Want to buy stock at a big discount? This strategy is one that is often referred to as stock replacement. With this strategy, we can buy options that have the same upside as shares of stock but at a fraction of the cost. In theory any time someone buys a call, there is the same upside as stock, but some setups give a trader more of the upside benefit than others.

When I think of using options in place of stock, I’m looking for two things, relatively high probability and low Theta decay. When buying a option with no hedge, the natural way to lower time decay is to buy a call well out in time where it will decay slowly. To get it to move with the underlying stock, having an in-the-money option can get most of the move up (or down).

So for this strategy, I look for options 6-12 months out with a Delta value of 75-80. These options will likely cost 10-20% of the cost of the shares as they have significant intrinsic and extrinsic value. With over 6 months until expiration, time decay is slow, but still present.

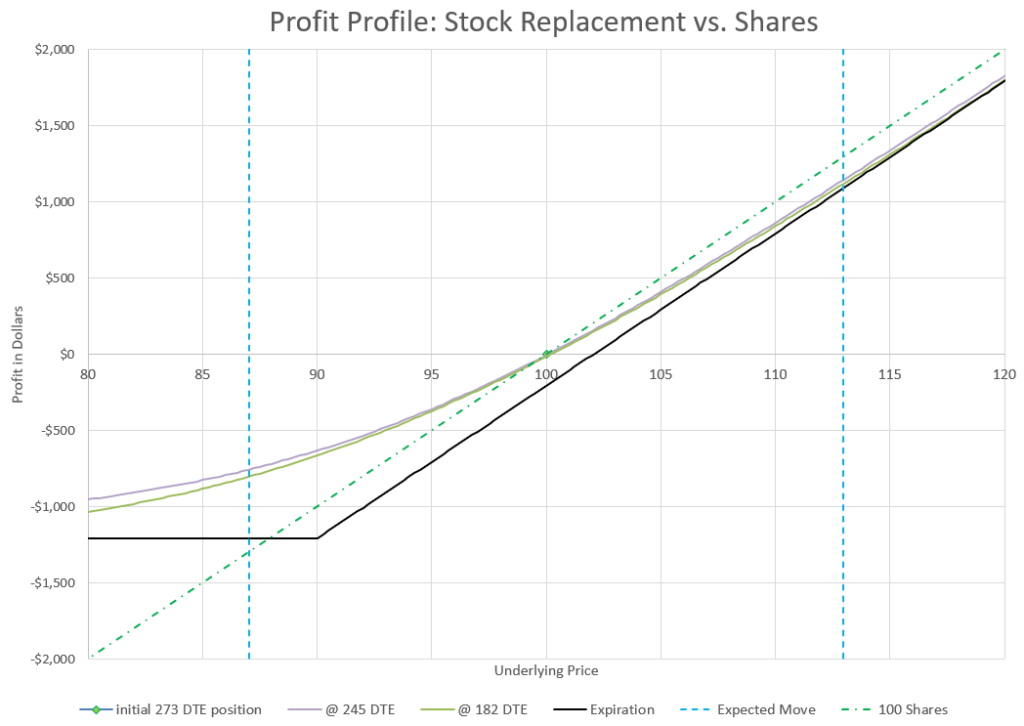

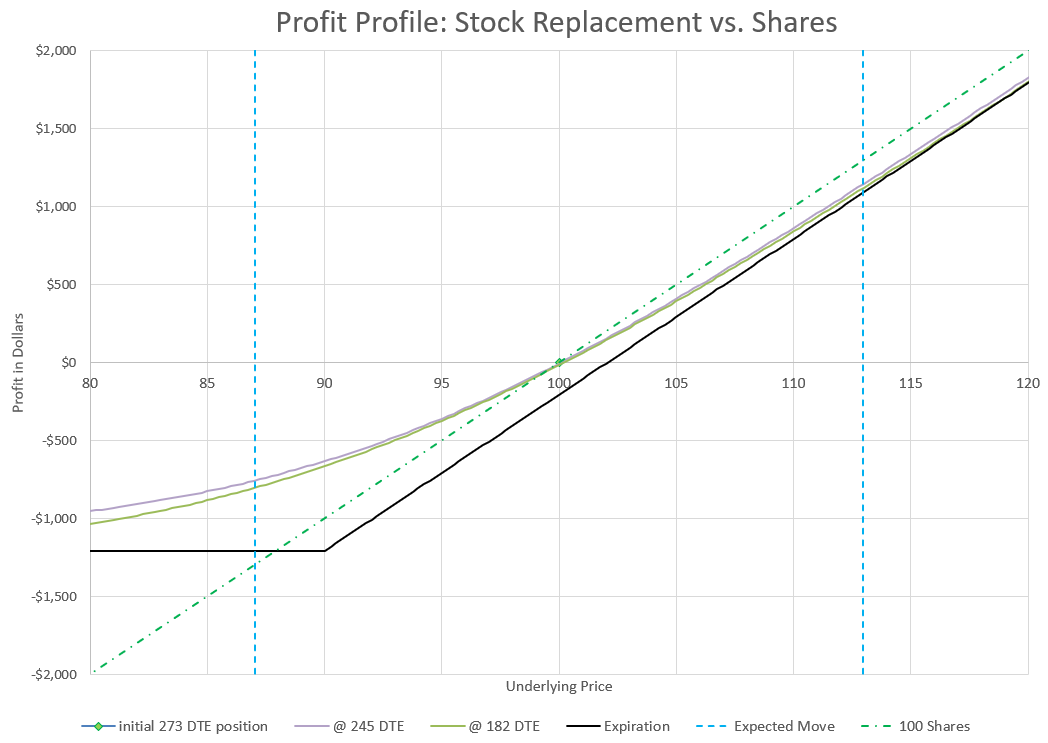

Because I’m buying an option with a Delta of 75-80, I have the equivalent of 75-80 shares of stock from a price movement stand-point. If the price goes up, over time the Delta will increase and the option will behave closer and closer to the movement of 100 shares of stock.

The risk to the downside is limited to the amount paid for the options, so a big market drop could wipe out the position, but even a big drop would still likely hold some value, but mostly the extrinsic time value. However, the really good news is that losses in the options on a downturn are less than the losses that would come from 100 shares of stock.

My goal in this trade is not to hold until expiration, but to either exit or roll to a longer duration before we get into the last quarter before expiration. If the stock price has gone up, I can roll to a new time at a higher strike price and collect the amount the stock has appreciated less the time decay that was lost.

This trade needs a small move up to break even, so the theoretical probability of profit is a little less than 50%. But, by getting out way before expiration, the odds get ever closer to 50/50, and in a bull market the unlimited upside with limited downside is a pretty compelling proposition.

One watchout with this trade (and other long call option strategies) is thinking that since we use just one fifth or one tenth of the capital of buying stock that we can now buy five or ten times as many options and really cash in. We have to respect the downside risk. A big move down will wipe out this position. So we don’t want to put all our eggs in this basket.

But when the market is frothy and looking like it is going nowhere but up, this is a good way to participate in the upside while protecting the downside, assuming that there’s plenty of capital left to deploy if the market suddenly goes against the position.

I want to allocate up to 20% of my capital to call the SPY for leveraging my existent personal equity plan. Because I work full-time I like longer duration strategies. My goal is to grow my account consistently over years.

Why do you choose to roll or exit when the last quarter begins? Why not choose 1 month or even 1 week before?

Another questions concerns your statement: “This trade needs a small move up to break even, so the theoretical probability of profit is a little less than 50%”. If I play with tools like optionstrat and choose your mentioned criteria (183 days from today, delta 80) there is only roughly a probability of 40%. The further away the expiration the worse. So I don’t see a strong edge like you mentioned?

Keep the good work. I hope you are doing well!

Lots of good question. Depending on how far in the money a call is, there can be significant extrinsic value in the premium. That evaporates as expiration nears, so I try to roll out. There’s no “correct” time to roll, it’s up to each trader to decide.

The further you go out in time, the more extrinsic value you are paying for, so the more there is to lose if the stock doesn’t go up. But, most stocks have a bias toward going up, so probabilities are under-stated. Back-tests might be more appropriate in this situation, as long as you don’t cherry-pick the time-frames or use only favorable underlying securities.

If the stock doesn’t go up, you’ll lose money from time decay if not also intrinsic value, so yes, probability of profit is less than 50%. That is almost always true when someone buys an option. But the reason someone buys stock, or a call option is that they believe that the stock will go up. Buying a deep in the money call allows the buyer to get most of the notional gain while only paying a fraction of the price of the stock.

For example, earlier this year I bought just under $100,000 notional value of Nvidia stock for around $20K for a call option. That notional value has increased by around $40,000 since I entered the trade. I don’t get to keep it all, because some of the extrinsic value has been lost, but I’ve nearly doubled my money on a 30% stock price increase. That one option turned to 10 when the stock split and I’ve taken some money off the table, more than my initial investment, but I was able to participate in the big run-up with much less capital. Had the stock gone down, I would have experienced out-sized losses, but ultimately limited to the cost of my call purchase.

So, like all trades, understand the probabilities, understand the risk, and understand the potential benefits. Then evaluate whether the trade meets your criteria for being a favorable trade to enter.