In 2022, the option exchanges rolled out options on a few indexes that expire every day of the trading week. This has caused a frenzy of option trading by individuals who are trading a variety of expiration day strategies every day. Many people are buying and selling options with zero days to expiration (0 DTE in option lingo). But is this a good idea? Are there strategies that actually work? Or is this just gambling? Well, like many things in options, it depends. There are strategies that have been successful with years of history, and we’ll dig in to discuss them.

Over the past several years, the frequency of option expirations has increased dramatically, particularly for the major indexes, the S&P 500, the Nasdaq 100, and the Russell 2000. Initially, there were only monthly expirations that expired on the third Friday of the month. Options expiring every Friday were added several years ago, and Monday and Wednesday were added a few years back, and finally in 2022, Tuesday and Thursday expirations were added. Trading volume has grown exponentially, and trading on options expiring within the next few days are now the majority of option trades. Clearly, expiration day trading is very popular.

I’ve been exploring trading strategies for expiration day for several years, going back to when we started having expirations available for Monday, Wednesday, and Friday. I’ve discovered that 0 DTE is not for everyone, can have many elements of gambling for many, but has a few strategies that have a positive expectancy of profit.

Things to know about 0 DTE

First off, 0 DTE requires a different mindset than longer duration trading. Profits and losses explode in minutes, making the importance of having a plan critical. Options in general require strategies and planning, but 0 DTE is significantly more volatile. So, for traders that can’t handle huge swings in value over very short periods, 0 DTE may not be a good place to go.

For traders that do trade 0 DTE, I highly recommend keeping a log of all trades to be able to evaluate whether the strategy being used is actually working. Some trades have fairly high win rates, but have big losses when they lose- a log will help a trader determine if the wins outweigh the losses over the long run. Also, keeping note of what went well and what went wrong will help a trader learn from success and failure. I can tell you that most traders that fail do so by not sticking to their own rules for managing risk.

One key consideration is the Pattern Day Trade Rule that applies to accounts with less than $25,000. Federal regulations prevent small accounts from opening and closing the same position the same day more than three times in any 7 day period. Doing so will place severe limits on the traders account. If you have an account with $25,000 or less, or even just slightly more, you need to be very aware of this rule and how it works before even thinking about 0 DTE trading or any short duration in and out trading strategies.

There are a number of ways to trade 0 DTE. Some traders try to get in and out, while others hold a trade to expiration at the close of the day. Some are net buyers of options, what I will call debit trades, while other are net sellers, or credit traders. I say “net” because many strategies involve trading spreads, buying one option and selling another, generally the more expensive being hedged, protected, or partially financed by the cheaper option.

When options are expiring at the end of the trading day, all the characteristics of options are sped up. From a data driven standpoint, there are three key Greeks to consider. The two most obvious are Theta and Gamma which essentially battle it out for the day. But Vega also plays a key role, as big moves spike up Implied Volatility and option’s premium, and calmness can sap premium almost as fast. With hours or even minutes until the options expire, the Greeks’ calculations stop meaning as much as the concepts behind them.

Options sellers are banking on Theta eating away the premium as the day progresses. If the option ends out of the money at the end of the day, it is worthless. On the other hand, Delta will end the day at either 100 or zero and is likely to swing huge amounts during the day, which is the measure of Gamma, the change of Delta. So option buyers are looking for options to get in the money and run way up in value.

Since we are talking about expiration, it is important to understand the implications, which vary depending on what underlying the option is based on. Remember, there are four types of underlying securities, and at expiration the differences really stand out when an option expires in the money. For stock and ETF options, in the money options are settled with shares, which may not be the best outcome for day trading. In addition, while expiration option trading ends at the closing bell, expired stock and ETF options can be exercised until midnight, so even options that end trading out of the money still might be exercised if market conditions change after hours from news or earnings impact. Index options are much more straightforward. Index options are cash settled based on the price of the index at the closing bell. Because of this, index options, like SPX, are generally the preferred trading vehicle for traders holding options through the closing bell. Futures options settle with futures contracts unless the futures contract is also expiring the same day. However, futures options are assigned based on the price at the closing bell, not any after hours moves, so a trader knows at the bell whether there will be an assignment or not. So switching between underlying types for 0 DTE trades in not a trivial decision.

As mentioned before, because 0 DTE trades can rapidly change in value, having a mechanical trading plan becomes critical for consistent success. Most traders that trade short/selling strategies use stop losses to keep losses from getting out of hand, and long/buying strategies use some type of trailing stops or rolls to protect winning positions and keep upside unlimited. There are a few trades where holding to expiration (no matter what happens) could be considered, but I think 0 DTE are best managed by active trading based on market action.

So let’s get to it. Let’s discuss some typical strategies, both from the long and short side, considering what it takes to be successful.

Selling options with 0 DTE

Most 0 DTE option sellers I know actually sell spreads to define risk. Selling naked options on expiration day simply requires too much capital and carries too much risk for the average trader. The width of the spread can vary based on the strategy or capital available to the trader, but wider spreads tend to decay faster than narrower spreads. These trades are expected to win a high probability of the time, but to avoid severe losses, stop losses are also critical parts of the strategy.

While there are many variations of these strategies- different times to enter and exit, trading one side or both sides (puts and/or calls), entering or exiting all at once or legging in based on the market, the core of the strategy is the same. Sellers want to sell at a relatively high premium and buy it back for less or even let it expire worthless. I’m going to focus in on two common strategies that I have had success with and 0 DTE trading friends have done successfully- a wide Iron Condor and an Iron Fly. For discussion, let’s assume that we are selling spreads directly on the S&P 500 Index, ticker symbol SPX.

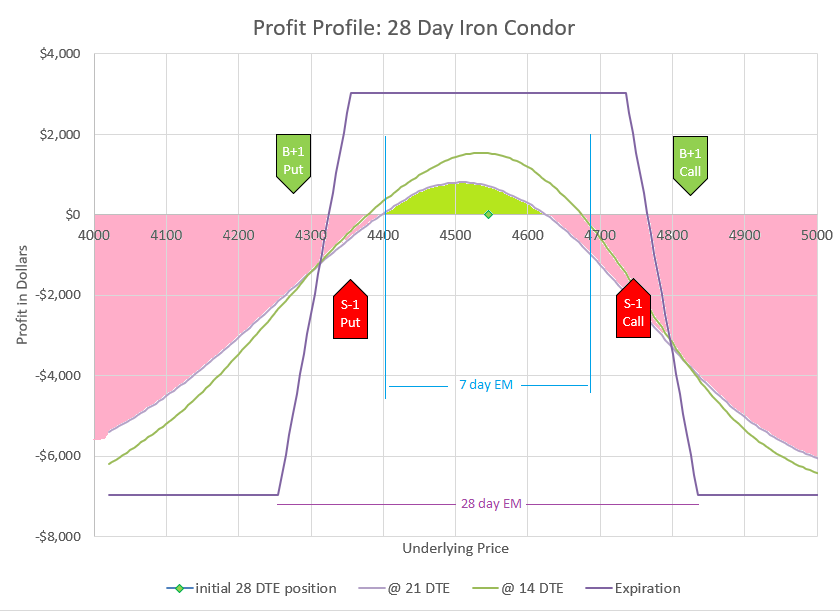

0 DTE Iron Condor

Iron Condors on expiration day seem to perform best way out of the money, selling options with 10 Delta or less and buying 30 to 100 points further out of the money. Greek calculations for 0 DTE can be flaky and vary widely, so many traders are more comfortable choosing strikes based on the premium available. For example, a trader may sell the lowest put strike that sells for over $1.00 or maybe over $1.50, and buy the put that sells for under $0.75 or $0.50. For perspective, you can estimate the expected move at any time in the day by adding the premium of the at the money put and at the money call. Generally, these strikes are between 1.5 and 2 times the expected move for the put being sold and another half expected move further for the put being bought as a hedge. So, it’s highly likely that the strikes will expire worthless.

Similarly, we do the same thing on the call side, selling a call and buying a higher strike call for less. If we choose similar Delta values, the premium for each call will be less, but the difference in premium may actually be more if we have the same width wings. It is a matter of preference as to whether to try to collect as much on the call side as the put side.

The risk vs reward for this set-up is the net premium difference between what was sold and what was bought and the difference between strikes. For example, if we sell a put for $1.50 and buy a put at a strike price 40 points lower for $0.70, we are risking 40 to make 0.80. Then, if our calls were sold for $1.20 and bought for $0.40, we have another 0.80 on another 35 wide spread. So in total we have 1.60, but still only 40 risk because the options can’t expire in the money on both sides. Actually, because the options are for a multiplier of 100, we risk $4000 to make $160. So, if all goes well, we make a 4% return on the capital needed in one day. Some traders sell slightly closer strikes to try to collect more premium, and others sell for less to improve probabilities.

While probabilities are fairly high that the strikes will end up out of the money, we never know for sure, so we have to protect our capital. Most traders I know use a 2x stop loss on each side. They limit their loss to twice the premium they collected on each side. So, if a put was sold for $1.50, losses are limited to $3.00 by entering a stop loss on the short put at $4.50. While a stop can be entered for the price of the spread, it isn’t recommended because during the day prices can vary in weird ways and stops can trigger on spreads when the price hasn’t really moved much. I’ve read numerous posts of traders who were frustrated by a stop that was executed when there position was in no danger because of a rogue quote. If possible, it’s best to have the stop trigger based on the bid price of the option if your broker allows it- for the same reason- to avoid bad quotes triggering a stop.

It can be frustrating when a stop triggers just as the underlying price hits the high or low of the day and reverses. A trader looks at this and thinks, “Gee, if I wouldn’t have triggered the stop, my option would have expired worthless. I took a 2x loss when I could have had a gain.” Unfortunately, a trader never knows when the price will reverse and when it will keep going. The goal is to stop our loss at 2x and not let it get to 10x or 20x. We can recover from small losses, losing all the capital of a spread trade can be devastating.

The Iron Condor is a 4 legged trade, so if one leg is stopped out, we still have three legs. On the side where the stop occurred, the long position will have gained value, although not as much as the short strike lost. We can hold the long strike in the event that price keeps moving, making the long strike more valuable. However, since the strike is likely still well out of the money, it is likely to expire worthless and probably is best to be closed out soon after the short strike stop occurs.

When we are stopped out on one side, it is even more likely that the opposite side will expire worthless. However, there is a small possibility that price action could reverse and move far enough to stop out the other side as well. For that reason, some traders will close out one side if the net premium has decayed 80 or 90% of the way while there is still a lot of time left in the day. The choice is take risk off the table, or hold out for that highly probable last 0.25%. Again, it’s personal preference.

So, let’s look at the various potential outcomes of our $1.60 Iron Condor:

1. most likely (~70%) both sides expire worthless $1.60 profit

2. sometimes (~25%) one side is stopped out and the other expires worthless ($3.00 loss on short stop, $0.20 gain on long, $0.80 profit on other side) $2.00 loss

3. rarely (~5%) both sides stopped out, assume no net gains from long strikes so $6.00 loss ($3.00 each side)

Adding all the probabilities together, we get an average return of 0.33 profit, or $33 on our $4000 capital. That’s just under 1% per day.

Can some traders do better? Yes, there are lots of variations that some traders believe give them a better advantage. But lots of traders do worse. Why? Because managing trades while sticking to a plan isn’t easy for most traders.

How can the trade be varied? Some traders enter the trade at different times in the day. They may enter at market open and again a few hours into the day. They may open on just one side based on technical indicators predicting movement in a certain direction. They may add based on one side based on market movement. They may have plans to add new positions when an old one is stopped out. Which variations work and which ones don’t? The probabilities are essentially the same but can be tweaked by collecting a little more or less in each trade.

Some may wonder why we wouldn’t just look at stopping out the whole Iron Condor when it loses twice the premium collected instead of managing each side separately. While it could be done that way, the challenge is that each of the legs of the trade are very dynamic in their values and the relationship between them changes dramatically during the course of the day. If the trade is opened early in the day, it is likely that by the final hour of the day only one position will have any meaningful value. Also, managing puts and calls separately allows traders to add and take away positions on either side independent of how they treat the other side.

On an ideal day for this trade where the market doesn’t move much after the Iron Condor position is opened, all the legs will decay proportionately and have little value left by the afternoon period a few hours before expiration. This is because expectations of the remaining move for the day will decrease and the price distance that was 1.5 times the expected move will become 3 to 4 times the remaining expected move. Since the probabilities are exponentially smaller of being tested, the premiums simply evaporate. One doesn’t have to wait to the very end to see the result.

Other days Iron Condor traders may see the price creep around moving toward one of their short strikes. Big moves early in the day can quickly lead to executing a stop, but the nerve-wracking position is the one is close to stopping out all day as the price moves ever closer to a strike price but not close enough to trigger a stop. For some traders this is stressful, for others fascinating. To avoid stress, many traders set their stops and go on about their day knowing that the market will decide whether the trade wins or loses.

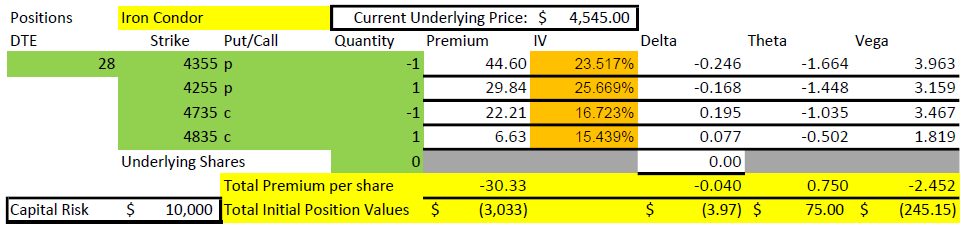

Iron Fly 0 DTE trades

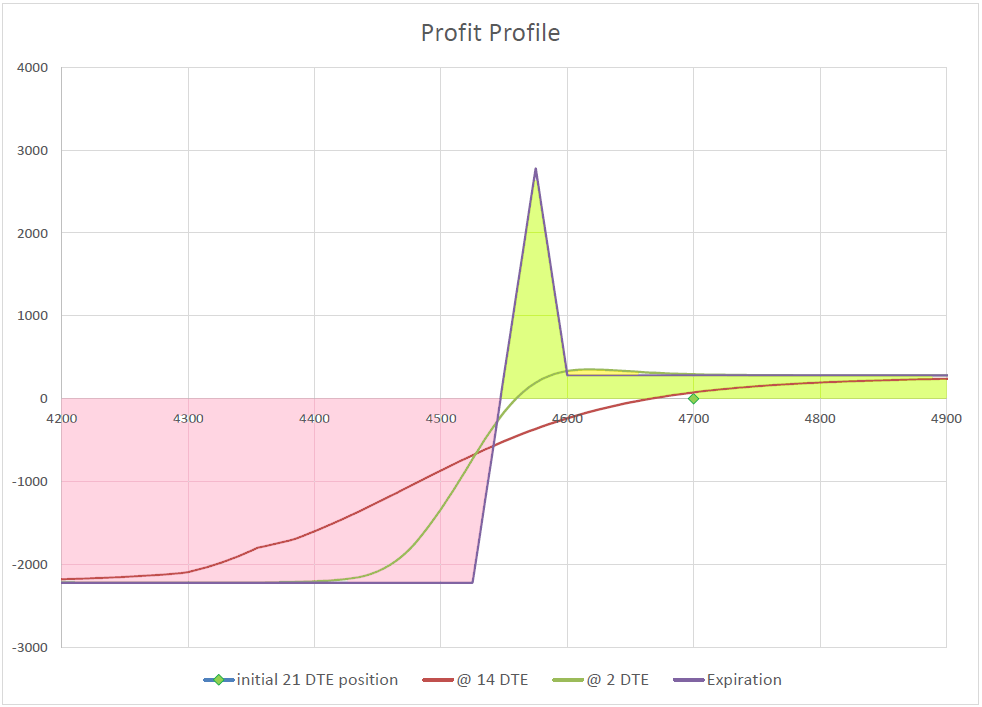

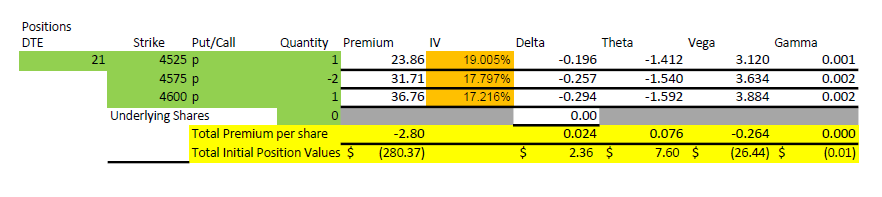

A completely different approach to capturing decay on expiration day is selling an Iron Butterfly or Iron Fly as it is more commonly called. The Iron Fly is created by selling an at the money call and an at the money put and buying protective wings outside the expected move of the day. The trade simulates a straddle, but defines the risk as the width of the wings to keep buying power reasonable. Most traders try to open these trades soon after the market opens and get out fairly soon, taking advantage of early morning premium decay as the market settles in.

As discussed earlier, the at the money put and call premium imply an expected move for the remainder of the life of the option. How big the expectation is varies from day to day. For example, on days when the Federal Reserve announces interest rate policy, the expected move is much higher than other days. Other anticipated news events can also trigger uncertainty about pricing changes to expect later in the day, driving premium higher. Other days, little news is expected and low premiums reflect that. So setting up this trade requires a review of prices to pick wing strikes that are appropriate.

Generally, most traders look for Iron Fly wings that are 1.5 to 2 times the implied or expected move. For example, if the total premium of the at the money put and call is $30, one might choose to buy puts and calls $50 away from the money. These should be fairly cheap compared to the at the money strikes. The idea is that there isn’t much decay left, these long options are simply protection from a sudden outsized move. An alternative is to use a set price for one or both of the longs, like $1 for the long call and buying the equidistant long put, which may cost slightly more due to pricing skew.

The most common management strategy I’ve seen for this trade is to set a win target and an offsetting stop loss, and let the odds play out. Iron Fly sellers pick either a percentage target or a dollar target for profit and typically set the stop loss at twice the win target. For example, one trader may target a profit of 5% of the premium, while another may target $1.50 profit every day. There’s logic for either approach, big values may hold value until the news event that is expected to move price, while low values may decay slowly. The key is that the bigger the target, the longer a trader is in the trade.

Why not go for it all and let the position expire? First of all, one short strike will definitely be in the money at expiration while the other short strike will be worthless. The day to day variation in results would be huge, perhaps making 50% return one day and losing 140% the next day. In addition, most studies I’ve seen on this approach suggest that this is a net losing trade over time.

The idea of getting in and getting out is that there are periods of time during the day, primarily at the open, when the level of uncertainty drops significantly in a matter of minutes or a few hours. Even with price movement, expected moves drop faster and the premium of the Iron Fly decays for a win.

In practice, the Iron Fly can tolerate a move of a few strikes up or down initially without stopping out. Early in the day the market often moves around searching for a price to stabilize on. The Iron Fly seller expects that movement to be small enough most days that a stop isn’t triggered and the settling price is close enough to the price where the trade started that the profit target can be achieved.

Setting a stop order or profit limit order is trickier with an Iron Fly than with the Iron Condor. The issue is that with the Iron Fly, a price move of the underlying generally impacts three of the four legs. One short goes into the money and the long on that side starts increasing in value, while the other short starts decreasing in value. The long on the untested side goes from low value to nearly worthless and isn’t a factor. A set and forget stop strategy would be to set a stop for the whole four legs, but triggers and fills can be inconsistent. Another approach is to watch the direction of price and set a stop for the three legs that are most impacted. Another is to set a mental stop and manually close if the price goes beyond your mental stop.

For example, let’s say we open an Iron Fly for $30 credit and target $1.50 profit. We can enter a limit buy to close order to buy the whole position back for $28.50. We could alternatively place a stop loss order at $33. Some brokers allow a bracket order that combines the two orders into one for a situation like this. If we want to watch and mentally manage the order, we may choose to only close the three legs that have meaningful value.

Time in the trade can vary from minutes to hours. Some days the price sticks right where the Iron Fly was sold and the price decays in 5-10 minutes. Other days, the price may grind away varying premium between the profit and stop targets for hours. Many traders set a time limit- if the trade doesn’t hit a stop or profit target in 2 hours, close it and move on.

Time to enter is a bit of a personal preference as well. Some traders try to enter within seconds of the market open when there is the absolute most premium available. Others wait five to fifteen minutes for the initial big move to stop. Some do just one of these trades a day, while others open several at different points in the day. Some avoid Federal Reserve days while others embrace them. There are advantages and disadvantages to each way of entering, but often it comes down to comfort of the trader with a chosen approach, the probabilities are similar.

Over time, the math is fairly simple with this trade. We need to win more than twice as often as we lose. The studies I’ve seen show this as a net winner. The other key is stay mechanical and respect identified stop values. Most people who fail at this trade do so by getting sloppy with their stops and hoping for prices to reverse while the loss multiplies. Discipline can’t be overstated.

Long Strategies for 0 DTE

Buying an option on expiration day requires a strategy that can overcome the rapid time decay of the option purchased. Since there are huge volumes being bought each day, there must be some validity to this approach.

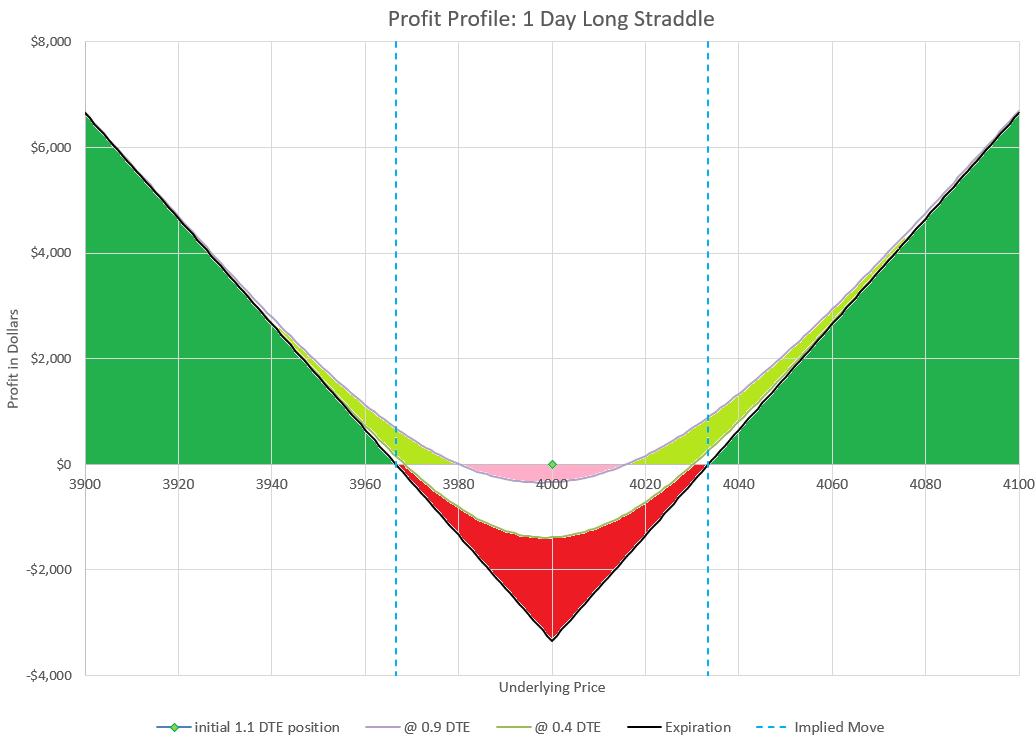

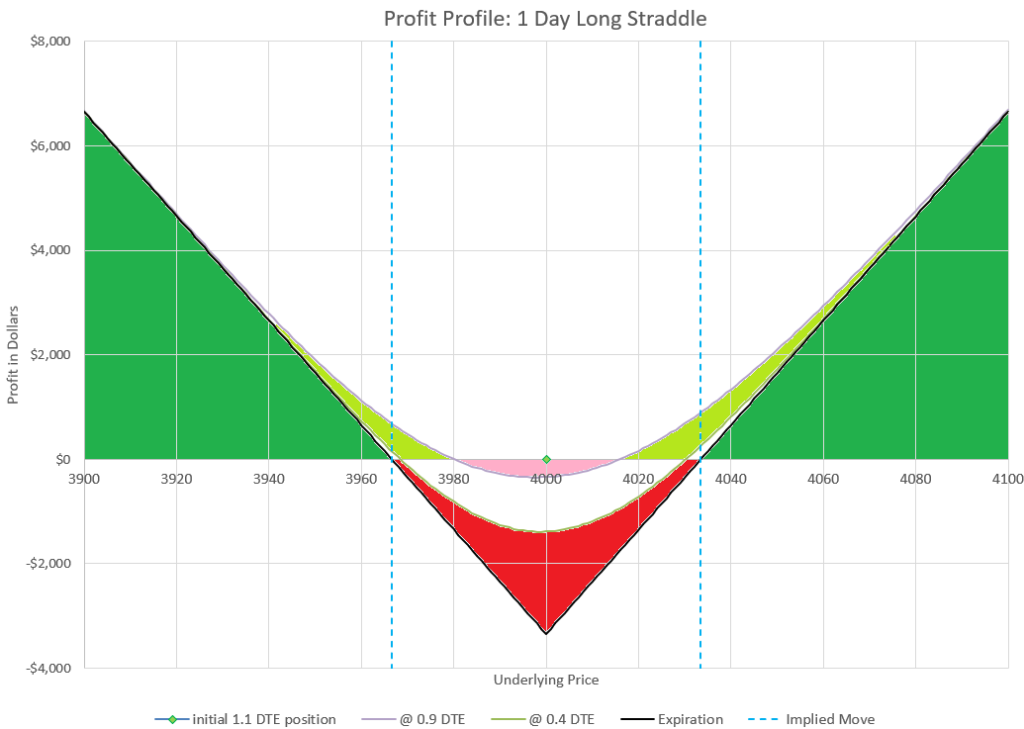

Buy 0 DTE Straddle

One simple approach is to buy a straddle and hope for an outsized move. This is essentially the strategy discussed in the post on the 1 DTE Straddle I’ve written about separately, just done on expiration day. The difference is that at 1 DTE, there is overnight movement that may impact pricing, while once the 0 DTE trading day has started, we only have the day’s price movement to consider.

This strategy is essentially the opposite of the Iron Fly strategy and counts on movement of price to exceed time decay. Since risk is limited to the premium paid, there isn’t much value in selling wings, which would limit the upside of any move.

When would one open a 0 DTE straddle? Perhaps right at the open, looking to capture a big early morning move. Or just before a big announcement, like the Federal Reserve interest rate announcement or press conference. Or maybe at a point in the day where there is time left but the straddle is just very cheap and a small move will make it profitable.

The biggest challenge is deciding when to get out both for winning and losing positions. The position won’t expire worthless, so should there be a stop loss? When a position wins, when is the profit enough to justify the strategy over time? Since the trade has theoretical unlimited profit, shouldn’t we preserve that potential? Tough choices, so thinking through a plan ahead of time for the situation is critical.

My go-to plan is usually to roll in the money puts toward the current strike price when I can collect a significant percentage of the roll distance. Early in the day, I might roll my strikes $10 when I can collect $7. Later in the day I may do it if I can collect $8. The idea is to take some of my winnings off the table while allowing for additional movement to make more. I protect myself from a reversal wiping out my profit. I find this approach reduces the volatility of my win and loss amounts.

Jump on the Trend with a Long Option

Many traders like to use Technical Analysis to predict future movements of the market. They detect when a trend in one direction is starting and determine how long they expect it to last. A great way to take advantage is to buy a call when the market is trending up and sell it at the top before it has time to decay, or buy a put on a downtrend and sell it at the bottom.

Generally, the idea is to get in opportunistically and get out. Time is ticking against the option buyer on expiration day, so the buyer has to be right on direction and right on timing. If the trend is small or slow moving, premium will decay faster than the underlying price can increase it.

A typical strategy on an uptrend is to buy a call a few strikes out of the money. For SPX, this might cost $10 premium or $1000 for the contract. The Delta value might be 30, so that a $10 price move would net $300.

If the strike ends up in the money and is above 50 Delta, a roll to a higher strike should net at least half the distance of the roll. For example, one might roll up $10 for a $5 credit. Or wait to get further in the money where a roll up could net a higher percentage. Or just close the trade when technical analysis says that the move is approaching the top of the range.

The same basic strategy would work with puts on a downtrend. In either case, the market needs to move decidedly in the buyers favor for there to be a profit.

Time of day impacts premium pricing as well. Early in the day there is obviously more premium than late in the day. Buys earlier in the day can follow long all-day trends and make up for the high premium to get in. Late day buys can pay off quickly with a fairly small move in the direction of the trade. A trader has to be aware of the time left and manage accordingly.

The Binary Event

Often, the option premium and price movement of a day is greatly influenced by a single scheduled event. A piece of news, like an economic report, or a Federal Reserve rate announcement is often anticipated by the market with high option premium before the event and much lower premium after. These events are referred to as “binary,” in other words true or false, 1 or 0, good or bad. The impact of these events really have three outcomes for option traders- the market goes up, the market goes down, or the market basically doesn’t move. A trader doesn’t really know what the market will do, so how can we play one of these events.

A starting point might be to look at how much premium is elevated. Sometimes the market is expecting a big impact and sometimes a small one, and it often pays to be contrarian in regards to expected impact. How do we know if the premium is high or low? It takes only a few weeks of watching premium prices to grasp whether premium is higher or lower than normal, and if the high premium for a binary event is extra high, or actually a bargain. If premium is lower than normal, it might be a good time to buy options, either a straddle, or an out of the money call or put in the direction that the market is most susceptible to a big move. If premium is extra high, selling an Iron Fly or Iron Condor might make more sense.

Binary events tend to behave in crazy ways. When the initial news comes out the market may rocket in one direction for a few minutes and then reverse back to where it started or even switch from a big move in one direction to another. Most market observers explain this by noting that the very first reaction is from robot traders that look for certain numbers or words in a statement and interpret them as bullish or bearish, triggering large buys or sells. Then a combination of cooler heads prevail, as the market digests the information and puts things in context. After a while, the market decides whether to take the event as a positive, negative or neutral for the near-term future.

I know many traders avoid binary events because of the unpredictability of market behavior. There simply isn’t a built in probability advantage to any specific trade, and big losses are a distinct possibility. For traders that do like these trades, a plan for managing the trade is critical, when to get in, and a plan to hold, fold, or roll depending on the behavior of the market.

Conclusion

0 DTE trades are extremely popular now that they are available every trading day. However, that doesn’t mean that they are an easy way to make money. In many ways, they are the closest option trade to gambling that there is available. Gaining an edge requires developing and following a plan that accounts for both the potential movement of the market and decay of options. For traders that regularly trade 0 DTE options, it is critical to track all trades to make sure that the strategies used actually average a positive return over time.

I’m actually not a big fan of 0 DTE. For me it is too much drama with too little edge. The rest of this site is dedicated to other strategies that I prefer. But for traders that have the wits and discipline to trade 0 DTE, all I can say is “best wishes!”