Since early January 2021, I have been trading a continuously rolling 7 DTE put spread on SPX. I finally took time to separate the data for this trade from my other trades to show how well it has worked. I’m averaging greater than 6% per week return on capital. The basic 7 DTE trade is that I sell a 40-50 wide spread one week out at 10-12 Delta for the short strike. I usually collect over $1.50 in premium, and I try to buy it back 2-3 days later as part of a roll for something under $1.00, usually by collecting around a dollar. For the most part, I roll the position every Monday, Wednesday, and Friday. No matter what happens, I roll and try to collect additional credit.

Said another way, I’m in a trade for a couple of days and collect about 2% on average for the effort. For example, a 50 wide spread collecting a net $1 on a roll has collected 2%. The profit comes mostly from time decay (Theta) and somewhat from upward price drift.

What is a roll?

For those not familiar with rolling, it is a trade where one position is closed while a similar trade with better profit probabilities is opened all in the same trade. In this case, I might buy back a position with 5 days left to expire for $0.75 and sell a similar position with 7 days to expire for $1.75, a net credit of $1.00.

Managing when the market goes down

Most of the time (76%), the trade wins outright and I close for less than what I sold the spread for. When the market goes against my position, I roll down and out as much as possible while collecting more premium.

In the few events where I end up in the money, I use debit rolls to reposition out in time at lower strikes. In this situation, I may pay more to close my 5 DTE position than I receive for opening a new 7 DTE position. The idea is that SPX will eventually turn around and the roll won’t cost that much if I stay within a reasonable distance. I’ve used this technique on many put positions last year during the Covid crash and now on this trade. Since the trade should generate lots of credit most of the time, I’ll take the risk of a total blow-up, and use profits to protect the position however far is needed. Probably not everyone’s cup of tea, but it’s my plan- roll, roll, roll, no matter what. I don’t know where I would want to set a stop for this trade- it’s defined risk, and rolling gives me the possibility and probability of full recovery, eventually.

Historically, 98% of my rolls with this strategy are for net credit, and only 2% are a debit. That’s a lot more cash coming in than going out.

Why does this work?

The general concept is that this trade is selling a spread that starts with about a 90% chance of expiring worthless. Essentially, it would take two expected moves in the full time-frame of the trade to put the short strike in the money. It also decays quickly and approaches zero well before expiration in the majority of the time. So, my expectation is that most of the time I can get around 1/2 of the premium collected to decay in about 1/3 of the time to expiration, then get out and do it again. By always being in the trade, I take advantage of the fact that time is always passing, which is the only sure thing with options. Being two expected moves away to start allows the position to filter out a lot of noise and still make money without a lot of stress over where the market is going. When we get the expected move down, the position is still in good shape because that’s only half-way to the short strike. By rolling down and out, we can re-establish further away from the money and still collect a credit. Even several down days in a row can be absorbed, as this happens somewhat regularly. My experience is that defensive rolls work out back to a full win without getting in the money 80-90% of the time. To be really problematic, it takes a move of over 5% down in less than a week that doesn’t recover at all to move the position into the money. I’ve been in survival mode several times with this trade and recovered fully each time. I expect that there will someday be a scenario where I can’t roll enough to recover, but I have saved back cash reserves to allow starting over if that time ever comes.

On the other hand, this trade generates 4-6% return on capital per week most of the time, so it should double its value in about a five-month time frame if there is not a major drawdown and even with no compounding re-investment. I’m not sure how to calculate the probability of a winning week, but I’m pretty sure it is well above 90%. The probability of an in the money scenario is likely in the 2% range, and I expect this scenario a few times a year, with a position that drags out without recovering for over a month happening in the once every few years timeframe.

I’ve adjusted my mechanics a few times during the time I’ve been trading it. I started this the second week in January, at 100 wide and switched to 50 wide contracts when I realized that the extra width wasn’t gaining much, and was extra risk and extra buying power. I’m now trading 40 wide. I’ve gradually gotten more methodical in my approach, although I’m still not that rigid. Originally, I was selling 4-5 DTE and rolling 3-5 times a week. Since I switched to 7 DTE, I’ve found the trade much less time consuming with more premium and time cushion, but slightly less decay. However, the concept is the same- sell way out of the money put spreads and roll out every two days or more often to collect additional premium.

Why SPX?

I trade SPX only for this, and I think it is perfect because it has less price swings that almost any other underlying, and it is big enough that the commissions/fees are negligible. I tested RUT and NDX and found them to be too volatile for my taste. I’ve tried SPY, but I find it hard to get filled near the mid-price on my rolls, and commissions are a much higher percentage of the trade. I got the original idea from a post in a Facebook group last December, and tweaked it until it fit with my style. There are a lot of ways to vary this, but this strikes me as a nice way to trade fairly near to expiration options with a high probability of success without a lot of drama. I know several people who now also do their version of this trade, some using stops, some getting in and out based on the market, some using technical indicators to inform their decisions.

Results summary

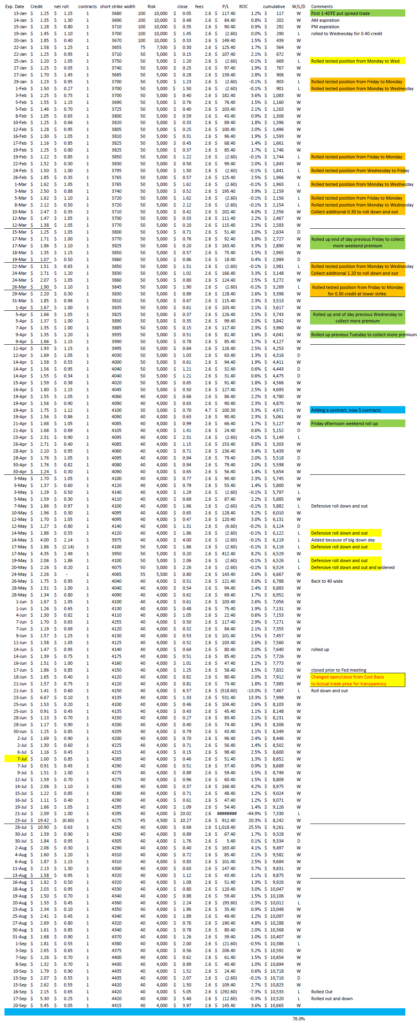

The sheet at the end of this post shows each individual trade. At the first of the year, I showed trades that I rolled out that were losing by their cost basis to me. So, if I sold a spread for $1.50, bought it back for $2.10 and sold the new position for $2.50, I would show closing at 1.50 and opening the next trade at $1.90, my adjusted new cost basis. In June, I decided that this wasn’t very transparent, so I switched to showing the actual closing cost and opening sales price when I have to roll out on a tested position. Either way, these were my actual trades. I think that is easier to see how the trade works when the market is challenging. I’ve scaled up the number of contracts I trade, but for simplicity, I’m showing just one contract. The dates are the expiration date of the position- I don’t track which date I actually roll.

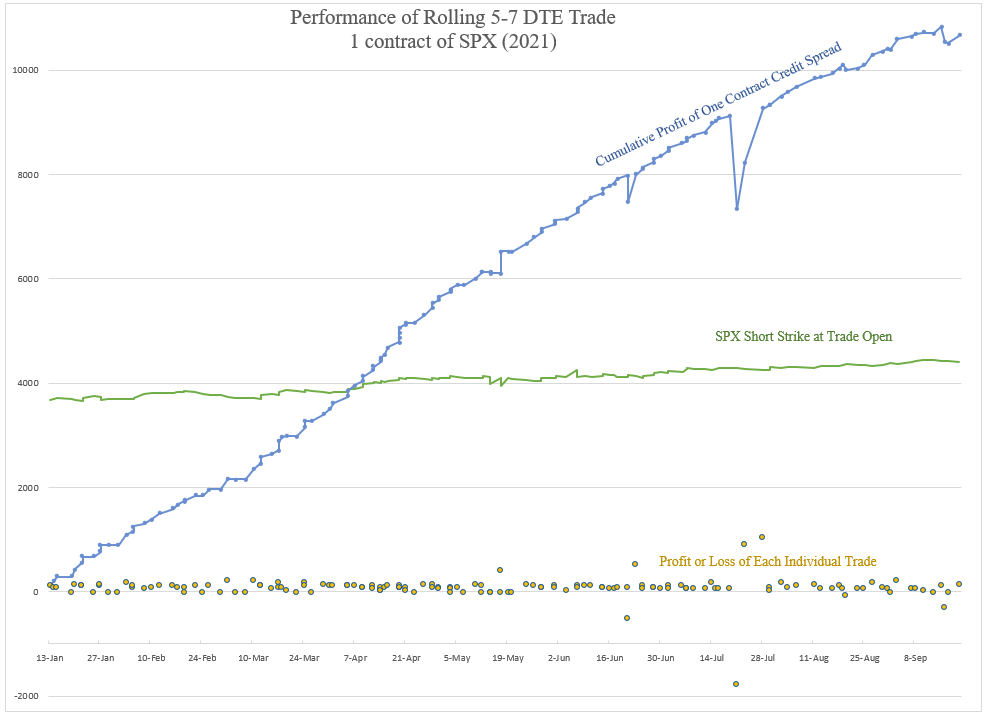

When I charted this out, I was surprised to see how consistent this trade has been in accumulating profits. Keep in mind that my results are just for the trade, and don’t take into account having cash on the sidelines to use for defense if the trade goes into the money. My goal in this trade is to consistently generate cash as time passes by, and for the most part that is what has happened.

My results for this trade are in line with these expectations so far. In over 8 months, I have made money every single week on this trade except three, which is amazing to me, considering that the market had a few weeks where it really trended down. In the first four months of this trade I doubled my money. While this is the most consistently profitable trade I regularly do, I only use a small portion of my capital with this trade due to the tail risk from a major crash.

I hope this explanation and the data attached helps you understand this trade a little better. As you all know, this is one of several trades I do. I thought this would be of particular interest, especially considering how well it has worked. I’m very aware that there is considerable risk in this trade, despite its high probability of success, and that even in the majority of times significant volatility to the position can be expected.

I’ve shared this trade in a number of other forums and received a lot of questions. Here are some common ones:

How does this compare to 0 DTE?

One reason I started this trade was that I wanted an alternative to the 0 DTE or expiration day trades that I see a lot of people doing. I tried my hand at these using stops, and I would have long strings of wins followed by a big loss that I couldn’t get out of in time. It was very stressful to me, and most importantly, I wasn’t making money for all my effort. When I came across this concept, I saw that I could use many of the same management techniques, namely rolling, that I use in longer duration trades, and avoid expiration day stress.

Where does 4-6% return on capital per week calculation come from?

A couple of ways to think about this. I’m making at least three trades a week with this strategy. Each trade has an average profit of around $0.80 per share, or $80 per contract. The capital at risk is the width of the spread, $40 per share, or $4000 per contract. Either way, that’s 2% profit for the capital at risk. With three trades a week, I total up to 6%. I could just as easily say 25% per month, or 100% per quarter, but that is less intuitive.

Why not use stops?

I know a lot of people are big fans of stops. They prevent losses from getting out of hand, which in many situations is an absolute necessity. Stops also eliminate the possibility of a position recovering. My view is that market movement is mostly random up and down, and my experience with stops is that I often get stopped out right before the market reverses, locking in a loss that would have been much less if I had stayed in the trade. As a result, I prefer to find ways to extend out the trade on positions where I have a reasonable expectation that the position will recover in a reasonable amount of time. With the S&P 500, this has been a very reasonable expectation, especially if I can re-position my strikes down while collecting more credits in the process.

Advantage of defined risk over naked puts

I know that many people are big proponents of selling naked puts because there is more premium per contract than with a spread. However, naked puts take more capital in most situations, and have undefined risk. Because a spread requires less capital, the return on capital can be much higher. Having defined risk through a spread, provides a floor for the trade that prevents the possibility of completely blowing up an account with an outsized black swan type loss event. For those reasons, I avoid selling naked puts, and instead sell credit spreads. One caveat is that if a naked put is sold cash secured, the risk is reduced to market risk and can never blow up an account- however, returns will be a small fraction of trading a spread. It’s all trade-offs and a matter of strategy preference.

Are these three trades at once or one?

I trade this with just one position, opened and closed three times a week or more with a roll. For example, each Monday I close the following Friday position 4 days out and open a position for the following Monday 7 days out. Then, on Wednesday I close the Monday position 5 days out and open a new position for the following Wednesday 7 days out. Then, on Friday I close the Wednesday position 5 days out and open a position the following Friday 7 days out. I just repeat over and over. If the market jumps up somewhere in between rolls, I may choose to roll to higher strikes in the same expiration for an extra credit.

Why not hold to expiration if the odds are so high?

The strikes I pick decay quickly, and I expect the position I roll into to decay more than if I had held the position I closed. This is why I can make $3 in a week with a position that sells for $1.50 to $2.00 to open on average. By rolling to a new position, I make better use of my capital. Also, rolling early gives more flexibility to manage compared to positions that are closer to expiration.

What time of day is best for the roll?

I’m still trying to determine when the most profitable time to roll is. I don’t believe time of day is as critical as the action of the market. Ideally, the IV of the strikes at 7 DTE are much higher than those at 5 DTE to maximize the difference in premium. But when is that most true? What triggers that situation? It appears to be a mix of variables that I haven’t yet been able to model or pin down. My tactic is to monitor the net credit available throughout the day and trade when I can get what seems high based on my previous experience. So, it is more art than science, which is never my preference. Alternatively, I just put in the trade when I have time, knowing that time decay generally works out so that no matter what credit I get to roll, it will average out in profits in the end. I’m not convinced this is optimal, and I may be leaving some return on the table. This is an area I continue to study.

What strike do you roll to? Always to 10-12 delta?

Ideally, I’d always roll to 10-12 delta strikes if the market were constantly grinding higher. However, the market varies and sometimes goes down and rolling to 10-12 delta would require paying a debit to achieve. My strategy is to collect a credit to roll whenever possible. So, if I can roll to an ideal short strike in the 10-12 delta range for a credit, then I do it. If I can’t, then I roll to the lowest strikes I can while still collecting a credit. This causes the delta value to drift when the market is in a downturn with an expectation that eventually the position will work its way back to the ideal delta values. Because we work from values so far away from the current price, we can afford to drift closer from time to time, knowing that the probabilities still favor the position decaying.

What about bear markets?

I don’t know when we will have a bear market. Obviously, if I did, I’d get out of this trade to avoid losses and get back in at the bottom. Lots of people predict crashes, and if you predict a crash enough times, you’ll eventually be correct. I’m not naïve, I know a bear market will come some time. But since I can’t predict it, I’ll deal with it when it or a significant correction comes. I’ll use the mechanics I’ve described for this trade, and fight to make a profit with defensive and survival rolls. Remember, in down markets the strategy is to aggressively roll down strikes, improving the probability that even a modest recovery will lead to a profit.

Is there a scenario where this trade could be a total loss?

Sure, this is a highly leverage trade, and as such a fairly small correction could put this position deep in the money and marked for a near total loss. Any number of events could trigger a sudden drop in the market- for example: a surprise Fed announcement, another unexpected financial crisis, a natural disaster, a military or terrorist action against the US or US interest, or another pandemic. Most situations would progress slowly enough to allow this trade to be adjusted and rolled out and down, but some could be so sudden that there would be no action that could be taken. After 9/11 the market was closed for several days, and opened way down when it did open. Is it possible that the market could be closed for the life of a contract? Absolutely. I’m sure there are numerous scenarios for total loss that I can’t anticipate with this strategy. The only thing I can do is be prepared that a total loss won’t ruin me financially because I keep cash on hand as an ultimate hedge.

How much do you scale up your position to compound profits?

This trade can provide a lot of cash. I see three ways to use the cash that is generated. One is to take it as income. Another is to save it as a buffer for when the market requires a survival roll for a debit, or even a total loss. And finally, cash profits can be plowed back in to increase the amount of contracts traded. So, how much to use for each purpose? It depends mostly on how much income you need from the position. I know that taking income distributions means that money can’t be used to build the size of the account. But, I take out what I need to. With what’s left over, I have a simple rule. I want as much cash available in the account as is required for the strategy. For example, in a $40,000 account, if I have $20,000 capital required for five 40-wide spreads, then I want to have $20,000 cash buying power available and not used. If the account grows to $48,000 balance, I can add another contract- that’s another $4,000 at risk and another $4,000 cash buying power sitting in the account. Effectively, this cuts my portfolio return in half, but with compounding from scaling up, the portfolio would theoretically

These returns seem unbelievably crazy. Are you making this up?

These results are actual trades I’ve done. I don’t know what will happen in the future, but this trade has worked well so far. There’s no guarantees, and past performance does not predict future results. This trade has substantial risk, and potential for big rewards.

Can I see a log of this trade over time?

Sure, here’s eight months of raw data:

2022 Update-

As we moved into 2022, the market changed dramatically. 2021 was a very calm year with no downturns in the S&P 500 of over 5%. However, with inflation growing and the Federal Reserve taking action to tackle inflation, the market became much more two-sided and essentially bearish.

So, for this trade, I have adjusted to sell both sides of the trade, puts and calls. Instead of a credit put spread, I now sell an Iron Condor. I aggressively adjust my strikes up and down with each roll now, using credits from moving the untested side rolling toward the current price to pay for debits if needed to roll the tested side away from the current price. This has reduced volatility of my positions and made the trade manageable in this near bearish environment.

The other change that I have made is taking advantage of Tuesday and Thursday expirations. With expirations every day, I can move my positions out to 7 DTE every day, allowing regular adjustment of my strikes while rolling out each day.

Combined, I feel like I have more control managing my 7 DTE positions in a volatile market. Results are looking positive with these changes and I will update when I have enough data to show. Once the Federal Reserve is done tightening the economy and switches back to stimulating, I will likely switch back to puts only or some hybrid that goes in and out of calls.