I see four ideal goals for executing a roll of any position, but specifically Iron Condors. First, I want to neutralize the position delta. Next, I want to harvest profits from the existing position. I also want to collect a net credit with the roll from the old position to the new. And finally, I want to improve probabilities of success by widening the body of the Iron Condor. If I can achieve all four, that’s the quadruple crown of rolling.

Often I see posts in social media lambasting rolling positions as a way to lock in losses and having no point. While that can be a possible scenario, I’d like to take a moment to discuss the ideal outcome of a roll, and share a recent example of what we are striving for with a rolling strategy.

For more information on the initial setup of Iron Condors, refer to my earlier post on the subject. This post is meant to build on that earlier post.

Example Iron Condor Roll

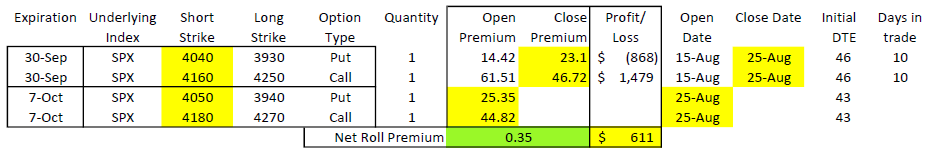

Earlier today I rolled an Iron Condor from 36 days to expiration out to 43 days to expiration. I opened the old position 10 days ago when the market was a little higher. Today, I wanted to better center my position to bring in my position Delta, and be less at risk for a move up. So, I rolled both sides up, rolling the calls up 20 points and rolling the puts up 10 points, which widened the body of the Iron Condor from 120 points to 130 points. Here is a summary of the old and new positions, with key points highlighted for further discussion.

Let’s look at each goal and see how I did.

1. Neutralize Delta

While I don’t track Delta in my trade records, I do look at it for my open positions every day. For background on what Delta is for an option, a position, or a portfolio, see my posts on the topic. The account with this position was showing a lot of negative Delta, so I wanted to bring that in to a more neutral amount. Specifically, this position had a position Delta of -4.7, which equates to a Beta-weighted Delta of -47. This would be the equivalent of being short 47 shares of SPY. With my short call strikes slightly in the money, I wanted to reduce delta, get out of the money, and get more time. Rolling out a week accomplished all of that.

By rolling up 20 points, I got my short call out of the money. I rolled out a week, so I have more time. But most importantly, I cut my Delta almost in half from -4.7 to -2.5. I’m not zero delta or completely neutral, but it is a move in the right direction. I try not to over-adjust and chase being neutral too much or I can get whipsawed back and forth. So, now my premium value will be less volatile as the market moves up and down. Goal 1 accomplished.

2. Harvest profits from old position

The market has moved the direction I was positioned for, and today seemed like a good time to roll and recognize some profit. I’ve been in this position for 10 days, just over 20% of the life of the option. I’ve had some help from all the main pricing factors- price has moved down while I had negative Delta, time has passed while I had positive Theta, and volatility has come down slightly while I have negative Vega. All good for me. Notice that my put side lost money and my calls made money. I track them separately which helps me see trends, but the goal is for the net profit to be positive. And this position made $611 over 10 days. That’s around 8% return on capital. Goal 2 accomplished.

3. Collect a net credit from the roll

With a roll up on both sides, I had to pay a debit to roll up the calls, but I collected a bigger credit to roll up the puts. So, the net of the transaction is that I collected $0.35 per unit, or $35 overall. I try to collect credits in every roll because this is cash going into my account, while debits are cash leaving my account.

This old position wasn’t centered, and I widened the position while rolling out, factors that limited my net credit. However, I was able to find strikes that accomplished my other goals while still collecting a net credit. My new position isn’t ideal, but it is better than where I was and I got paid to make the change. Setting up a roll is an exercise in balancing many different desires, and I focus on collecting a credit as a way to determine how far I can go with my other desires. It isn’t a lot, but I collected a credit, so Goal 3 is accomplished.

4. Widen the body of the Iron Condor

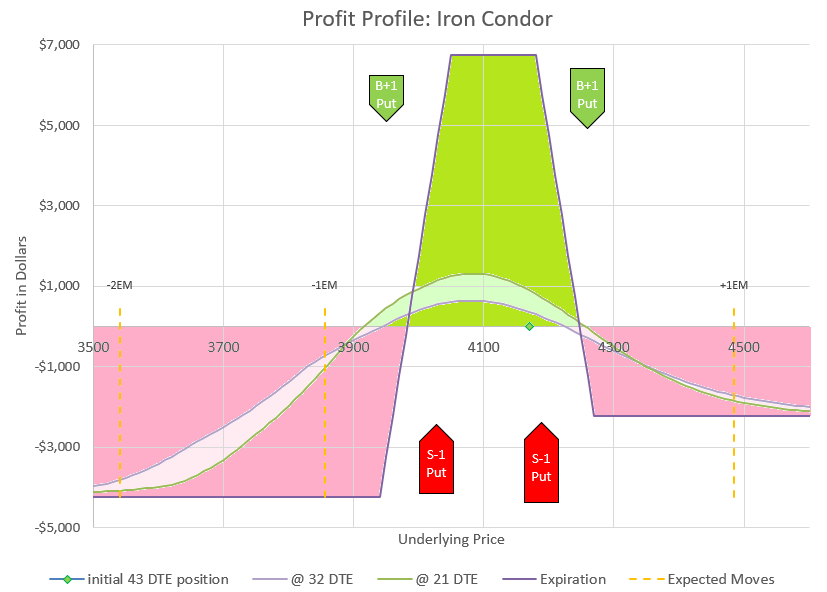

The body of my Iron Condor is pretty narrow. How do I know? Look at the profit profile and it is clear that the whole position is inside of one expected move either way. Ideally, I’d like to get the expected moves inside my short strikes, but I’m managing a trade that is much tighter. So, every chance I get, I want to widen the body, the distance between the short strikes. Why do I want to do that? Because wider strikes have faster decay, up to a point, and we aren’t near that point. This position has strikes close to the money and the Theta values of the longs tend to cancel out the Theta of the short strikes more than I’d like. And the wider the distance between short strikes, the higher the probability of the price staying out of the money. Over several rolls, I want to get wider to where the position can tolerate moves without getting into the money as often. I went from 120 points between short strikes to 130 points, so Goal 4 is accomplished.

Quadruple Crown!

This roll accomplished all four of my goals for an Iron Condor roll. As I mentioned, I had to make some trade-offs along the way to accomplish all four goals, but this is an example of how I use all the data at my disposal to pick the trade that best suits the current situation.

Not every roll can be hit all four goals. If the current trade is a loser, the best you can do is meet the other three goals. Sometimes, I have to miss one goal to make another. In those cases, I choose based on what goal I’m most concerned with- do I need to neutralize delta more than I need a credit, or do I need to maintain body width more than I need a credit? Generally, I have a good shot to meet most of my goals if the current underlying price is inside the short strikes. As short strikes go deeper into the money, it becomes more and more likely that a roll will miss many of my goals.

This mindset of positive goals for trades isn’t exclusive to Iron Condors, but I thought today’s example would be a good way to illustrate the thought process involved in rolling for positive outcomes.

Hello Carl.

I’d like to start by thanking you for taking the time to write about all these different concepts and strategies throughout the numerous posts in your blog.

I’ve been trading stocks and ETF’s fulltime for a little over 2.5 years (still paying my tuition with a positive mindset) and I just began to dip my toes into the options realm on my margin account after testing various credit spread strategies in a paper money account over the last few months.

I came across your 21 Day Broken Wing Put Butterfly (BWPB) post on 11/23 after re-reading about the Broken Wing Butterfly (BWB) strategy in Tastytrade.com and doing a Google search for similar strategies. Reading the 21 Day BWPB post led me to the BW Put Condor and the 1-1-2-2 Put Ratio Spread.

These last two posts led me to read other posts and I’ve been reading every post as if the website was going to be taken down soon because it has 7 days to expiration. Needless to say, my understanding of the dynamics behind trading options has been greatly enhanced. Moreover, for better or worse, the idea lightbulb has been turned on with these new pieces to the ever-changing puzzles.

The 21 Day BW Put Condor post was very insightful, and I really liked the high probability of profit (POP) of the strategy. Me being me, I went and placed a tiny trade in my margin account using the strategy on SPY during the limited session on 11/25. Time will tell how it unfolds.

This brings me to my current situation in regards to trading in general and the proverbial conundrum quoted by the likes of Aristotle and Einstein – the more I learn, the more I realize how much I don’t know. Nevertheless, I’m passionately curious about it all.

I now have tons of questions, some of which you’ve already addressed in posts such as this one; https://datadrivenoptions.com/tag/rolling-losing-option-trades/

“To be, or not to be, that is the question”. Not really, it’s more like: to hold, stop, or roll?

I have six Iron Condors with one contract per leg that were not adjusted in a timely manner and have 18 DTE (opened at 45 DTE). Like you mentioned, “It isn’t easy emotionally to roll in tough markets, but I don’t think it is any easier to take a loss when you are stopped out”.

Furthermore, I totally agree with this observation you pointed out, “For me the benefit of rolling a losing position is giving myself time and space to be right”.

Hence, it all circles back to, “I think the issue is when the discussion comes to managing a losing position. There’s really three choices: hold, stop, or roll. A legitimate argument can be made for each approach, but I think the right answer comes down to the type of position that is in trouble, the trader’s view of the market probabilities looking forward, and personal preferences around risk and reward”.

I have a lot to think about and the clock is ticking, but I’m leaning towards “giving myself time and space to be right” while accepting the uncertainty of every trade.

To wrap things up. Again, I truly thank you for sharing your views and experiences in your posts since I genuinely believe that they help all those who take the time to read them. Like most of your readers, I’ve probably watched and/or read hundreds if not thousands of videos and/or articles/posts since I began to trade. Most are just fluff and only a handful of them are gold. This blog is one of the latter.

AJ- Thanks for the kind words. I share your sense that the more I learn about options, the more I realize how much more there is to know. The best analogy I can compare to is the movie “12 Monkeys” with Brad Pitt and Bruce Willis from the mid-1990s. The movie constantly exposes new information from the past that completely changes the view of what really happened. For me, I just keep digging into researching questions and trying to optimize my approaches to trading with each new piece of data.