except three, which is amazing to me, considering that the market had a few weeks where it really trended down. In the first four months of this trade I doubled my money. While this is the most consistently profitable trade I regularly do, I only use a small portion of my capital with this trade due to the tail risk from a major crash.

I hope this explanation and the data attached helps you understand this trade a little better. As you all know, this is one of several trades I do. I thought this would be of particular interest, especially considering how well it has worked. I’m very aware that there is considerable risk in this trade, despite its high probability of success, and that even in the majority of times significant volatility to the position can be expected.

I’ve shared this trade in a number of other forums and received a lot of questions. Here are some common ones:

How does this compare to 0 DTE?

One reason I started this trade was that I wanted an alternative to the 0 DTE or expiration day trades that I see a lot of people doing. I tried my hand at these using stops, and I would have long strings of wins followed by a big loss that I couldn’t get out of in time. It was very stressful to me, and most importantly, I wasn’t making money for all my effort. When I came across this concept, I saw that I could use many of the same management techniques, namely rolling, that I use in longer duration trades, and avoid expiration day stress.

Where does 4-6% return on capital per week calculation come from?

A couple of ways to think about this. I’m making at least three trades a week with this strategy. Each trade has an average profit of around $0.80 per share, or $80 per contract. The capital at risk is the width of the spread, $40 per share, or $4000 per contract. Either way, that’s 2% profit for the capital at risk. With three trades a week, I total up to 6%. I could just as easily say 25% per month, or 100% per quarter, but that is less intuitive.

Why not use stops?

I know a lot of people are big fans of stops. They prevent losses from getting out of hand, which in many situations is an absolute necessity. Stops also eliminate the possibility of a position recovering. My view is that market movement is mostly random up and down, and my experience with stops is that I often get stopped out right before the market reverses, locking in a loss that would have been much less if I had stayed in the trade. As a result, I prefer to find ways to extend out the trade on positions where I have a reasonable expectation that the position will recover in a reasonable amount of time. With the S&P 500, this has been a very reasonable expectation, especially if I can re-position my strikes down while collecting more credits in the process.

Advantage of defined risk over naked puts

I know that many people are big proponents of selling naked puts because there is more premium per contract than with a spread. However, naked puts take more capital in most situations, and have undefined risk. Because a spread requires less capital, the return on capital can be much higher. Having defined risk through a spread, provides a floor for the trade that prevents the possibility of completely blowing up an account with an outsized black swan type loss event. For those reasons, I avoid selling naked puts, and instead sell credit spreads. One caveat is that if a naked put is sold cash secured, the risk is reduced to market risk and can never blow up an account- however, returns will be a small fraction of trading a spread. It’s all trade-offs and a matter of strategy preference.

Are these three trades at once or one?

I trade this with just one position, opened and closed three times a week or more with a roll. For example, each Monday I close the following Friday position 4 days out and open a position for the following Monday 7 days out. Then, on Wednesday I close the Monday position 5 days out and open a new position for the following Wednesday 7 days out. Then, on Friday I close the Wednesday position 5 days out and open a position the following Friday 7 days out. I just repeat over and over. If the market jumps up somewhere in between rolls, I may choose to roll to higher strikes in the same expiration for an extra credit.

Why not hold to expiration if the odds are so high?

The strikes I pick decay quickly, and I expect the position I roll into to decay more than if I had held the position I closed. This is why I can make $3 in a week with a position that sells for $1.50 to $2.00 to open on average. By rolling to a new position, I make better use of my capital. Also, rolling early gives more flexibility to manage compared to positions that are closer to expiration.

What time of day is best for the roll?

I’m still trying to determine when the most profitable time to roll is. I don’t believe time of day is as critical as the action of the market. Ideally, the IV of the strikes at 7 DTE are much higher than those at 5 DTE to maximize the difference in premium. But when is that most true? What triggers that situation? It appears to be a mix of variables that I haven’t yet been able to model or pin down. My tactic is to monitor the net credit available throughout the day and trade when I can get what seems high based on my previous experience. So, it is more art than science, which is never my preference. Alternatively, I just put in the trade when I have time, knowing that time decay generally works out so that no matter what credit I get to roll, it will average out in profits in the end. I’m not convinced this is optimal, and I may be leaving some return on the table. This is an area I continue to study.

What strike do you roll to? Always to 10-12 delta?

Ideally, I’d always roll to 10-12 delta strikes if the market were constantly grinding higher. However, the market varies and sometimes goes down and rolling to 10-12 delta would require paying a debit to achieve. My strategy is to collect a credit to roll whenever possible. So, if I can roll to an ideal short strike in the 10-12 delta range for a credit, then I do it. If I can’t, then I roll to the lowest strikes I can while still collecting a credit. This causes the delta value to drift when the market is in a downturn with an expectation that eventually the position will work its way back to the ideal delta values. Because we work from values so far away from the current price, we can afford to drift closer from time to time, knowing that the probabilities still favor the position decaying.

What about bear markets?

I don’t know when we will have a bear market. Obviously, if I did, I’d get out of this trade to avoid losses and get back in at the bottom. Lots of people predict crashes, and if you predict a crash enough times, you’ll eventually be correct. I’m not naïve, I know a bear market will come some time. But since I can’t predict it, I’ll deal with it when it or a significant correction comes. I’ll use the mechanics I’ve described for this trade, and fight to make a profit with defensive and survival rolls. Remember, in down markets the strategy is to aggressively roll down strikes, improving the probability that even a modest recovery will lead to a profit.

Is there a scenario where this trade could be a total loss?

Sure, this is a highly leverage trade, and as such a fairly small correction could put this position deep in the money and marked for a near total loss. Any number of events could trigger a sudden drop in the market- for example: a surprise Fed announcement, another unexpected financial crisis, a natural disaster, a military or terrorist action against the US or US interest, or another pandemic. Most situations would progress slowly enough to allow this trade to be adjusted and rolled out and down, but some could be so sudden that there would be no action that could be taken. After 9/11 the market was closed for several days, and opened way down when it did open. Is it possible that the market could be closed for the life of a contract? Absolutely. I’m sure there are numerous scenarios for total loss that I can’t anticipate with this strategy. The only thing I can do is be prepared that a total loss won’t ruin me financially because I keep cash on hand as an ultimate hedge.

How much do you scale up your position to compound profits?

This trade can provide a lot of cash. I see three ways to use the cash that is generated. One is to take it as income. Another is to save it as a buffer for when the market requires a survival roll for a debit, or even a total loss. And finally, cash profits can be plowed back in to increase the amount of contracts traded. So, how much to use for each purpose? It depends mostly on how much income you need from the position. I know that taking income distributions means that money can’t be used to build the size of the account. But, I take out what I need to. With what’s left over, I have a simple rule. I want as much cash available in the account as is required for the strategy. For example, in a $40,000 account, if I have $20,000 capital required for five 40-wide spreads, then I want to have $20,000 cash buying power available and not used. If the account grows to $48,000 balance, I can add another contract- that’s another $4,000 at risk and another $4,000 cash buying power sitting in the account. Effectively, this cuts my portfolio return in half, but with compounding from scaling up, the portfolio would theoretically

These returns seem unbelievably crazy. Are you making this up?

These results are actual trades I’ve done. I don’t know what will happen in the future, but this trade has worked well so far. There’s no guarantees, and past performance does not predict future results. This trade has substantial risk, and potential for big rewards.

Can I see a log of this trade over time?

Sure, here’s eight months of raw data:

2022 Update-

As we moved into 2022, the market changed dramatically. 2021 was a very calm year with no downturns in the S&P 500 of over 5%. However, with inflation growing and the Federal Reserve taking action to tackle inflation, the market became much more two-sided and essentially bearish.

So, for this trade, I have adjusted to sell both sides of the trade, puts and calls. Instead of a credit put spread, I now sell an Iron Condor. I aggressively adjust my strikes up and down with each roll now, using credits from moving the untested side rolling toward the current price to pay for debits if needed to roll the tested side away from the current price. This has reduced volatility of my positions and made the trade manageable in this near bearish environment.

The other change that I have made is taking advantage of Tuesday and Thursday expirations. With expirations every day, I can move my positions out to 7 DTE every day, allowing regular adjustment of my strikes while rolling out each day.

Combined, I feel like I have more control managing my 7 DTE positions in a volatile market. Results are looking positive with these changes and I will update when I have enough data to show. Once the Federal Reserve is done tightening the economy and switches back to stimulating, I will likely switch back to puts only or some hybrid that goes in and out of calls.

I have been trading your strategy for a month and I really like it as a side hustle for my much more conservative wheel strategy. I wondered if you could buy a put leap to insure against a full loss?

Sure, you can do that. However, realize that delta will change much faster on the 7 DTE trade than on the LEAP. So, if you take a total loss on the 7 DTE spread, the LEAP may not cover it at expiration of the 7 DTE. It just depends on how far down the index goes. The other watch out is that as the market goes up, the LEAP will lose value from price changes.

Very detailed write up. Thank you so much for giving away so much information without trying to sell anything.

You mentioned ‘I only use a small portion of my capital with this trade due to the tail risk from a major crash.’. Which strategy you mostly do with the bigger chunk of portfolio?

Thanks for the kind words. For bigger chunks of my portfolio, I do longer duration expirations like 45 DTE put credit spreads, or the put broken wing condor, which I’ve written about on other pages. Short duration trades can have very high returns in a short amount of time, but the trade-off is that strikes have to be fairly close to the money. If the market makes a series of big moves day after day, or week after week, a position can easily be over-run and become nearly impossible to defend. Longer durations allow more time and more space, and can still be quite lucrative. Also, longer duration trades take less effort, and less attention than trades that are expiring within a week.

I know this almost contradicts this post, but there is a place for all kinds of trades, and a 7 DTE trade can be a great return on capital. But if it is using a large portion of the capital of an account, it will likely become a problem at some point. Trading a variety of different strategies helps to diversify risk.

And probably most important for option traders is to keep plenty of cash on hand. Trades like this spin off cash, and some of it should be set aside to use for defense in tough times. Cash also is good to have on hand for opportunistic trades, like when the market goes down and volatility is up, it is a great time to open new positions.

Another question. Can we do a put credit spread and call credit spread on both sides at the same time and keep rolling both ?

Yes, selling both sides obviously provides more premium, and generally doesn’t take any more buying power. Selling both sides is a neutral strategy, but really more bearish. In a bear market, having call credit spreads can cushion losses from put credit spreads.

And yes, both sides can be rolled. It can be a little tricky, because most brokers only allow a maximum of four positions in a single trade ticket. So, each side has to be rolled separately- roll the calls, then roll the puts. When one side is rolled, there will be a temporary need to double capital or use more buying power. If the two sides were using $1000 buying power as an Iron Condor, then when the calls are rolled to a new expiration, they would need $1000 buying power, and the puts still would as well. Once both sides are rolled, then buying power is again shared by both sides, as only one side can be in the money at any given time. If capital is tight, one side might have to be closed, then the other side rolled, and then the first side re-opened in the new expiration. Any way you go about it, each old position is closed and a new position is opened in its place.

Another advantage of having both sides available to roll is that if one side has been tested or breached, it may need a debit roll to get it to a better set of strikes in a later expiration. That debit can be paid by rolling the other side’s strikes closer to the money while moving to the same later expiration, and collecting a similar or greater credit.

In a bull market, call credit spreads are a losing strategy. My experience is that the strikes are too close are frequently breach. Any backtest of data over the past 10 years of any call credit strategy will verify this. I’ve tried to find a profitable strategy for selling calls in a back test, and I can’t find one. So, I only use them in down trending markets, and look to close them out when I think the market is bottoming out. Of course, that’s easier said than done. As I write this in March of 2022, we have just gone through over a 5% up move in the past week off of a bottom. I’ve gone from having all my puts in the money to having all my calls in the money. It’s very frustrating to have your account lose value on a day when the market is way up, but that can be the outcome of getting too aggressive when rolling both sides down.

In any case, my goal is to collect a net credit with every roll. When I have both sides, calls and puts, I try to keep a gap between the sides as much as possible. If I have to narrow the gap to get a credit, I look for opportunities to re-widen the gap in a future roll. The closer the distance between the short put and short call, the longer it takes to decay, so I want them as far apart as possible, while rolling for credit.

I’m planning to write a post soon on the topic of rolling both sides of an Iron Condor as a management strategy. I’ve had a few people reach out to me on social media asking about this, and others doubting that this can even work. From just this response, it should be clear that there are a lot of things to consider, so I need to write a more detailed and organized explanation with graphics and examples. Stay tuned.

Thank You so much for this website. I learned a lot.

I have a question, do you use the same 10-12 delta and 40 width for call side?

Thanks

If I trade the call side, yes, I use similar Delta and width. However, in most market environments, the call side loses more than it gains due to a combination of market drift and skew in the Implied Volatility values. So, unless something has convinced me that we are near a market top or in the beginnings of a bear trend, I avoid selling call spreads. I try to avoid losing money when the market is going up, but that probably isn’t completely data-driven.

Thank you for your reply. Appreciate.

Thank you so much!!

You mentioned that you trade SPX because commissions are cheaper. Which broker do you use? I am using IBKR but I am being charged 1.64 for each leg (3.28 for a spread). Looks like SPX have a special charge of 0.50 plus commissions (0.65 per contract/minimum $1 per order). Is this normal?

Generally, I compare trading one SPX contract to trading 10 SPY contracts. So, no matter how crazy SPX commissions get, they are still less than 10 SPY contracts. That said, there are a range of different costs at different brokers. Schwab’s standard price is $0.65 to open and also to close, including SPX. At Tastyworks, opening a SPX trade costs $1.65 and closing costs $0.65. I know that many brokers will negotiate these rates down for high frequency traders- you just have to ask. Your broker is about the highest I’ve seen for commissions and fees.

One exception that applies to people trading very big quantities is that Tastyworks caps commissions at $10 per strike position on all stock and ETF options, including SPY. They also don’t charge anything to close the same position. So, if you trade 50 contracts of SPY, it would cost less than 5 contracts of SPX round trip with them. However, I generally have found that I don’t get as good of fills on SPY as SPX on a percentage basis, which would outweigh the commission savings.

I am planning to try this strategy with /es future option spreads. I like being able to roll anytime without concern for the Pattern Day Trader rule. I am wondering if a person could roll every day or even, in a volatile market, more than once a day. Your articles have been among the best I have seen. Thank you!

Futures options do bring a number of advantages, including avoiding the Pattern Day Trade rule. Generally, the span margin of the position greatly reduces the amount of buying power required, but that can be deceiving as big moves against a position can cause buying power required to spike when it is least convenient.

I have some short duration options that I roll just about every day. With option expirations available for every day now on many variations of the S&P, I can roll out and keep the same duration, day after day. However, with the really big moves we have seen in this bear market environment of early 2022, we are getting a lot of moves that are bigger than short durations of options can tolerate. As a result, I’m moving out in time to have a little more wiggle room and not be whipsawed as much.

I’ve also noticed that the new Tuesday and Thursday expirations don’t have the same variety of strikes as the Monday, Wednesday, and Friday expirations.

I recently had a trader reach out to me with a variation to this trade that has worked well for him. He tries to sell a 50 wide SPX credit spread three times a week with 7 DTE each time. He always sells counter to the trend of the market. So, if the market has been up two days in a row, he sells a call spread with a short strike at 5 Delta. If the market has been down two days in a row, he sells a put spread with a short strike of 5 Delta. If there is not a two day trend, he waits until the next day, and will double up if it goes longer. He lets each position expire. In eight months of 2022, he has only had one losing trade with this strategy. He typically collects a little over $1 per trade, so he makes around $100 on $5000 risk three times a week. This is quite remarkable to me in that we have had several long trends in the same direction with fairly big moves. He said he has had several positions get close to being in the money, but he has been okay all but one time. He did some studies that show that the market is unlikely to make two expected moves in 7 days in the same direction that it has already gone for two days. It also helps that IV has been high all year, keeping this position quite wide.

I decided to take it a step further and started opening a 7 DTE Iron Condor each Monday, Wednesday, and Friday. I sell the 5 delta put and call and go out 50 points or the closest strike to 50 points to buy my longs. I’m collecting around $2 per trade, and I’m closing at $0.30 limit about 4 days into the trade. Working great so far with the market not going anywhere. We’ll see what happens when things get more volatile.

Thanks so much for your detailed posts and commentary. They’re extremely helpful and open the door to quite a few more ‘options’ than I have been exposed to previously. One quick question: are you planning to roll these condor spreads as you have been doing in the 30dte condors from your other post? Or let these expire as the trader who you mentioned seems to do for his put/call spreads. Thanks!

Thanks for the nice words and the question.

So far, I’ve managed the positions early because that is what I’m most comfortable with. I’ve opened for around $2.00 credit, and then tried to close for $0.30 debit, which has worked several times with about two days to expiration. This week I rolled out my puts about 10 days, closed the calls for 0.05, and opened a new call spread to match the put spread. Now, I’ll manage those positions like I do other Iron Condor positions, and look to have it decay until I can close it for a profit.

Hi I read about the 50 wide spx credit spread 7 DTE selling counter to trend with short strike at delta 5 and your 7 DTE condor selling delta 5 calks and outs and going about 50 points wide for longs

How have these 2 faired since 2022 in 2023 and the bull market?

I’d appreciate your feedback

@Nick: 2022 was hard. This is a very bullish trade, and much of 2022 was a bear market, where there was no adjustment that would save the trade. Many trading friends gave me a hard time about this trade in particular, which added insult to injury. I never said it couldn’t lose money…

2023 was better as most of the year was bullish and the corrections were short and manageable.

IF the market is going up or flat, this trade can make a lot of money. If the market goes down very much, this trade can lose way more than it ever made. Beware.

I just recently found your website and want to thank you for sharing your trading experiences, studies, etc. I’ve learned more from you and the folks at Tastytrade about the markets in general and trading options specifically than from all other sources combined over the past several years. I wish I had found you both sooner!

One question, what does the ‘net roll’ column amounts refer to in your spread sheet above?

Thanks again,

Mitch

Mitchell- That’s high praise! Thanks for the kind words.

The net roll is the credit received for opening the new position minus the closing cost of the previous position. The numbers are a row apart, so it isn’t obvious. For example look at the credit in row 3 and the closing cost in row 2- the difference is the net roll in row 3. What’s the point? The point is that this is the value that a trader can mostly control. A trader picks the strikes to move into, and in this strategy tries to choose strikes that always net a credit.

This is different from the profit and loss of a position. If I open a trade today and close it a few days later, it might be a profit, it might be a loss. I have no control other than starting in positions more likely to be profitable. When I choose to close one trade and move to another, the profit and loss of the old trade is whatever it is, but I can control what strikes I use to open the position that replaces it. And my goal is to look for a credit from each roll.

A lot of people focus on the net losses of losing trades and that rolling a loser “locks in” a loss. You can see that there are losing trades in the list, and often that led to a roll that didn’t collect much credit but used the extra time being sold to get to lower strikes that had a higher probability of success than the old position.

It doesn’t always work, so we need to have personal limits on how much capital is tied to a strategy like this. It’s best to take some of the earnings and set them aside for a time when the market goes down faster than a trader can roll.

The goal of a continuous rolling strategy is to collect credit after credit after credit, while keeping strikes out of the money. Tracking the net credit helps keep this goal in front of you.

There are alternative strategies, like always rolling to the ideal strikes no matter what. It will lead to a higher percentage of debit rolls, but likely keep the position from going to full loss in any holding period.

Carl, many thanks for your very hard work putting your site together. WOW!

Yesterday, for the first time, I set up the 7DTE trade, with modifications. I used the XSP rather than the SPX because I really wanted to start small; the spread is two wide rather than the suggested four wide; and as your update suggested, the iron condor approach looked attractive. As I write this, the XSP is down more than 4 points, meaning the put side is getting closer to a problem. I’ll be rolling late today, prompting my question: Tasty says to roll up the unchallenged side. You indicate rolling both sides. Why the difference?

Thanks for the kind words.

There are several things to unpack from these questions. First, this trade is primarily a credit put spread trade that can be used as an iron condor. If I’m doing an Iron Condor, it is because we are in a neutral to bear market, which at the end of April 2024, may be true at least in the short term. In any case, my goal with an Iron Condor is to try to move toward centering with each adjustment. It tends to be easier to roll down both sides for a net credit than to roll up. I roll both sides because I’m trying to stay in the trade and not collapse it to an Iron Fly and I definitely don’t want to invert spreads.

Several things are different about Tasty’s approach that make this an apples-to-oranges comparison. First, Tasty doesn’t like to be in this timeframe of 7 DTE. It is very chaotic, and one that should never be a large portion of a portfolio. Second, and more importantly, Tasty mostly advocates for naked positions, not spreads. So, rolling up the untested side to collect premium can make a lot more sense with naked trades, even when the tested side is in the money. It’s a completely different game in many ways. With naked trades, there is always positive Theta. With spreads, once a side is in the money, Theta is negative, pulling you toward a total loss. So with credit spreads, getting out of the money is a top concern.

If you watch enough Tasty, you’ll see that they have a bit of a different approach to spread trading. They try to build in a “risk two to make one” set up when starting a trade. These set-ups are lower probability than I like and decay slower. However, the point is that as long as you win twice as much as you lose you make money and you let the chips fall where they may. With higher probability trades, the downside is that losses can be bigger, so managing the losing side becomes more important.

Finally, a watchout on XSP. Make sure your broker gives you a good deal on fees for XSP. Otherwise, lots of frequent trades can add up to big trading costs. XSP also isn’t nearly as liquid as other index products and it is hard to get good fills, especially when your position is in trouble- you don’t want it and nobody else does either. This is especially true for non-Friday expirations. SPX and SPY stay much more liquid over a wider range of strikes, as does /ES. Check out my write up of different index products for more choices.

Thanks, Carl. Good stuff!

Carl, Thank you very much for sharing your strategies publicly. I’ve been using the 7 DTE trade for about a month and with 24 trades only 2 losses!

One question: I paper trade alongside my active trades and have noticed the smaller wide spreads seems to close faster. For example, I use the same short strike at 10 delta, then place a 20 wide spread and a 45 wide spread, and close them both with a 1.00 profit. The 20 wide spread consistently closes faster – sometimes 1 day quicker. Do you know of any reasoning behind this strategy?

Tom- Thanks for the kind comments.

Your results seem counter to what I’d expect. If you are using the same short strike and entering at the same time, the wider spread should decay faster on an absolute dollar basis. The narrow spread will lose faster as a percentage of capital, at least at that low of deltas. The lower priced options have less premium to lose, so their decay should be less per day in theta. But, maybe you’ve stumbled on an anomaly where the long puts you are choosing behave a bit differently because of their already low value and the odd changes in the term structure volatility as expiration approaches. The last few weeks have very big swings in implied volatility.

Hi Carl, Thanks for this info. I have been doing them and they are going well so far. Some thoughts:

1. What about Vix? I notice on this and especially iron condors if Vix goes up after you buy it hurts the position, but if you wait till exp, guess it does not make a difference. Do you look at Vix to try and put a trade on with a higher intraday Vix?

2. Comms, so with just 2 legs it cuts comms in half, nice for rolls. But I get tempted to wait till expire, especially on 4 leg trades to avoid about $4 of extra cost(4 leg) not counting getting less than mid (bid/ask spread slippage) cost. What do you think is your early roll loss average from comms and from slippage? You have done a lot of these, so figure you would have good take on that.

3. Have you considered going to 5 or 10 spreads? My calcs are that if you get $150 (3.75%) for $4,000 margin if you drop to 1,000 margin (10s) I can get $65 (6.5%) . So if you do four 10s that is $260. Waiting till expire it seems superior, but maybe rolling extra comms and slippage on 4 trades vs 1 trade takes that advantage away.

Cheers

Darp- Good questions.

1. Ideally, if you can sell when VIX is higher, you can make more. But, how do you know when it is at a peak to sell? Yes, if I notice that VIX is up, I try to take advantage, but I also just try to stay mechanical in my trading.

2. Holding to expiration is a different way of doing this. My goal is to get a lot of decay in a day or two and then reset with a roll. The goal is to get a big chunk of decay, not leaving much for expiration. As you know from my comments elsewhere, I’m not a fan of holding to expiration, but you do what you want to do.

3. Didn’t you just say you were concerned with commissions? Doing a bunch of narrow spreads will cost a lot in commissions and fees. I also don’t like what it does to probabilities and risk. Theoretically, narrow spreads can make more as a percentage of capital at risk, but they tend to decay slowly because the thetas are almost the same and so the two premiums decay almost equally. If the spread is wider, the higher delta strike decays faster than the lower. My goal is to find the strikes where the lower one is slowing down its decay and the upper one is dropping a lot in value. So there’s two reasons to go wider.

I love reading your content. I’ve just recently gotten started in trading bull put spreads and a majority of the learning has come from you, so thanks!

I have been trying the 7 DTE strategy, albeit with a little safer deltas than 10-12 (7-9, just to get started). My question is about rolling at 5 DTE regardless of where the position is, and I think I know the answer. Right now I’ve got a position that would be down about 0.5%, why not wait it out until 3-4 DTE and see if it can turn a positive? Would love some stats to look at on this if you’ve got them!

-> I think that the answer is the theta decay you’ve accomplished in the first 2 days of the spread have helped offset the actual financial loss of the spread by SPY going down as it has, and now you can buy a new “fresher” theta by rolling down and out and start the process over again with minimal financial loss from the spread where the market has gone down. And this new 7 DTE spread has a better theta decay prospect than the currently held one with 5 DTE.

Thanks for the insights!

Yoshi- thanks for the kind words.

I think your analysis is spot on. The only thing I’d add is that the idea of continually rolling- win, lose, or draw, is to keep giving the trade time to decay, keep resetting the strikes to more favorable probabilities, and keep collecting premium whenever possible.

This is by no means the only way to do this, and every trader can look at optimizing mechanics to match their investing and risk preferences.

Hello Carl,

Thank so much for Sharing all your knowledge. Your blog ist a blessing.

Reflecting on the performance of this strategy in bull and bear markets, I was wondering whether you were able to derive any general rules that would signal a trader that this strategy is becoming increasingly risky?

I am thinking of market VIX levels, trend reversals on the weekly chart, moving average crossovers, etc. – I could imagine that the VIX could be a helpful indicator…

Manx thanks, Christian

Thanks for the kind remarks. This trade probably is most subject to a problem when VIX is low, and the market is hitting all-time highs. The challenge is to know when the market is starting to really fall. As you probably know, when the market is doing really well it can continue to do really well for quite a long time so being at a high level with low VIX doesn’t necessarily mean that the market is ready to crash. However, that is the time that when the market does start to move down, it often moves down quickly; and since volatility is so low the strikes of this trade will be very close to the current price. In comparison, when volatility is high, there’s more room for up and down movement. So, any indicators that help you see a change from a long ongoing uptrend to a significant downtrend might be a way for you to plan for your exit.

Hi Carl,

Thank you so much for sharing this strategy and all the other information on your site! Your insights help me a lot =)

One question I had was if you still use this strategy to this day and how well it/was performing. I really like the fast theta decay that this strategy provides and the simplicity of it. Also, what are your thoughts on this strategy compared to the 1122 strategy for smaller accounts 8K.

Again thank you, and keep up the good work!

Best regards,

Enzo

Enzo- thanks for the kind remarks.

I don’t use this strategy as much lately, as I am backing away for trades that require me to monitor and potentially act virtually every day. I’ve had a number of traders reach out that really like this approach and have provided anecdotes of their success and tweaks to the strategy.

This strategy does really well when the market is going up steadily with minor dips here and there, which is probably 80% of the time. The challenge is that with such short duration, the position is just a couple of percentage points below the market, so any kind of correction can quickly put the position into a potential for a total loss. So, identifying that environment and getting out until the market returns to an up trend is key to success.

The 1122 can also work, although I tend to trade it longer duration, so I have less short term risk and a lower long term return. Key to note after the Aug 5, 2024 volatility spike that traders using the 1122 generally weathered the IV spike, while those trading the naked 112 version likely got burned. Trading defined risk doesn’t eliminate risk, but it does limit it to a defined amount based on the spread width.

For small accounts as well as large, managing the total risk is key. After that, finding trades that match your trading demeanor and risk tolerance, and understanding the plan to manage in all seasons determines success.

Hi Carl,

Thanks for publishing the detailed results of your trading experience.

Theoretically, selling an option with a delta of 12 (or less), gives a probability of touch of 12*2=24 on each side of an Iron Condor.

I se that You usually take a 33% profit of the credit ( get 1.50 cr and close at less than 1 $).

Given the frustrating experience in 2022, and the less reproducible and sweaty « art of rolling out and down », why not just use a hard 100%(of the credit) stop loss ?

Using the Kelly Criterion Calculator: W%=76, Gain 33%/trade, loss 100%/trade , Initial capital 30 000 $; gives a optimal investment size of 3.27%(982$/trade), so a Positive expectancy.

A variant: Gain of 25% with a stop loss of 75% per trade , will result in a optimal Investment size of 5.33%(1600$)per trade.

Is this too theoretical?

Has anybody had a real time experience with hard stops on this ? (I think I’d only use Iron Condors)

Dan Tatu

Dan- Thank you for the kind remarks.

While I agree that a stop loss could help to prevent worst case scenarios, I think percentages and costs may be a little different than what you are suggesting. The problem is that this trade will lose several times the credit received by the time the underlying price touches the short strike, so either the percentage of stops needs to be higher, or the amount of the stop loss needs to be higher.

I find by rolling down my puts at any market downturn, I can improve my probabilities and reduce the chance of getting into the money. Rolling well before expiration makes modelling this a challenge, especially if not rolling to the same Delta every time as I’ve described in my approach.

I believe a few other commenters have found some alternative methods of managing this trade successfully using stop losses as part of their approach, so it is a matter of finding the right mechanical approach with positive outcomes that matches one’s trading preferences.

Thanks for sharing. Do you put on the 7-DTE and roll every Tue, Wed and Friday whether you have have profit or loss?

Yes, that’s how I’ve traded the strategy. It works great in neutral and bullish markets, but can be very problematic in a bear market, like early 2022 and Spring of 2025.

Hi Carl,

Appreciate you sharing so much insight in this strategy. I have recently tested it out and results are pretty good so far (6/6 wins), though I did make some minor tweaks to it which I thought could potentially improve the win rate:

1. Instead of rolling every 2-3 days, I tend to hold the position till expiration (or at least 75% max profit) IF SPX moves in my favour, rationale being I am now further OTM + if I were to roll to the same deltas, I will be moving my strike price up, which in my opinion would be increasing my risk.

2. I will close my positions before any of the ‘high impact’ events (e.g., FOMC meeting, CPI, PPI, unemployment claims etc) to prevent a potential gap down in price.

Is there anything that you think that I can look out for to further improve the win rate?

Regards,

JY

This is the beauty of option trading- each trader can adjust strategy to focus on the outcome that is most important to them. There is no best way for all situations, but each trader can determine what factors are most important to them and trade accordingly. For higher win rates, you could also use lower Deltas, but that would reduce the rate of return and add a higher max loss as a percentage of capital used. You could add more time, but that would slow decay. The point is that every adjustment has a trade-off, there is no free lunch.

Your concept of holding until expiration or 75% capture of premium isn’t bad, especially closing at 75% so you can re-use your capital for a new or rolled position, but if it comes down to holding several days for the final pennies to decay away, that may be a less optimal use of capital.

Allen –

Thank you for your generosity. Super kind of you.

I have a question – i been following this strategy verbatim – as stated exactly in the article. My legs were at 6245/6205 ($40 width, 0.12 delta for the short strike and approximately 0.07 delta for the long). I made about $22k in the last few weeks. This morning, with the whipsaw (almost), I blindly rolled my trades by 7 days (6050/6010, $40 width, same deltas as above) – like i always d0. Ended up losing $24K. My entire profit (and some) got wiped away. I realize i should not have executed it blindly. Questions – 1. What should I have done in today’s whipsaw scenario – what would you have done? How would you have managed – where would you have rolled to? 2. Is this a typical scenario? Next time it happens – what should i be doing instead of rolling blindly? I am pretty certain, this is going to repeat over and over – that is the nature of the market. Will appreciate your insights Allen. Thanks again. You are very kind to share so much of your knowledge with the world.

Thanks for the kind remarks.

With a continuous rolling strategy like this, I just take the market as it comes. When the market goes up, you don’t know what it will do next- will it go up more or fall? In hindsight, it always looks like there must have been a better way when there is a loss. So, I don’t know that I would have done anything differently. One problem is that as the market gets higher and more complacent, premium sellers get less premium and have to sell at strikes closer to the money, so they become more vulnerable to sudden moves to the downside.

On the flip side, we don’t know what will happen going forward. If the market were to reverse back up suddenly, the losses would go away, assuming the trade position remains and keeps rolling. If the market stays down, or goes down further, rolling the position will require a debit even to stay at the same strikes and will cost even more to roll down. Each trader has to determine for themselves how to proceed when a rolled position gets in the money- get out or keep rolling. Continuing to roll might mean lots of additional losses if the market stays down for a long time. Getting out might lock in a loss just before the market turns around in a move that would have erased the full loss.

It can take several months of wins to build up a buffer that can keep the strategy at a long-term positive profit during a downturn, and provide the capital to keep rolling. Because this is a high probability trade, it can be easy to get complacent and even scale up in good times and forget about the risk. There is always about 90% of the spread at risk when opening at the 12/7 delta strikes, and just 7 days to adjust when things go wrong, but for traders that want to keep the position going, that’s enough time to come up with a plan and adjust.

This also points to the need to have a plan for what to do in every scenario. Will you roll- and for how long? Will you roll down, will you widen the spread, and take on even more risk to get a position more likely to get out of the money? At what point will you close? Have a plan and then follow the plan.

Thx Allen. Thank you for the thoughtful notes. Appreciate the time.